'Startup Funding Simulator' allows you to simulate the flow of funds from startup to sale while understanding

Startup founders grow their companies through multiple rounds of funding. ' Startup Funding Simulator ' allows you to easily simulate the flow of funds from starting a business, raising funds, and finally selling the company.

Startup Funding Simulator

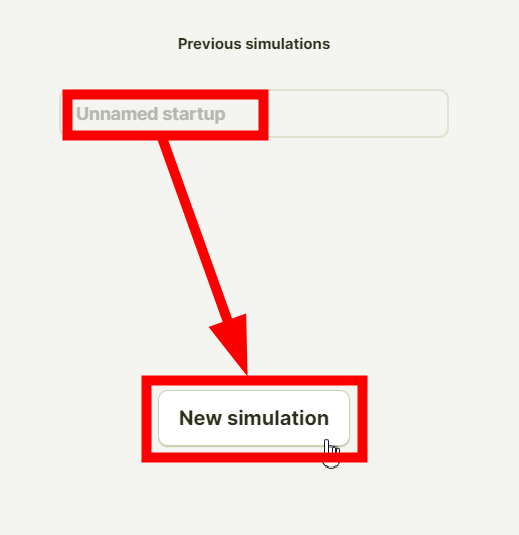

First, click on the text box that says 'Unnamed startup' to decide on the startup name, and click on 'New simulation'.

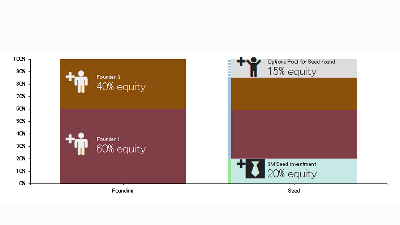

Then, the startup founder and investment ratio will be displayed. In the initial state, there is only one founder, so the investment ratio is 100%. Click 'Add founder' on the screen.

Then the number of founders increased to two. If you add a founder, the investment ratio will be divided equally, but you can also freely change the investment ratio manually. Additionally, added founders can also be removed from 'Remove'.

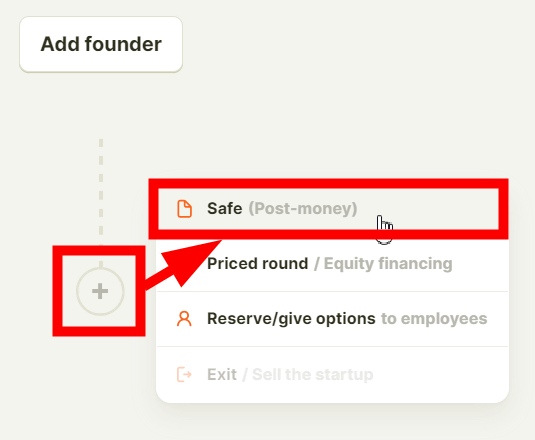

Set the number of founders to 4, set the investment ratio per person to '25%', click '+' and click 'Safe'.

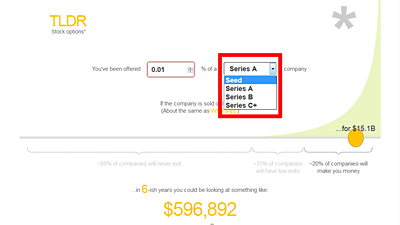

Then you can simulate a financing called Simple Agreement for Future Equity (Safe: Simple Agreement for Future Equity).

A Safe is a type of investment that startups typically accept in the early stages of startup, and is a contract in which the investment is made in exchange for a promise of future equity. Companies have the advantage of being able to easily raise funds without the need for complicated contract procedures, and investors can earn higher returns than those who invest later when the company has grown.

However, as the company continues to grow and the company reaches the stage where it is finally being valued, if the valuation is too high, the shares that early investors receive when they convert their rights to stock may become too high. The number will decrease. To prevent such situations, a method called ``variation cap'' is sometimes used, in which an upper limit is set in advance on the valuation that can be attached.

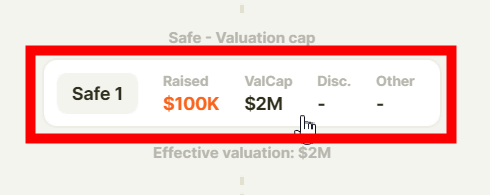

Startup Funding Simulator allows you to incorporate and simulate these concepts of Safe and variation caps. By default, 'Raised' (amount raised) is set to '$100K (100,000 dollars)' and 'ValCap' ( Valuation Cap ) is set to '$2 million (2 million dollars)', and at this stage The founder's investment ratio will not change.

Startup Funding Simulator allows you to incorporate and simulate these concepts of Safe and variation caps. By default, 'Raised' (amount raised) is set to '$100K (100,000 dollars)' and 'ValCap' (Valuation Cap) is set to '$2 million (2 million dollars)', and at this stage The founder's investment ratio will not change.

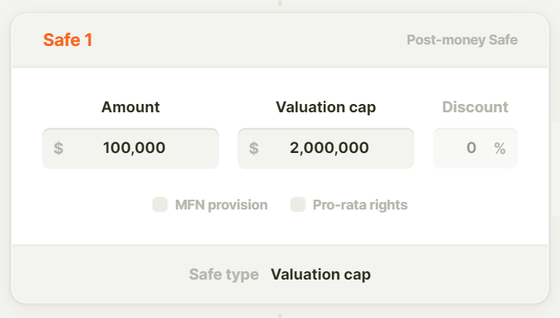

Click Safe to adjust each amount.

