PC shipments in the second quarter of 2023 decreased by 13% year-on-year, and demand declined, resulting in oversupply and manufacturers holding inventories

Market research company IDC has announced the results of a survey of global PC shipments in the second quarter (April-June) of 2023. According to IDC data, worldwide PC shipments in the second quarter of 2023 were 61.6 million units, down 13.4% from the same period last year. The downturn can be attributed to macroeconomic factors, as well as lower demand across the consumer and commercial sectors. However, IDC commented that even with this result, the number of shipments exceeded the previous forecast.

Global PC Shipments Continue to Decline in the Second Quarter of 2023 Due to Weak Demand and Shifting Budgetary Priorities, According to IDC Tracker

PC Shipments Drop Again in Q2, IDC Says | Tom's Hardware

https://www.tomshardware.com/news/pc-shipments-drop-again-in-q2-idc

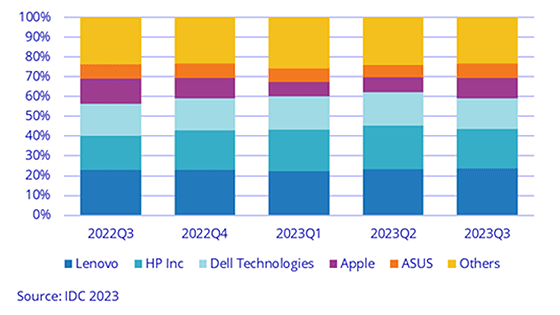

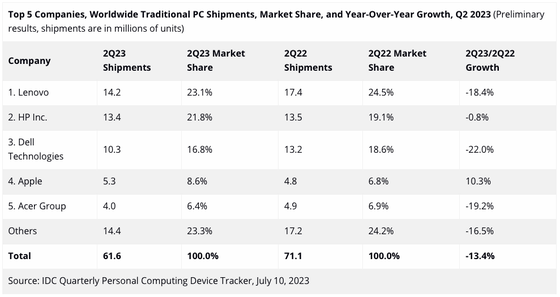

In the second quarter of 2023, Lenovo ranked first in shipments with 14.2 million units, with a market share of 23.1%, down 18.4% year-on-year. Second place was HP with 21.8% market share, with 13.4 million units shipped, down 0.8% from the same period last year. Third place was Dell with 16.8% market share, with 10.3 million units sold, up 22.0% year-on-year. Only Apple, which ranked fourth among the top five companies, showed growth, with sales of 5.3 million units, an increase of 10.3% compared to the same period last year.

Inventory levels have outpaced demand for a longer period of time than expected due to the overall weak demand, IDC said. In particular, HP has been facing an inventory oversupply over the past year, and the overstock situation is finally calming down. On the other hand, IDC analyzes that Apple's only increase year-on-year was due to supply shortages due to supply chain suspensions caused by the new coronavirus pandemic in the same period last year.

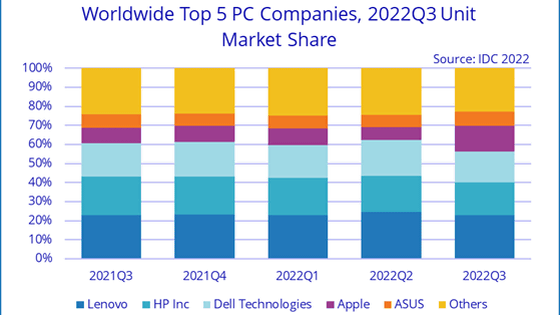

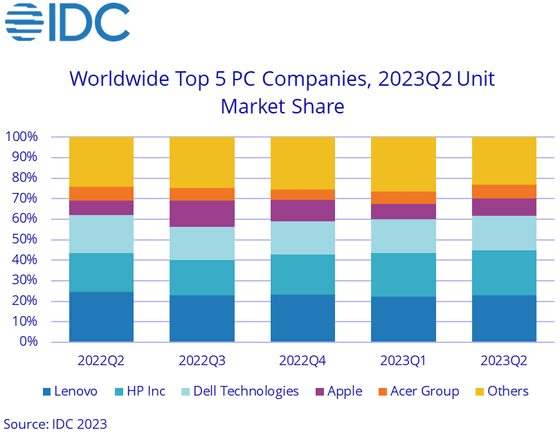

Below is the market share occupied by PC makers of Lenovo (blue), HP (green), Dell (light blue), Apple (purple), Acer (orange), and others (yellow) from the second quarter of 2022 to the second quarter of 2023. A bar graph showing changes in five quarters up to the quarter.

'The supply and demand roller coaster the PC industry has faced over the past five years has been quite a challenge,' said Ryan Reese, vice president of client device trackers at IDC. 'While they don't want a severe supply shortage, they seem hesitant to take big bets on a market recovery, while consumers are seeing a recovery.'

``We believe that computing needs will change and consumers will choose smartphones over PCs. Commercially, many companies are reducing workforces and introducing generative AI. is taking place, and further confusion is expected as to where to allocate the reduced budget.'

Related Posts:

in Hardware, Posted by log1i_yk