Financial secrecy index ranking that indexes the ease of money laundering by country is announced

Regions such as the Cayman Islands and Singapore are known as

Introduction

https://fsi.taxjustice.net/en/

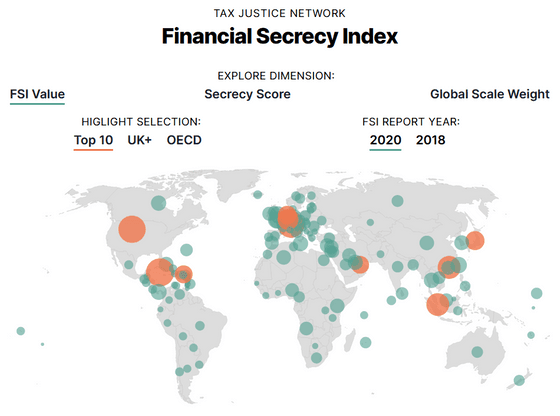

Here is a map of areas where tax avoidance and money laundering are easy, created by the Tax Justice Network.

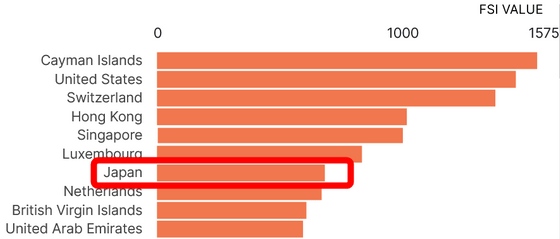

The target countries are 133 countries, and the top 10 are as follows. Japan is ranked 7th, with the Cayman Islands in 1st place, the United States in 2nd place, Switzerland in 3rd place, Hong Kong, Singapore and Luxembourg in 4th place and beyond.

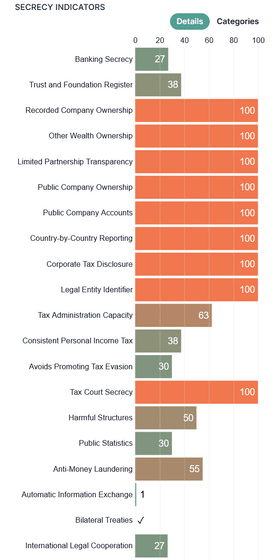

The indicators are evaluated separately for each of 20 items as shown below. Below are detailed scores for Japan: 'Bank Secrets' 27 points, 'Trust Property and Foundation Registration' 38 points, 'Company Name Registration' 'Other Asset Registration' '

The Tax Justice Network says, 'The amount of cross-border funds flowing is estimated to be between $ 1 trillion (about 113 trillion yen) and $ 1.6 trillion (about 180 trillion yen) annually. It's a hotbed of corruption, fraud, tax evasion, and money laundering. '

'It also shows that international efforts to crack down on tax havens have been ineffective for many years, but our analysis shows growing concerns about the global financial crisis and public inequality. We also know that this has created an unprecedented trend towards tax havens. '' It's important to tackle these issues fundamentally. '

Related Posts:

in Posted by log1p_kr