Then, you can freely change the procurement amount and valuation cap. You can change to Safe with a discount by entering a number in the 'Discount' field. A discount system is a system in which early investors can acquire shares at a discount when the investment progresses to the next stage.

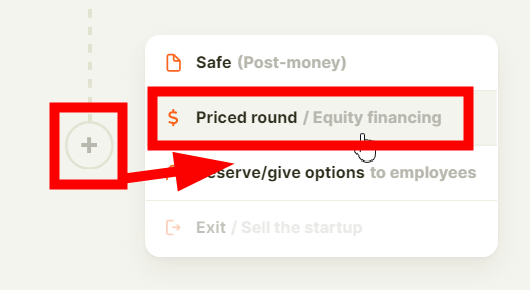

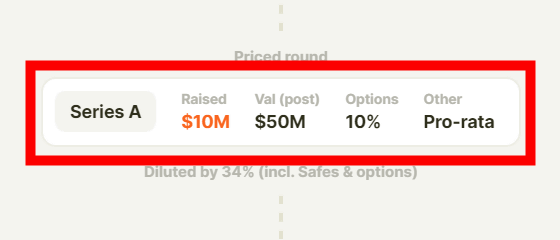

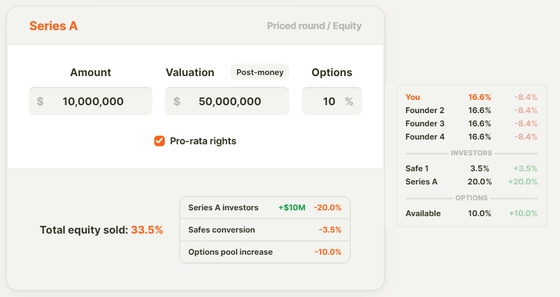

Next, click '+' and click 'Priced round'.

Then, you can add '

Just like Safe, you can change the Series A funding amount, post value, etc. It is easy to understand how the 'Total equity sold ratio' changes after Series A, and in the case of this figure, the total equity sold ratio is '33.5%'. You can check how the investment ratio has changed depending on the set value by checking the numbers on the right side of the screen. At this stage, my own investment ratio has decreased to 16.6%.

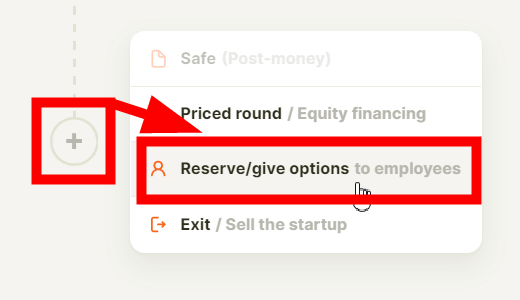

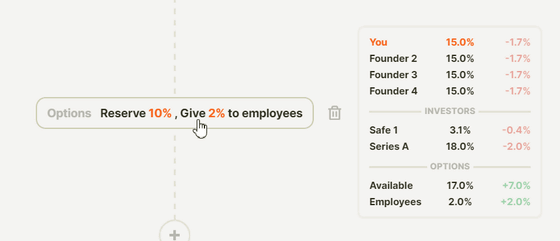

Click '+' and click 'Reserve/give options'.

When I allocated ``10%'' of the capital as ``Reserve'' (reserve) and ``2%'' of the capital as stock compensation to employees, my own investment ratio decreased to ``15%.''

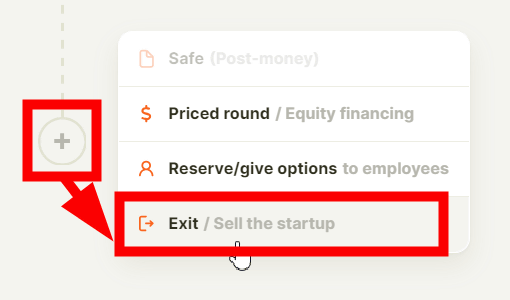

Click '+' and click 'Exit'.

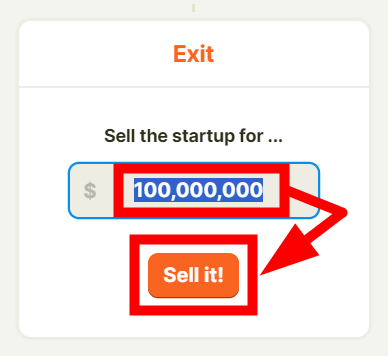

Enter how much you would like to ultimately sell the startup for and click 'Sell it!'

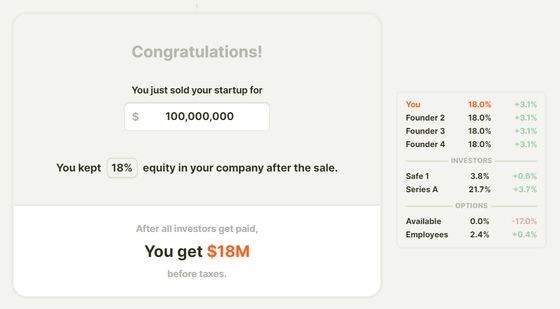

Then, the capital secured as reserves (17% of the total) was distributed to each investor, and finally their own investment ratio became ``18%''. As a result, 18 million dollars, equivalent to 18% (investment ratio) of the sale price (100 million dollars), is his own profit from the sale.

Related Posts:

in Review, Web Service, Posted by logu_ii