A startup that earned 170 million yen in 90 days explains the attitude of raising funds

Selling products and raising funds can be a daunting task for start-ups. About this, Wasp, a programming language development company that raised nearly 170 million yen in about 90 days, has released 'What did you do to succeed in raising funds?'

Our fundraising learnings --250+ meetings in 98 days to the oversubscribed round | Wasp

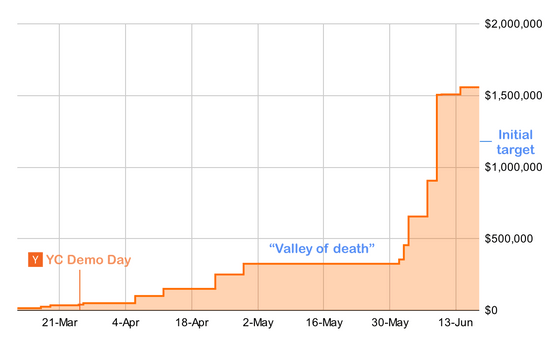

Wasp, launched by Matiya Sosic, has developed a domain-specific language (DSL) of the same name. Participating in the program of Y Combinator, a startup support organization, we have successfully raised nearly $ 1.5 million (about 170 million yen).

'I'll just list what we've done, not general advice,' said Sosich, prefaced by the secret story of success.

Wasp is a DSL that works in conjunction with React and Node.js to help build web apps. It is said that the success of this product, which attracted the attention of developers due to its ease of use, was due to the sales efforts of Mr. Sositch and others. After enrolling the product in the Y Combinator program, Sositch and his colleagues received attention from more than 100 investors, so they followed up with weekly Gantt charts and user feedback to investors about their products. He said that he worked to understand what he was thinking.

Mr. Sositch has always been critical of their marketing and continues to make efforts such as listing calls for further product improvements. Strategies such as when to launch a product, whether to publish the development team, and how to monetize it are called 'story creation' and built to memorize a story that is more compelling to investors. And continued to provide it. 'I felt that the strategy was more sophisticated and the team started to feel more confident than when I started,' said Sosic.

However, it was not finally funded by the 100 investors who initially expected it. 'Investing in a startup at the demo stage is risky and natural,' Sositch said. Originally, the product itself was so technical that Sositch and his colleagues realized that a particular developer was the true understanding, and reduced the number of customers. He investigated other development companies that participated in Y Combinator and introduced only those who have invested in similar technology products in the past.

Mr. Sositch and his colleagues say they learned that they should 'follow negative opinions, not positive ones' and 'do not spend time on suspicious people' in marketing. 'I like the product, but I'm skeptical about the size of the market and the potential for monetization,' Sositch recalls, as it was difficult and distracting to change his mind.

Sositch also said he experienced a period of little progress in the funding process. As shown in the graph below, Mr. Sositch and his colleagues earned 300,000 dollars (about 34 million yen) in about two months, but they said that they did not receive any response for one month from that point. He admitted that this was a difficult time, calling it 'valley of death,' and said he strived to continue to use all the resources he had.

Mr. Sositch felt that 'comparing themselves with large companies' was the most useful when he finished raising funds. Finding similarities in the strategies that we and big companies take is the best way to market them to investors like big companies, and although we didn't know how important this was at first, it's now 'the best.' It can be said to be advice. ' 'I hope it motivates you when you find it difficult,' Sositch wrote of these experiences.

Related Posts:

in Posted by log1p_kr