Micron reveals 3D XPoint production base to Texas Instruments for 100 billion yen

Semiconductor manufacturing company

Micron to Sell Lehi, Utah, Fab to Texas Instruments | Micron Technology

https://investors.micron.com/news-releases/news-release-details/micron-sell-lehi-utah-fab-texas-instruments

TI to acquire Micron 300-mm semiconductor factory, extending TI's cost advantage and greater control of supply chain | news.ti.com

https://news.ti.com/ti-to-acquire-micron-300-mm-semiconductor-factory-extending-tis-cost-advantage-and-greater-control-supply-chain

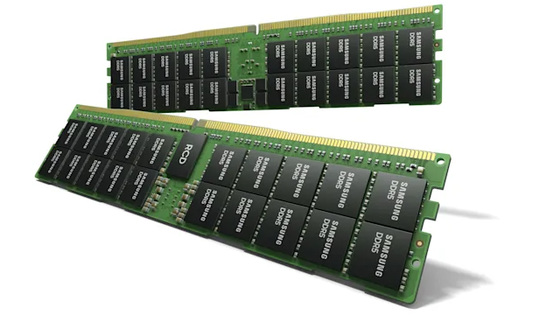

3D XPoint is a memory technology announced by Intel in 2015 that consumes 30% more power than NAND flash memory , has 1/10 latency, 3x write life, 4x write speed, and 3 read speeds. It was attracting attention as a technology that can achieve double the ultra-high performance.

Intel is moving toward the market launch of next-generation non-volatile memory technology '3D XPoint DIMM' memory with explosive speed and large capacity --GIGAZINE

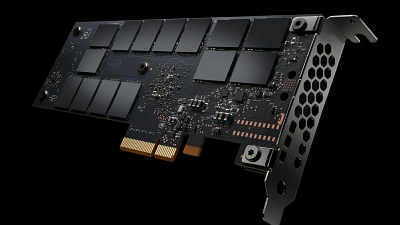

After that, Micron, which was developing 3D XPoint with Intel, announced in October 2019 the high-speed, low-latency SSD ``

Micron withdraws from the development of explosive memory technology '3D XPoint', Intel indicates intention to continue development --GIGAZINE

And on June 30, 2021, both companies announced that Micron would sell its 3D XPoint-related factory in Lehi, Utah to Texas Instruments for $ 900 million. At the same time, Micron is considering selling memory-related assets amounting to 600 million dollars (about 67 billion yen), and Micron plans to obtain an economic profit of 1.5 billion dollars (about 167 billion yen) from a series of sales. .. At the time of writing the article, it is said that the seller of memory-related assets is under consideration, but technology-related media AnandTech said, 'Given that the memory-related assets that Micron is considering selling are special, It's no surprise that the seller is Intel, 'he said , speculating that Micron might sell its memory-related assets to Intel.

Texas Instruments considers the factory purchased from Micron to be a 'semiconductor factory capable of producing 300mm wafers' and has no plans to produce 3D XPoint related products. Kyle Fresner, senior vice president of technology and manufacturing at the company, said, 'The factory we buy from Micron is a great asset and we have a great team. We have the team's engineering experience and technical skills. I'm looking forward to it, 'he said, indicating his intention to continue hiring employees after purchasing the factory.

Meanwhile, Micron CEO Sanjay Mehrotra said, 'Texas Instruments is a leader in the semiconductor industry and truly appreciates the capabilities offered by our factories and teams, so we are pleased to reach an agreement.' At the same time, he said, 'We will focus on the development of the next-generation connection standard Compute Express Link (CXL) in the future,' he said about the future outlook.

The factory sale procedure by Micron is scheduled to be completed by the end of 2021.

Related Posts:

in Hardware, Posted by log1o_hf