PC shipments in Q1 2024 finally return to pre-pandemic levels, defying sluggish demand in China and turning to positive growth

According to a report by market research firm IDC, the global PC market in the first quarter of 2024 is set to grow, overcoming the slump of the past two years, due to factors such as a slowdown in inflation.

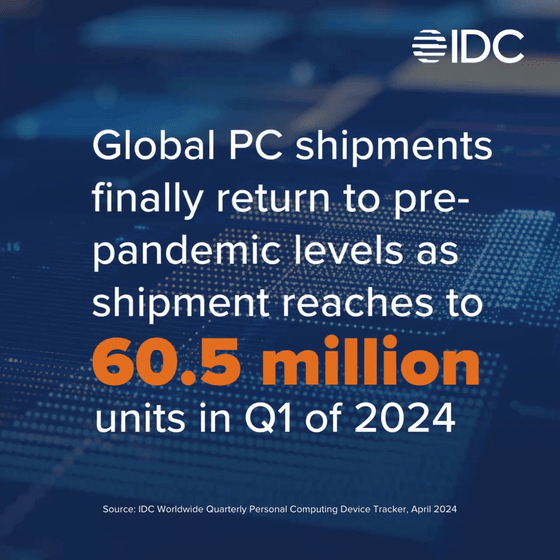

Global PC Shipments Return to Growth and Pre-Pandemic Volumes in the First Quarter of 2024, According to IDC Tracker

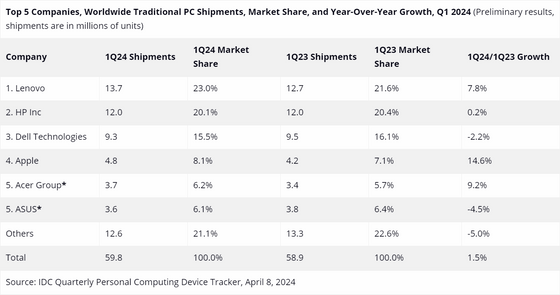

According to IDC's quarterly Worldwide Quarterly Personal Computing Device Tracker, the global traditional PC market saw shipments of 59.8 million units this quarter, up 1.5% from the same period last year.

IDC points out that this turnaround was easy to achieve, as the first quarter of 2023 was down 28.7% year-on-year, the lowest on record.

Additionally, the quarter's shipments of 59.8 million units are close to the 60.5 million units shipped in the first quarter of 2019, confirming that the PC market has finally returned to its pre-COVID-19 pandemic boom.

Looking at the figures by region, most regions are on a recovery trend due to the slowdown in global inflation rates, with growth recorded not only in North and South America but also in

While the global economy is recovering from the damage caused by the pandemic, China, the epicenter of the COVID-19 pandemic, is facing increasing deflationary pressure due to its economic slowdown, which has a direct impact on the global PC market. In particular, desktop PCs, which are already facing pressure from the notebook PC market, continue to struggle due to sluggish demand from China, their largest consumer.

'China is struggling, but we expect it to continue to recover through 2024 as new AI PCs hit store shelves in the second half of 2024 and commercial buyers look to replace PCs purchased during the pandemic,' said Jitesh Ubrani, research manager at IDC. 'As shipments increase, we expect prices for AI PCs to rise, providing further opportunities for PC and component manufacturers.'

Looking at the performance of individual PC manufacturers, Lenovo, one of the top five companies, continued to hold the top spot from the same period last year and outperformed the market average, but IDC analyzed that this was 'largely due to the decline in shipments experienced in the first quarter of 2023.' Similarly, Apple showed a strong recovery from the previous year, when shipments fell by 40%.

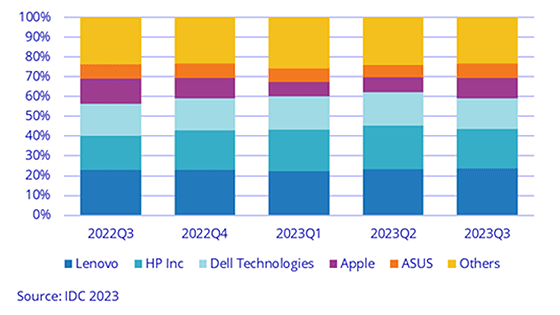

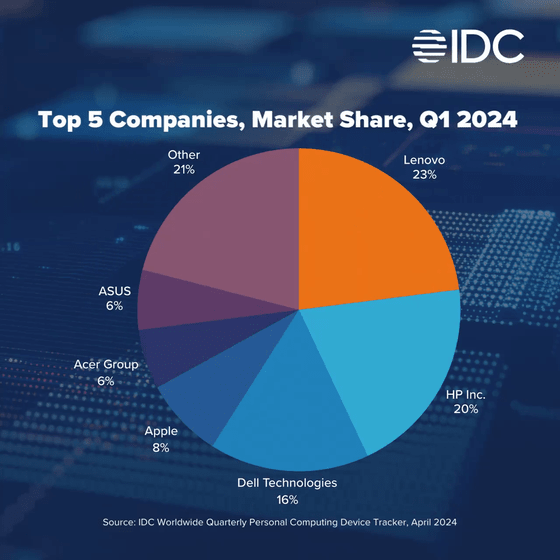

The market share of the top five companies is shown in a pie chart below.

Related Posts:

in Hardware, Posted by log1l_ks