I tried to actually use 'e-Tax' which made it possible to file a tax return online without prior notification.

" E-Tax " is a system that can make a tax return on-line that appeared in 2004. In the past, it was not possible to use it before notifying the tax office president in advance and receiving notification of ID and password, but after 2019 no prior notification becomes necessary, as soon as there is a My Number card and an IC card reader In fact, I tried to make a final tax return. In addition, it is necessary to arrange for my number card and IC card reader for reading card information with PC in advance.

【Corner of making final declaration form etc】 - Create corner top

https://www.keisan.nta.go.jp/kyoutu/ky/sm/top

【E-Tax】 National Tax Electronic Declaration · Tax Payment System (E-Tax)

http://www.e-tax.nta.go.jp/

My number card system is a special feature declaration for Heisei 30

https://www.nta.go.jp/taxes/shiraberu/shinkoku/tokushu/info-kakutei-mnc.htm

◆ Advance preparation - The items prepared this time are as follows. It is unnecessary to apply beforehand such as "I'd like to file a final tax return on e-Tax", so it's OK if you have all the necessary items.

· IC card reader " SONY PaSoRi RC - S380 "

· My number card · Tax collection slip · "Certificate of donation receipt" of my hometown tax payment

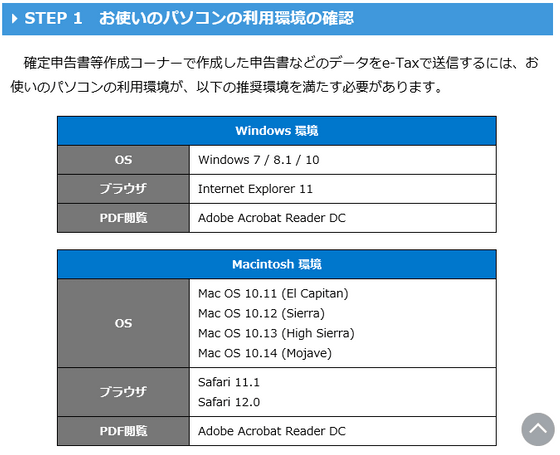

When you check the page of the National Tax Agency, the preparations are listed in 4 steps. STEP 1 is about the environment, the required environment is as follows. This time I am using Windows 10.

In STEP 2 you are instructed to prepare my number card. In addition, in order to use e-Tax, you need the following three passwords entered when my number card is issued.

· Password of electronic certificate for user certification (4 digits of number)

· Password of digital certificate for signature (6 to 16 alphanumeric characters)

· Password (4 digits of number) for assisting with entry of coupons

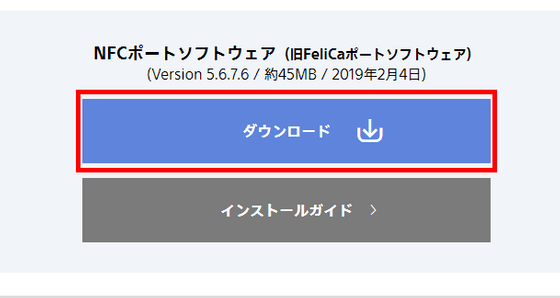

STEP 3 is the content that it is necessary to prepare an IC card reader. I set up the IC card reader here. Since I use Sony's card reader this time, please access Sony's Felica application · software download page and click on "Download page" of NFC port software.

Click the "Download" button that appears when you scroll the page.

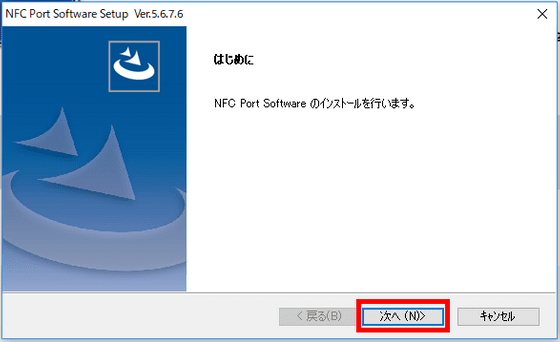

Run the downloaded installer. Since there are no settings to change in particular this time, it is ok if you click "Next" all the time.

