What is the mechanism by which banks generate money in the market?

by NikolayFrolochkin

Speaking of banks, there may be many people thinking about "depositing money", but in banks that are the central bank of the country called the central bank, they generate money in the market and revitalize the economy It also plays the role of. A movie that explains such "How the bank creates money" is published on YouTube.

Money creation in the modern economy - Quarterly Bulletin article

The reporter man is facing the interview partner in the depot of the Bank of England, the central bank of the UK.

A large amount of gold bars are kept in the surroundings. Once in the UK where the gold standard was maintained, in 1931 it moved to the managed currency system. The opponent who asks the reporter man as "Where is the money being produced?"

Mr. Ryland Thomas of the Bank of England. According to Mr. Thomas, the money in the world consists of the currency issued by the central bank with the right to issue currencies and the reserve deposit that financial institutions other than the central bank deposit to the central bank.

The central role of the central bank is not only to function as "Bank of Bank" "Bank of the Government" but also that it is responsible for national monetary policy such as price stability and monetary easing. If the economy is stagnant, the central bank will increase the amount of money circulated in the market and increase the financing of companies and households by general banks to encourage economic revitalization.

Then, how do central banks work on the market ... ...

Normally, the central bank controls the amount of currency circulating in the market by changing the policy interest rate when lending to other banks. When the economy is good, the central bank raises the policy rate. As a result, ordinary banks raise interest rates on deposits and savings and loans, and reduce the amount of currency circulation on the market. On the contrary, when the economy is bad, we will lower the policy interest rate and increase the amount of currency circulating in the market.

As the economy gets worse, the policy rate will be lowered, but in the recent recession of the recent year it has come about to reduce the policy interest rate to nearly zero by referring to the zero interest rate policy . However, if you take a zero interest rate policy, the central bank can not do any further monetary easing by lowering interest rates. Then, if the central bank wishes to further stimulate the market by stimulating further monetary easing, it is forced to take a method other than lowering the interest rate.

What is done is a method called QE (Quantitative Monetary easing policy) . General banks will be able to make loans in proportion to their own deposit balances, but quantitative monetary relaxation is based on the idea of increasing the amount of currency circulating in the market by increasing this deposit balance I will.

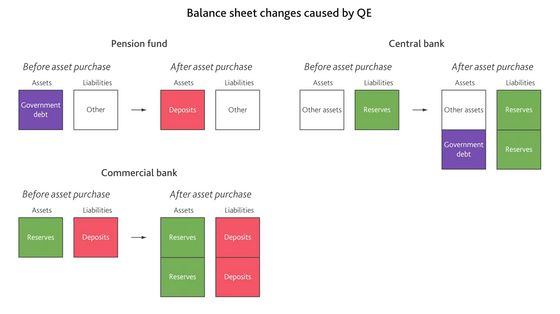

Sometimes it is said that "In a quantitative monetary easing central banks with the right to issue currencies rose money against ordinary banks", but you can see that it is not so when you look at the balance sheet. In quantitative monetary easing, the central bank will purchase government bonds from pension funds other than banks. As a result, the government bonds are sold to the central bank, and from the pension fund the gains from the sale of government bonds remain in exchange for government bonds. As a result of this gains on sale of government bonds being deposited in banks, the amount of deposits in general banks will increase. Mr. Thomas says that the central bank is acting as a bridge between pension funds and banks.

In this way, the general bank will have a large amount of deposits, the central bank thinks that investment and loans will increase to make the most of the deposits held by the banks to earn money. Some economists say, "In the situation close to the zero interest rate, even if quantitative monetary easing is done, great effect can not be expected", but if it goes well, if the currency distribution volume improves, the depression of depression You can do it.

Related Posts:

in Video, Posted by log1h_ik