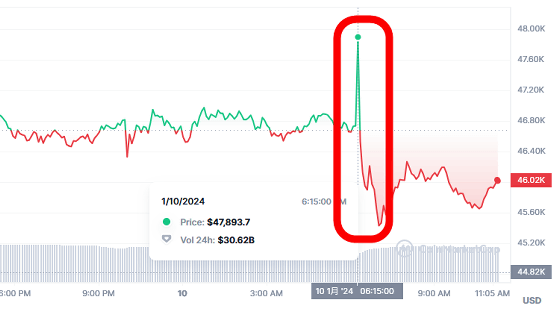

Bitcoin spot ETF officially approved for the first time

On January 10, 2024, the U.S. Securities and Exchange Commission (SEC) approved 11 applications for

SEC.gov | Statement on the Approval of Spot Bitcoin Exchange-Traded Products

https://www.sec.gov/news/statement/gensler-statement-spot-bitcoin-011023

Spot Bitcoin ETFs Approved to Launch in US by Gensler's SEC - Bloomberg

https://www.bloomberg.com/news/articles/2024-01-10/spot-bitcoin-etfs-approved-to-launch-in-us-by-gensler-s-sec

US approves first spot bitcoin ETF applications for 11 issuers | TechCrunch

https://techcrunch.com/2024/01/10/sec-approves-spot-bitcoin-etf/

First Bitcoin ETFs approved by US regulators - The Verge

https://www.theverge.com/2024/1/10/24026863/bitcoin-etf-sec-crypto-finance

An ETF is an investment trust that can be bought and sold like stocks at securities companies. Until now, ETFs that track Bitcoin futures prices have been approved, but ETFs that invest directly in Bitcoin have not been approved.

On January 10, 2024, the SEC's X (formerly Twitter) account, which had been hijacked by someone

This time, 11 companies received SEC approval, ranging from major companies such as BlackRock and Fidelity, which have been attracting particular attention, to Valkyrie, an asset management company specializing in digital assets. ETF approved. The specific brands are as follows.

・iShares Bitcoin Trust

・ARK 21Shares Bitcoin ETF

・Bitwise Bitcoin ETP Trust

・WisdomTree Bitcoin Fund

・Fidelity Wise Origin Bitcoin Trust

・VanEck Bitcoin Trust

・Invesco Galaxy Bitcoin ETF

・Valkyrie Bitcoin Fund

・Hashdex Bitcoin ETF

・Franklin Bitcoin ETF

Expectations for a Bitcoin spot ETF have been high for some time, and the initial increase following this approval was only a small one.

ETFs that invest in Bitcoin can now be traded on traditional financial markets, allowing retail investors and institutional investors such as pension funds who have not previously invested in cryptocurrencies to access digital assets. It has been pointed out that it becomes easier.

Campbell Harvey, an economist at Duke University in the US, said: 'This approval will make it easier for both retail and institutional investors to incorporate cryptocurrencies into their

While the crypto market has welcomed Bitcoin ETFs, the SEC has made it clear that they have only reluctantly approved them. SEC Chairman Gary Gensler said in a statement: 'While we today authorized the listing and trading of certain Bitcoin physical exchange-traded instruments, we do not endorse or endorse Bitcoin. 'We must continue to be aware of the myriad risks associated with Bitcoin and other products whose value is tied to cryptocurrencies.'

As mentioned above, the SEC has rejected Bitcoin ETFs for a decade. However, when Grayscale, one of the 11 companies that received approval, sued the SEC, the federal appeals court overturned the SEC's denial of the application, calling it 'arbitrary and capricious,' making approval unavoidable. it was done.

'The District of Columbia Court of Appeals remanded the SEC's decision to disapprove Grayscale's application for listing and trading in the ETF, finding that the SEC had not adequately explained why it disapproved the listing and trading of the ETF,' Gensler said. Based on the circumstances and the arguments surrounding the approval, I feel that the most sustainable path forward is to approve the listing and trading of this Bitcoin spot ETF.'' He explained that this led to the approval of

◆Forum now open

A forum related to this article has been set up on the GIGAZINE official Discord server . Anyone can write freely, so please feel free to comment! If you do not have a Discord account, please create one by referring to the article explaining how to create an account!

• Discord | 'Do you want to buy a Bitcoin ETF? Wait and see? Not interested?' | GIGAZINE

https://discord.com/channels/1037961069903216680/1194927854962626600

Related Posts:

in Note, Posted by log1l_ks