It turns out that Opera Software had earned fraudulently with up to 876% of profit-taking loan apps, and if caught it could shut down the Opera browser

Opera, first released in 1997, is the world's first web browser with tabbed browsing and mouse gesture features. Opera Software, which develops such Opera, distributes applications that illegally make short-term loans with ultra-high interest rates, disregarding Google's rules, reports financial research company Hindenburg Research You.

Opera: Phantom of the Turnaround – 70% Downside – Hindenburg Research

What is going on at Opera Software?-GHacks Tech News

https://www.ghacks.net/2020/01/19/what-is-going-on-at-opera-software/

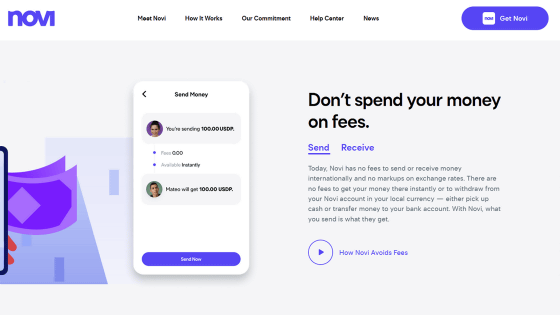

Opera Software, the developer of Opera, initially released Opera for a fee, but from September 2005 it will offer a completely free version without ads, and as of January 20, 2020 version 66.0.3515.36 Release has been repeated until.

However, Opera has not regained its market share from Firefox and Google Chrome, and Opera Software's browser business was later set up in 2016 by a Chinese

However, according to Hindenburg Research, revenue from the browser business, which was Opera Software's core business, fell 22.6% in just one year since the IPO. Opera's market share was nearly 4% in 2016, but has fallen to 2.28% as of January 2020, with operating cash flow totaling $ 24.5 million as of January 2020. It seems to be negative.

When Opera Software sold the browser business to a Chinese company and founded the new Opera Software, Kunlun founder Zhou Xin became the chairman and CEO. Zhou, who also runs a finance business in China, has launched a short-term loan business that requires “full repayment within 60 days” via a mobile app, apart from the browser business, which loses share and makes a deficit.

The short-term loan business, primarily in Africa and India, increased Opera Software's third quarter 2019 revenue by 42.5% year-over-year. For example, Kenya's short-term loan business performance was $ 6.5 million in the first quarter of 2019, $ 11.6 million in the second quarter of the year, and $ 39.9 million in the third quarter (Approximately 4.3 billion yen).

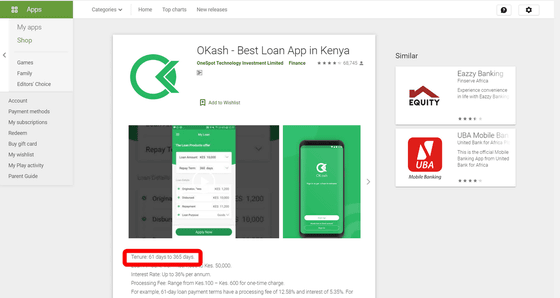

However, Hindenburg Research reports that Opera's loan app, which allows for short-term lending, has become popular through the Google Play store in Kenya, Nigeria, India and elsewhere. Google has completely ignored the terms of Google's 'ban'. For example, here is the store page of the OKash loan application actually offered in Kenya, with a repayment period of 61 to 365 days.

