Research proves credit cards cause overspending, experts say 'carry cash if you don't want to waste money'

Some people have switched to cashless payment due to the hassle of carrying cash or the opportunity to accumulate points or mileage points, while others feel that doing so leads to spending too much money and are sticking to cash. A new study has confirmed that credit cards and electronic payments like 'XX Pay' tend to make people loosen their purse strings.

Less cash, more splash? A meta-analysis on the cashless effect - ScienceDirect

We spend more with cashless payments | Newsroom | University of Adelaide

https://www.adelaide.edu.au/newsroom/news/list/2024/06/06/we-spend-more-with-cashless-payments

Cashless Payments Are Changing Our Spending Behavior, Study Reveals: ScienceAlert

https://www.sciencealert.com/cashless-payments-are-changing-our-spending-behavior-study-reveals

'When you use cash, you physically count and hand over notes and coins, which makes the act of payment feel more tangible. Conversely, if you don't physically hand over anything, it's easy to lose track of how much you've spent. To avoid spending more than you planned, we recommend carrying cash instead of cards wherever possible,' says Lachlan Schomberg, a marketing researcher at the University of Adelaide in Australia.

In a study published in the Journal of Retailing in May 2024, Schomberg and his team investigated the 'cashless effect,' in which non-cash payments increase spending.

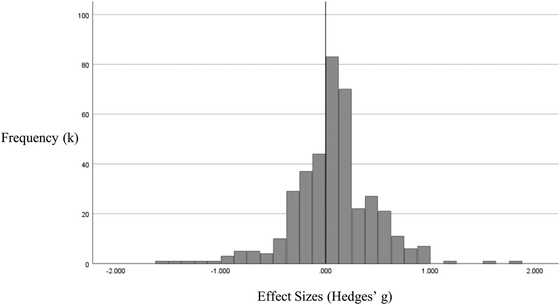

First, the research team searched for previously published literature on the cashless effect and found 71 papers published between 1978 and 2022. The data collected in these papers covered 338,513 payments made by 11,257 people living in 17 countries around the world.

We then calculated and analyzed standardized

The difference between cash payments and cashless payments was small but significant, and was consistent across all cashless payments, regardless of the payment method used, such as credit cards, debit cards, or deferred payment services.

On the other hand, when comparing cashless payments with each other, card payments tended to result in higher spending than mobile payments. The researchers believe this is because people are more familiar with card payments than with mobile payments, which are relatively new technologies, and because they perceive them as easy to understand and convenient payment methods, which leads to people becoming complacent.

The effect of going cashless also varied depending on the situation in which one made the payment, i.e., what was being purchased. While the effect was most pronounced in '

'Contrary to expectations, we found that cashless payments do not necessarily lead to increased tips or donations,' said co-author Alex Berri of the University of Melbourne.

In addition, the analysis results also showed that the cashless effect is shrinking as cashless payments become more widespread, suggesting that as people become more accustomed to cashless payments, the impact of payment methods on consumer behavior becomes smaller.

'The transition to a cashless society seems inevitable,' said Schomberg. 'I think our research is extremely important because it sheds light on an overlooked aspect of this transition: how it will affect our spending habits.'

◆ Forum is currently open

A forum related to this article has been set up on the official GIGAZINE Discord server . Anyone can post freely, so please feel free to comment! If you do not have a Discord account, please refer to the account creation procedure article to create an account!

• Discord | 'Do you feel like you're spending too much when using a credit card?' | GIGAZINE

https://discord.com/channels/1037961069903216680/1262697479665881120

Related Posts:

in Science, Posted by log1l_ks