How does a bank make money from nothing?

Banknotes and coins that people think of when they think of 'money' are issued by the

Atte Juvonen-Banks create money out of thin air, but it's less impressive than it sounds

https://www.attejuvonen.fi/money-out-of-thin-air/

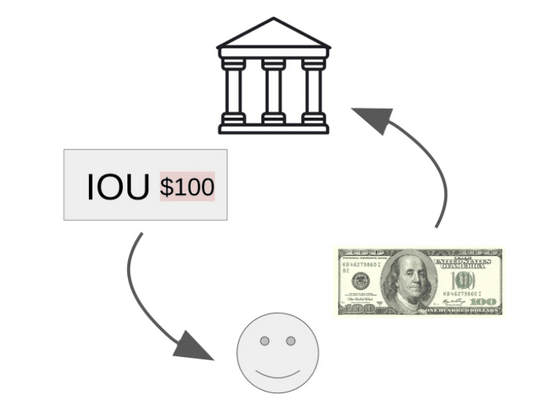

One of the major roles of banks is deposit business. 'The true nature of bank deposits is nothing more than an IOU ,' Juvonen explains. For example, let's say a person deposits $100 in a bank. As a result, the depositor's money will be out of hand, but instead the person can always get $100 back from the bank. In other words, depositing $100 in a bank means receiving $100 of IOU issued by the bank.

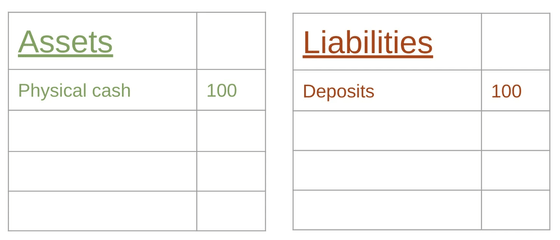

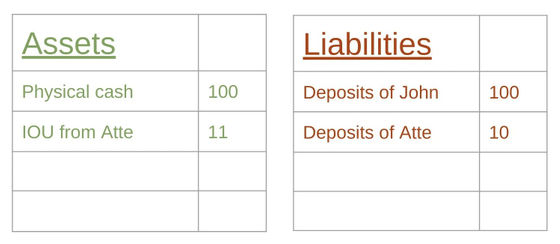

If the bank's only transaction was a $100 deposit, the bank's

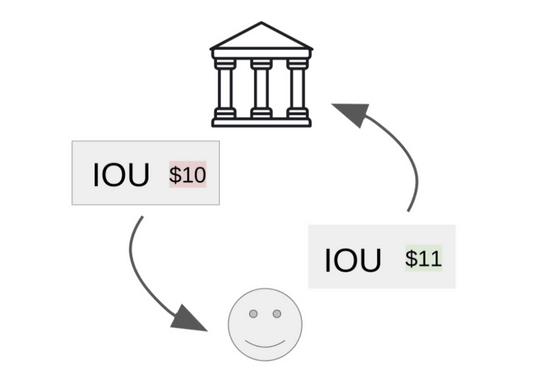

In addition to the deposit business, banks also have the role of providing loans. According to Juvonen, the loan is 'just an IOU exchange'. For example, when Mr. Atte makes a loan that 'borrows 10 dollars (about 1050 yen) from the bank and returns 11 dollars (about 1150 yen) including interest later', the bank and Atte's $10 and $11 IOUs will be exchanged between.

Below is the bank's balance sheet after making a loan. In the Assets and Liabilities section, $11 that Mr. Atte will return and $10 that Mr. Atte lent were filled in, respectively. At this time, the bank's total debt is $110, but the bank vault has only $100. This difference is 'the money that the bank makes from nothing.'

This mechanism was explained in a paper published in 2014 by German economist Richard Werner: 'Money supply is like a magic powder made by a fairy in a fairy tale. It's created from nothing.'

On the other hand, Werner also states that 'only banks can make money out of nothing', but Jvonen argues that this is 'a clear mistake.' It is true that only banks can legally make money in the above way, because it is stipulated by law and not only banks have the ability to make special money. Because there is no.

For example, Full Tilt Poker , a global online poker service that opened in June 2004, has a payment system that allows you to exchange stakes, allowing players to exchange money more quickly than banks. Said he was still using Full Tilt Poker's payment system in situations other than poker, such as movie ticket transfers.

Since Full Tilt Poker was not a bank recognized by the government, the operator of Full Tilt Poker was arrested in April 2011 for gambling law violations, etc. 'Full Tilt Poker is an example of a non-bank company making an IOU,' said Juvonen.

From this point of view, Juvonen said, “Bank deposits and loans are just the issuance of IOUs. And while banks can make money from nothing, IOUs that money are made can be made by anyone. So there is no special power in banks.'

Related Posts:

in Note, Posted by log1l_ks