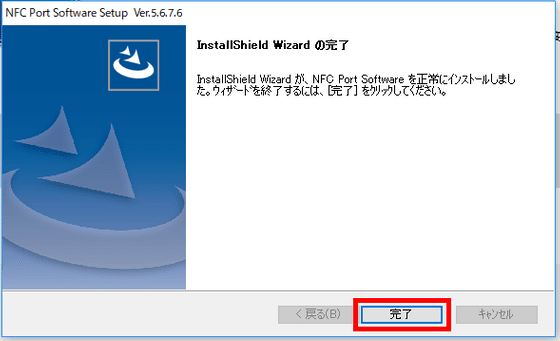

Click "Finish" to finish the installation. Rebooting PC after installation is unnecessary.

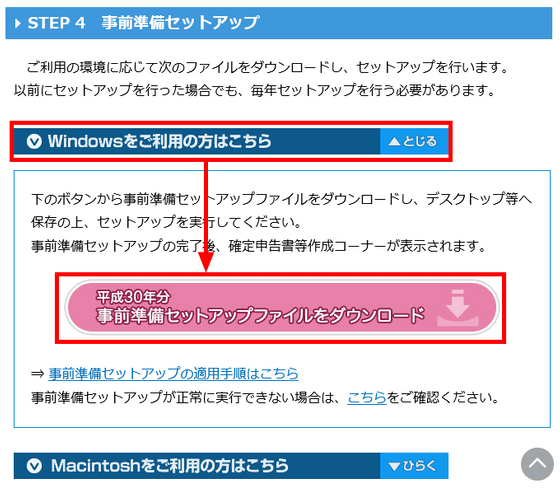

In STEP 4, click "Download Preliminary Preparation Setup File" according to the instructions.

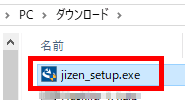

Double click on the downloaded "jizen_setup.exe" and execute it.

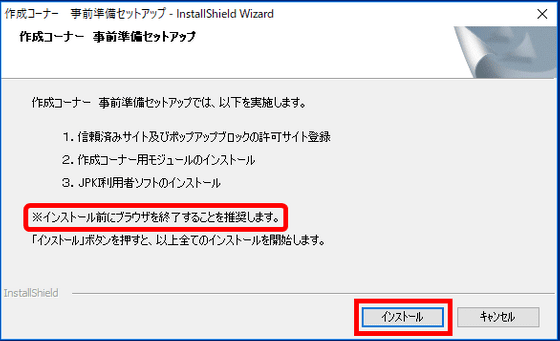

"Terminating the browser before installation" is recommended. Especially it seems better to terminate Internet Explorer. Click "Install".

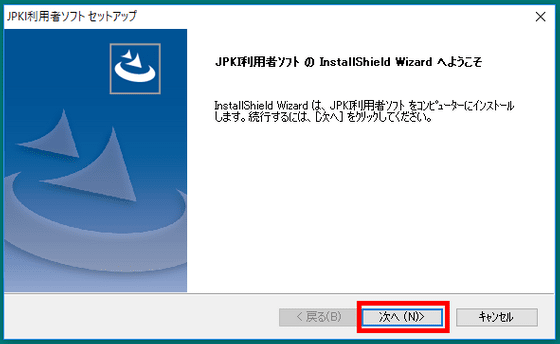

A window called "JPKI user software setup" is newly displayed during installation. Follow the instructions to install.

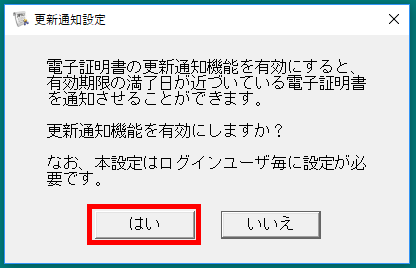

You can also choose whether or not to notify you when the validity period of the electronic certificate saved in my number card is approaching. For this time, click "Yes".

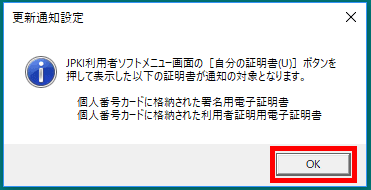

A dialog will appear asking "Which electronic certificate will be subject to notification", so click "OK" to proceed.

