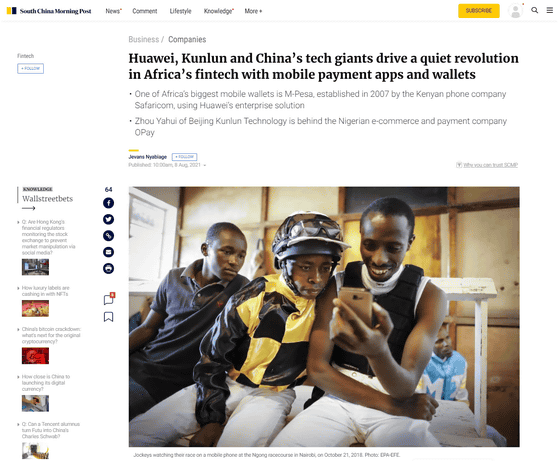

Chinese IT companies are revolutionizing FinTech in Africa

Huawei, Kunlun and China's tech giants drive a quiet revolution in Africa's fintech with mobile payment apps and wallets | South China Morning Post

https://www.scmp.com/business/companies/article/3144127/huawei-kunlun-and-chinas-tech-giants-drive-quiet-revolution

For Huawei, which has been locked out of the United States, the only growth field is 'corporate solutions,' and sales increased 18.2% in the first half of 2021. Africa is the main region, for example, Africa's largest mobile wallet, M-Pesa, uses Huawei's solutions. 'M-Pesa' is a service established in 2007 by the Kenyan telephone company Safaricom. In addition, Ethiopia's former state-owned monopoly company Ethio Telecom has also helped 'TeleBirr', which started in May 2021, and is providing technology to a total of 19 countries.

However, it is not only Huawei that is focusing on Africa, but Zhou Aki, the former owner of the popular gay dating app Grindr and the founder of Kunlun Technology, said through Kunlun's web browser division Opera, Nigeria. Involved in the electronic payment company OPay. OPay was founded in 2018. Recently, we have succeeded in raising 400 million dollars (about 44 billion yen), and the corporate value has reached 1.5 billion dollars (about 166 billion yen).

In addition, Ant Group's payment service 'Alipay', which is an affiliate of Alibaba Group Holdings, the world's largest distribution company, is also a super app with 70 companies developed by South African mobile phone company Vodacom. It is part of the business in partnership with VodaPay.

'Africa's appeal is that many people still don't have a bank account,' said Dobek Pater of research firm Africa Analysis. He explained that he was less reluctant to enter emerging markets than he was, 'because he wants to get a big return even if he takes a big risk.'

Digital financial services also create the potential to offer a variety of products to low-income earners, including insurance, loans and funerals, a great investment not found in many regions of the financial sector. Pater also said it was an opportunity for growth.

Related Posts:

in Note, Posted by logc_nt