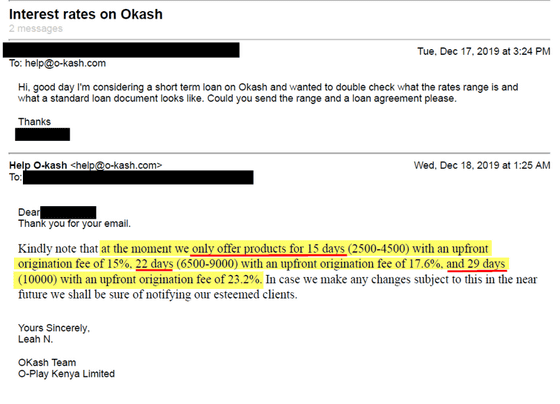

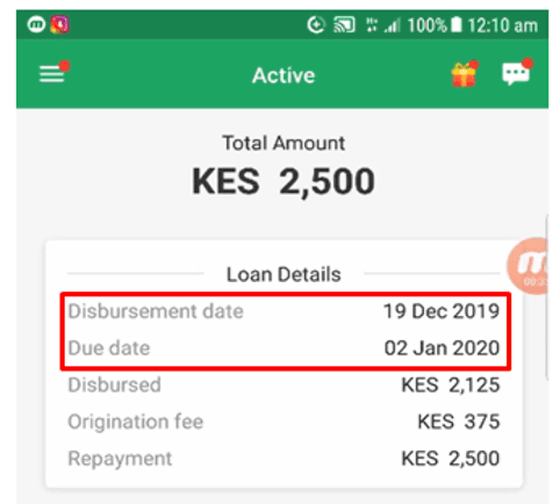

Hindenburg Research asked a consultant living in Kenya to actually contract a short-term loan with OKash. The consultant sent an email to the OKash support desk saying, 'I want to sign a contract.' 'The repayment period is 15 to 29 days, 15% for 15 days, 17.6% for 22 days, 23.2% for 29 days. The interest rate is attached, 'and a different guide from the store page was returned.

In addition, when actually signing a short-term loan contract, the repayment period displayed on the application was a minimum of 15 days. Opera Software has released other similar loan apps,

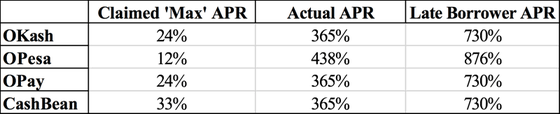

The store page claims to be 'up to 24% interest up to 365 days', but if you set the repayment deadline to 365 days and calculate it, it turns out that the interest rate is actually 365% to 438%. Also, when including the delinquency loss, the interest rate was calculated to increase from 730% to 876%.

In other words, '1: Low loan rates and long repayment period complain to download loan application' '2: Download application and provide guidance on loan while blurring that interest rate will be higher if repayment period is longer' '3 : When a user enters personal information and passes the examination, a short-term loan with an ultra-high interest rate is made. '

A former employee of OKash told Hindenburg Research, 'People who use the app have little education and read the terms of service, so they forget to check the loan repayment date and earn 1% interest per day. Often, you don't even notice that your debt is growing until it's too late. '

In addition, there are many reports of harassing collections, such as the contact of friends, family members and employers of delayed repayment users are grasped through the app and emails are sent to inform them of the fact of debt. I am. In addition, many poor college students who do not have stable income use such loan applications, and there is also a threat that they will be blacklisted by the Credit Performance Reference Office (CRB). It is said that getting on the CRB blacklist will make employment in Kenya impossible.

Can a referee of a #digitalcredit user be negatively listed at CRB? Please confirm the customer recourse process for the referee in this case? @CreditinfoKenya @MetropolCRB @TU_Africa #OPESA pic.twitter.com/wahksODRtJ

— OliviaObieroNg'ang'a (@oliviaobiero) April 16, 2019

So OKASH has access to your phone contacts that when you default on your loan they call and send messages to random people in your contacts list and loan shame you ... Wow! Who else has experienced this? Is it in the terms and conditions when you install the app?

— Petrovich Kirundi (@kirundiray) April 8, 2019

However, a former employee of OKash said that it had not been done as of June 2019 because 'it was pointed out that collecting flickering blacklists to the CRB was illegal'.

Hindenburg Research also pointed out that Opera Software's accounting in the first place and the acquisition of the browser business in 2016 itself are quite unclear. Despite three weeks before the acquisition, Zhou CEO holds all the shares of Opera Software for some reason, or the new browser software Opera Software is involved in Zhou CEO's karaoke application development business for a total of $ 75 million (about 8.2 billion yen) ), And suggests that 'Opera Software may have made a large-scale dressing statement.'

If Google bans all short-term loan apps, Opera Software's investment in Opera Software should be careful because the operation of Opera Software, which earns a lot of profits from loan apps, may suddenly decline. Hindenburg Research calls for attention. If the short-term loan business could not stand up due to Google's app detection, it would have a significant impact on the browser business, `` In the worst case, the Opera web browser with a history of more than 20 years may be ended '' Technical media ghacks.net speculated.

Related Posts:

in Software, Smartphone, Posted by log1i_yk