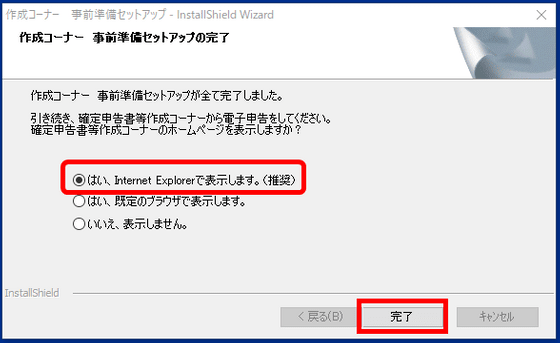

When setup is completed, you can choose whether to open "Final return form etc. creation corner". Since I would like to proceed with the declaration as it is, click "Finish" while checking "Yes, I will display it with Internet Explorer".

◆ My number card & user information registration

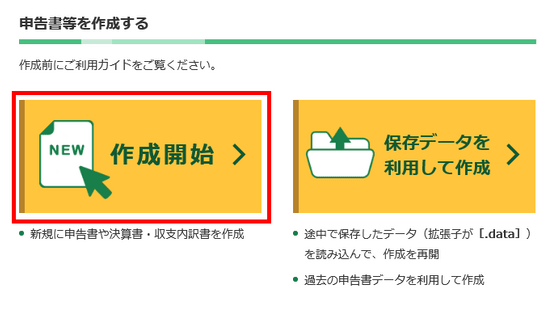

Internet Explorer will be launched and the page of the National Tax Agency will be opened. Click the "Start creating" button on the displayed page.

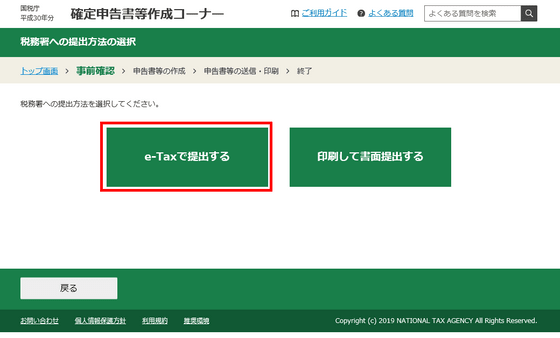

You can choose the submission method. This time click "Submit with e-Tax".

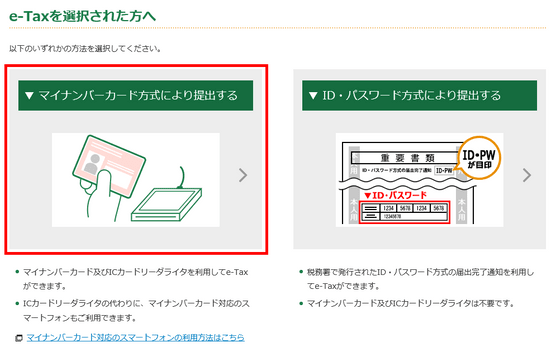

Click "Submit by my number card method".

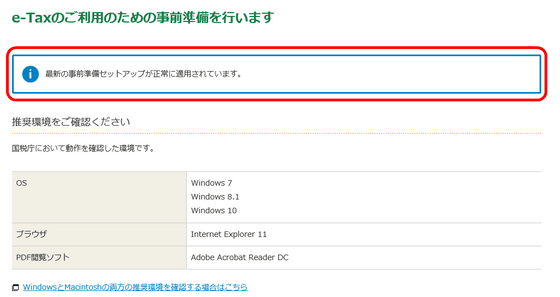

A preliminary preparation notice is displayed. At the top is the display saying "The latest prepare setup has been successfully applied."

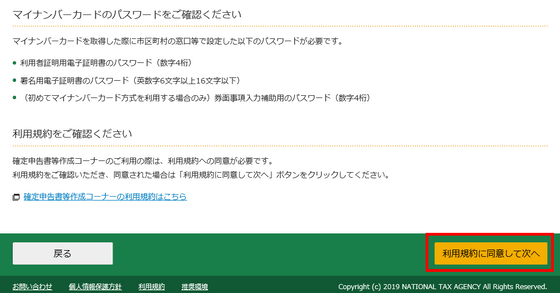

After reading the notice · terms of use, click "I agree to the terms and conditions and click" Next.

