Google's parent company 'Alphabet' announced financial results for the third quarter of fiscal 2023, sales increased by 11% year-on-year, YouTube was also strong, but the cloud division was lower than expected

GOOG Exhibit 99.1 Q3 2023 - 2023q3-alphabet-earnings-release.pdf

(PDF file) https://abc.xyz/assets/4a/3e/3e08902c4a45b5cf530e267cf818/2023q3-alphabet-earnings-release.pdf

Google-parent Alphabet's cloud division misses revenue estimates, as Microsoft's cloud booms | Reuters

https://www.reuters.com/technology/google-parent-alphabet-reports-quarterly-revenue-above-estimates-2023-10-24/

Alphabet (GOOGL) earnings Q3 2023

https://www.cnbc.com/2023/10/24/alphabet-googl-earnings-q3-2023.html

Alphabet Q3 2023 Earnings: YouTube Ad Sales Jump 12.5% to $7.9 Billion

https://variety.com/2023/digital/news/youtube-q3-2023-alphabet-earnings-1235766877/

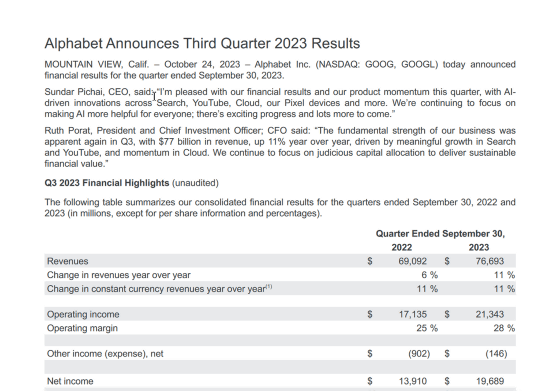

Alphabet released its financial results for the third quarter of fiscal year 2023 on October 24, 2023 local time. Sales increased 11% year-on-year to $76.69 billion, marking the first double-digit growth in a long time and exceeding analysts' forecasts of $75.97 billion (approximately 11.38 trillion yen). In addition, net income was $19.689 billion (approximately 2.95 trillion yen), significantly exceeding the $13.91 billion (approximately 2.084 trillion yen) for the same period last year.

In the third quarter of FY2023, the advertising business, which is the mainstay of earnings, performed well, with sales of $59.65 billion (approximately 8.94 trillion yen), exceeding the $59.12 billion (approximately 8.86 trillion yen) predicted by analysts. , an increase of nearly 10% from $54.48 billion (approximately 8.16 trillion yen) in the same period last year.

Additionally, YouTube's advertising revenue increased by 12.5% year-on-year to $7.95 billion (approximately 1.19 trillion yen), exceeding the $7.81 billion (approximately 1.17 trillion yen) expected by analysts. Ta. Please note that this amount does not include subscription revenue such as YouTube Premium, YouTube TV, and ' Sunday Ticket ' that allows you to watch all National Football League (NFL) games, and Alphabet actually earns from YouTube. The revenue is said to be even higher.

Sundar Pichai, CEO of Alphabet and Google, commented that he has received good feedback from NFL partners about Sunday Ticket's efforts and its ' multi-view ' feature, which allows users to watch four live streams simultaneously. In addition, YouTube shorts, which compete with TikTok, are watched by more than 2 billion users per month, and the average number of views per day has increased from 50 billion at the beginning of the year to over 70 billion.

While the advertising business and YouTube performed well, Google Cloud's sales, including AI tools, increased 22.5% year-on-year to $8.41 billion (approximately 1.26 trillion yen), compared to analysts' expectations of $8.62 billion. This was the lowest growth rate since the first quarter of 2021. The cloud division's operating profit was $266 million (about 39.8 billion yen), compared to $440 million (about 66 billion yen) in the same period last year.

Following the results, Alphabet's stock price fell 5.7% in after-hours trading. Ruth Porat, Alphabet's head of finance, maintains that growth in the cloud division is strong, explaining that the growth rate 'reflects the impact of customer optimization efforts.'

On the other hand, competing Microsoft's cloud service Microsoft Azure's revenue for the third quarter of fiscal 2023

Jesse Cohen, senior analyst at financial markets portal Investing.com , said, ``While Alphabet beat expectations for quarterly profit and revenue, investors were disappointed by the relatively weak performance of the Google Cloud platform.'' 'I'm disappointed. This risks falling behind Microsoft Azure and Amazon Web Services (AWS).'

Related Posts:

in Web Service, Posted by log1h_ik