It is reported that Amazon's profit decreased for the first time in the past two years, and AWS's growth is slowing down

by

For the first time in the past two years, Amazon's quarterly earnings are reported to have lost revenue. As a result, Amazon's stock price fell 9% in overtime transactions.

Amazon (AMZN) 3rd Quarter Earnings: What to Expect | Nasdaq

https://www.nasdaq.com/articles/amazon-amzn-3rd-quarter-earnings%3A-what-to-expect-2019-10-24

Amazon (AMZN) Q3 2019 earnings

https://www.cnbc.com/2019/10/24/amazon-earnings-q3-2019.html

Amazon profit declines for first time in two years; shares drop, Companies & Markets News & Top Stories-The Straits Times

https://www.straitstimes.com/business/companies-markets/amazon-profit-declines-for-first-time-in-two-years-shares-drop

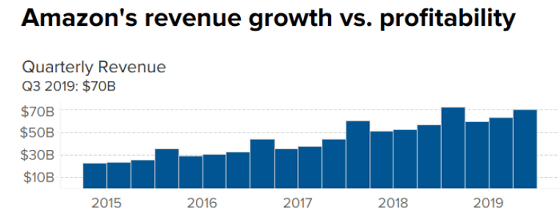

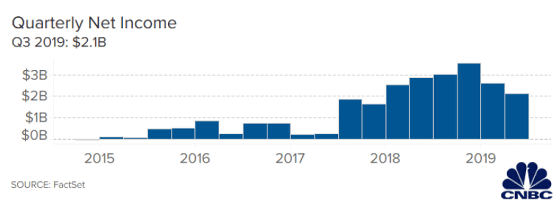

Amazon's third quarter EPS (profit per share) was $ 4.23 (about 460 yen), but last year was $ 5.75 (about 620 yen). The analyst's forecast was $ 4.62 (about 500 yen), so it was lower than expected. On the other hand, revenue was 70 billion dollars (about 7.60 trillion yen), which exceeded the analyst's forecast of 68.8 billion dollars (7,470 billion yen). Amazon has spent $ 800 million (about 87 billion yen) on free next-day delivery services in the past two quarters, and it seems that the decrease in EPS and the increase in revenue are due to this.

Graphing Amazon's quarterly earnings is like this.

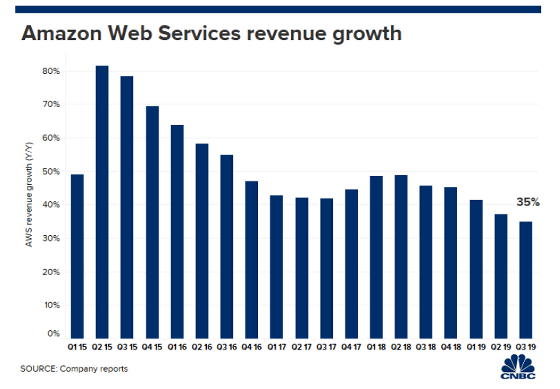

Meanwhile, the quarterly sales of AWS, a cloud business, was $ 9 billion (approximately 977.0 billion yen), compared with analyst forecasts of 9.1 billion dollars (approximately 987 billion yen). Operating profit was $ 2.66 billion (¥ 289.0 billion), an increase of 9% from the same period of the previous year, but below the market research firm's fact set estimate of $ 2.55 billion (approximately ¥ 277.0 billion). . As AWS has accounted for most of Amazon's operating profits over the past four years,

Below is a graph showing the growth of AWS revenue. The horizontal axis represents each quarter, and the vertical axis represents revenue growth.

However, Amazon explains that this decline is due to marketing talent and the timing of investment in sales. Amazon plans to invest $ 1.5 billion (163 billion yen) in the fourth quarter to expand the warehouse and expand the product handling range, and it is expected that investments will also be made in cloud business and advertising sales.

Amazon's investment cycle has made it difficult to predict revenue and tends to lower profitability. Net income was $ 2.1 billion (228 billion yen), down 26% from the same period last year. The fourth quarter is expected to be in the range of $ 1.2 billion to $ 2.9 billion.

Related Posts:

in Web Service, Posted by darkhorse_log