An attempt to search for a 'tax system that balances economic equality with productivity' using artificial intelligence

Taxes support various public services and social security, but it is lonesome that hard-earned money is deducted as taxes. Therefore, a research team at

The AI Economist: Improving Equality and Productivity with AI-Driven Tax Policies

https://blog.einstein.ai/the-ai-economist/

The AI Economist-Salesforce.com

https://www.salesforce.com/company/news-press/stories/2020/4/salesforce-ai-economist/

AI devising a more equitable tax system

https://techxplore.com/news/2020-05-ai-equitable-tax.html

“Economic inequality is accelerating globally, and concerns are growing because it negatively impacts economic opportunities, health, and social welfare,” the research team said. Pointed out that it is an important tool to reduce. However, if high taxes are levied, the distribution to the poor will be strengthened and inequality will be resolved, while if the taxes are too high, there will be a problem that the willingness to work will decrease and productivity will decline. It is difficult to create an optimal tax system that balances productivity with productivity.

Economists have been discussing tax issues for many years, but it is difficult to build an economic theory that models the complexity of the real world, saying, 'Some promising tax regimes with real nations as experiments. It is also impossible to say “test”. The research team then trained AI using a

The classical tax theory focuses on workers who earn income from labor, who pay the cost of labor to make a financial profit. Also, because each worker has different abilities, less-working workers earn less income than more-working workers even if they work the same amount of time, causing economic inequality. Governments may want to tax and redistribute their income to improve economic inequality, but too heavy a tax burden will outweigh the cost of labor and increase productivity. There is a risk that people will stop working above a certain level.

AI economists have used a reinforcement learning framework that replicates 'workers' and 'taxes' to learn how a particular tax regime changes worker behavior. By repeating learning using two frameworks, AI economists can create a tax system that does not impair impartiality while keeping worker productivity high.

You can see how the AI economist actually performed the simulation by watching the following movie.

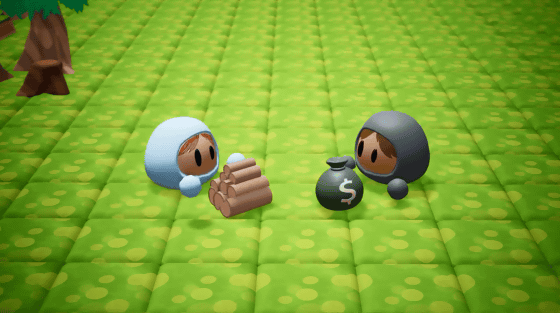

The AI framework designed by Salesforce simulates a flat world like a game.

Each worker earns income by engaging in different jobs on the field. Collecting resources that appear in a limited proportion on the field ...

Alternatively, the resources can be used to build a building that allows the worker to make a profit.

Various workers with different abilities live in the entire field, and those with low abilities mainly engage in resource collection and sales.

Higher-capacity workers are mainly engaged in wholesale trade or building construction, and the higher-capacity workers are, the greater their income for working hours.

The government collects taxes from the income of workers ...

Taxes are redistributed to workers as a subsidy to eliminate economic inequality.

Income increases the

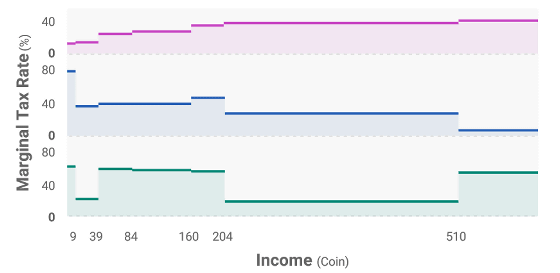

In the graph below, the vertical axis shows the

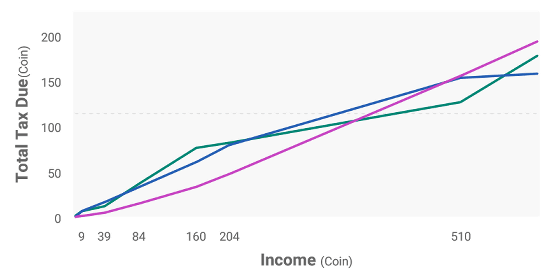

Below is a graph showing the total amount of tax paid by workers by income. Although low-income people are taxed rapidly, it can be seen that the increase in tax payments declines in the middle class and increases again in the high-income class. Looking only at this graph, the tax system devised by AI seems to impose a high tax on low-income earners ...

In reality, the taxes collected by the government are redistributed. Therefore, considering after receiving the redistribution, the tax burden is low for the low-income group.

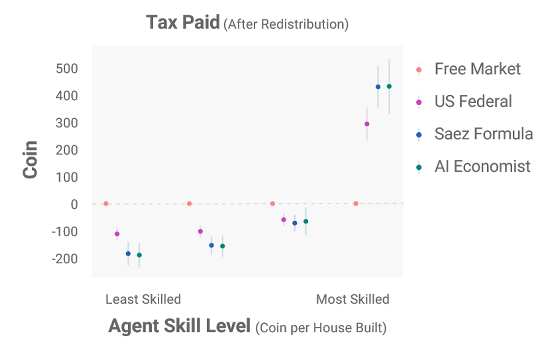

Looking at the graph below showing the ability of the worker on the horizontal axis and the amount of tax paid on the vertical axis, the worker on the far right with the highest ability and highest income pays the tax, which is transferred to the low-income group and the middle class. It can be seen that the real tax burden on low-income and middle-class people is lightened because they are distributed.

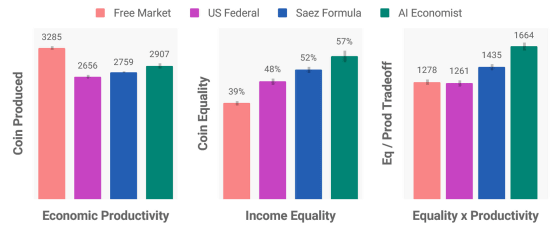

In fact, the research team used this simulation model to 'completely free market without taxation and redistribution' 'tax system used in the United States in 2018' 'tax system devised by economist Saez' 'AI economist The created tax system 'was used to compare productivity and economic equality. As a result, the tax system devised by AI does not reach the complete free market in terms of productivity (left), but it has the highest economic equality (middle) and the highest balance between productivity and equality (right). It turns out that The research team claimed that the AI-invented tax system improved the balance between productivity and equity by 16% compared to the tax system devised by Mr. Saez.

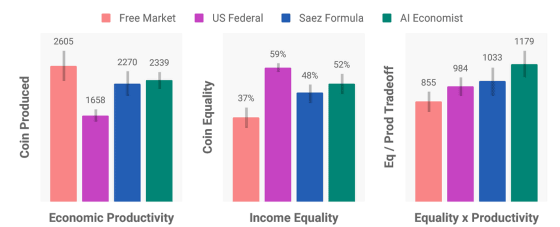

The research team not only conducts simulations using AI, but also conducts experiments involving over 100 people living in the United States. Participants used this simulation model to play a 'game that maximizes the utility of the' workers 'they control.' The graph below shows the results of 125 trials. Although there are many differences from AI simulation, it is clear that the tax system devised by AI is the best from the viewpoint of balancing productivity and equality.

The AI-based economic simulation model created by the research team has limitations, complicated behavioral factors of workers and worker interactions are not modeled, and the overall economic scale is also relatively small. I will. However, it is possible to improve the model by incorporating various factors that affect people's behavior and social institutions in the future. The research team claims that AI simulation provides a transparent and objective view of the economic impact of taxation, and hopes that future economic AI models can improve real social welfare. It was.

Related Posts: