Why did Amazon decide to withdraw from the Chinese market?

by

It is reported that Amazon will withdraw from China's online shopping business , and it will become clear that it will close its e-commerce business in China on July 18, 2019. While businesses such as Amazon Web Services (AWS) and Kindle will continue to be provided in China, why is Amazon, one of the world's largest online shopping services, unable to maintain service in China ? Is considering.

Amazon Quits China Market-Another US E-commerce Giant Failing in China-Pandaily

https://pandaily.com/amazon-quits-china-market-another-use-commerce-giant-failing-in-china/

'I wasn't too shocked to hear that Amazon pulled out of the Chinese market,' said Shaw One, a Pandaily reporter. When Mr. Wang was living in the United States, Amazon had always been the first choice for online shopping, as it handled 'a large number of trusted products.' But in China, compared to other online shopping services, there are fewer product brands to handle, and even Prime members have been delivering slowly, 'I have always plagued me,' Wang said.

Amazon's service in China will grow moderately after acquiring the Chinese online shopping site Joyo.com in 2004. By combining the experience of online shopping that Amazon had developed around the world with the expertise in the Chinese market that Joyo.com has cultivated until then, it was possible to lead online shopping services in the Chinese market to success. Was considered.

However, in fact, it takes three years to change the service name from Joyo.com to Joyo Amazon, and then four years until it is renamed to Amazon.cn.

It took as long as seven years before it became possible to deploy the service as Amazon.cn, but in the meantime, competitive services were rapidly growing their businesses.

One of the competitors, the online shopping service JD.com, started in 2004 when Amazon acquired Joyo.com. Alibaba, China's largest online shopping service, launched a single day in 2008. The single day has grown to a marvelous event that sells for 40 million yen per second in 2018, and it can be said that Amazon could not keep up with the growth rate of these competing services.

Alibaba renews sales record of 'single day' and sells for 40 million yen per second-GIGAZINE

Pandaily said, “While Amazon continues to move towards the goal in the traditional calm and slow turn, competitive services will make use of fierce discount battles, online advertising or offline advertising, etc. to see the eyes and wallets of Chinese consumers. I wrote, 'I'm stuck.' In addition, he pointed out that 'the Amazon, like Yahoo, MySpace and eBay, could not adapt to the ever-changing Chinese market.'

According to data published by research firm iiMedia Research, Amazon.cn's share in the Chinese B2C market in the first half of 2018 has fallen to less than 1.2%. On the other hand, the share of the three major online shopping services in China, such as Alibaba, JD. Com and Tmall, has grown to 83.8% in total. As of 2008, the share of Amazon (then Joyo Amazon) in the Chinese B2C market was quite high at 15.4% .

JD.com's CEO Richard Liu says that what I felt most when JD.com was competing with Amazon was that 'Amazon doesn't trust the Chinese team.' Liu said, 'The decision-making power of China was delayed by the US headquarters, so it was slowing down,' said that Amazon did not put the trust on the Chinese team, which is why the Chinese market is It is pointed out that it is the biggest factor that can not keep up with the change.

In contrast, one of the competing services, JD.com, is expanding its share of delivery speed to trump compared to Alibaba. While Amazon has also offered a two-day delivery service for purchase from prime members, JD.com has developed a service that delivers in half to one day, Liu said, 'Customers will be within six hours. We expect to be able to get the product, which will take too long in 2 days, 'highlighting the difference between Amazon and JD.com services.

Kyoto (JD. COM)-Genuine low quality, quality assurance, delivery and time, 轻!

https://www.jd.com/

Amazon plans to withdraw online shopping services from the Chinese market, but in February 2019 Amazon.cn and China's cross-border e-commerce platform NetEase Kaola are accelerating the move to integrate overseas purchasing businesses Yes. Wang points out in cross-border e-commerce: 'If Amazon can stick to its own high-quality products, it can change its marketing strategy and adjust its management structure.'

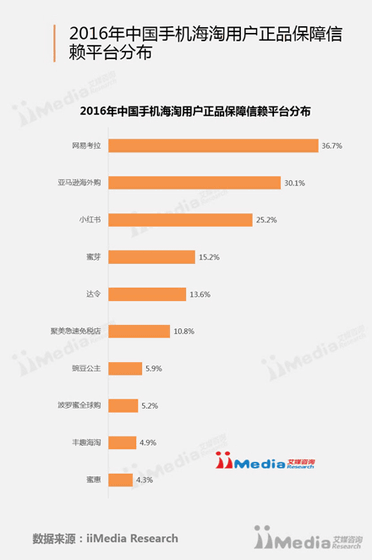

In fact, according to iiMedia Research data, Amazon's high-quality products are a great starting point for the Chinese market. The graph below is a graph summarized by iiMedia Research in 2016, 'What overseas e-commerce companies do you trust?' With 16.7% of NetEase Kaola and 20.1% of Amazon, Amazon's online shopping service has failed in the Chinese market, but the Amazon brand is still highly reliable. You can see that it is.

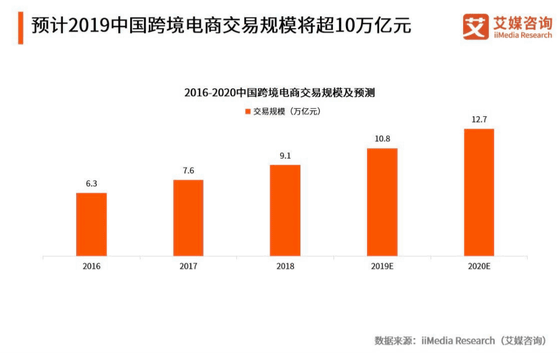

China's cross-border e-commerce market is in a growing stage, with a transaction volume of $ 1.4 trillion in 2018 (approximately 160 trillion yen) and is expected to grow further in 2019. It is unclear whether cross-border e-commerce will be the last hope for Amazon's China expansion in the future, but at least Mr. Wang seems to think that 'there is hope.'

Related Posts:

in Web Service, Posted by logu_ii