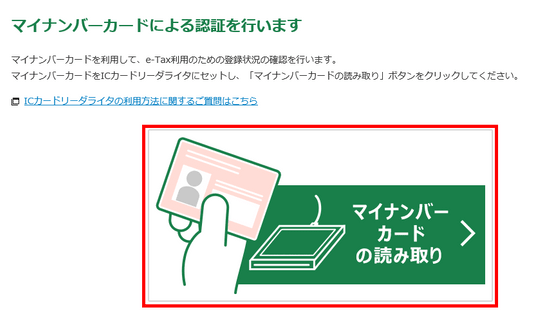

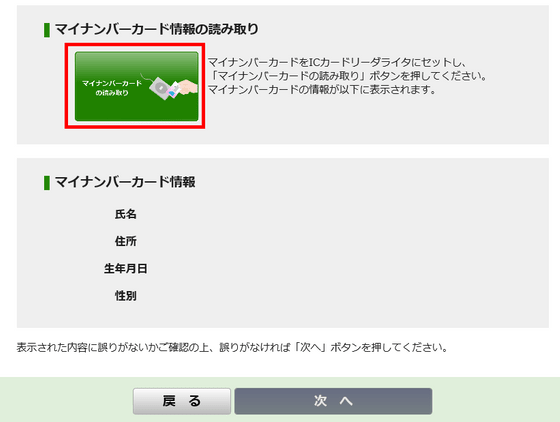

I set my number card in the IC card reader ......

Click "Read My Number Card".

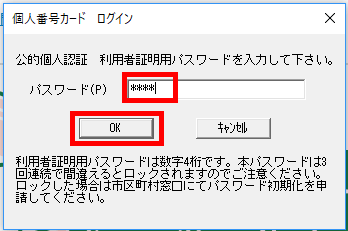

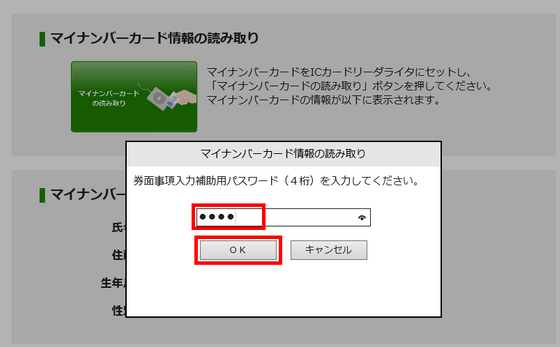

Since you can ask for "public personal authentication user certification password", enter the 4 digit number entered when issuing my number card and click "OK".

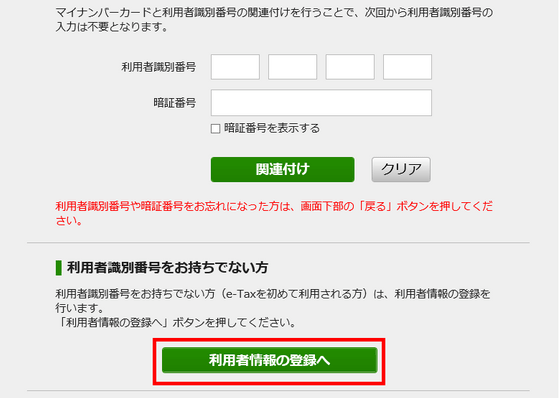

You will be asked for "user identification number". Since this time I will use e-Tax for the first time, click "To register user information".

Click "Read My Number Card".

Next, enter "Password for assistance in entering face".

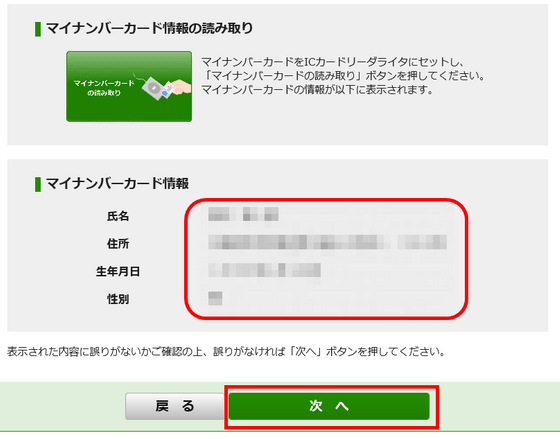

Then, the data recorded on My Number card is read out. Confirm and click "Next".

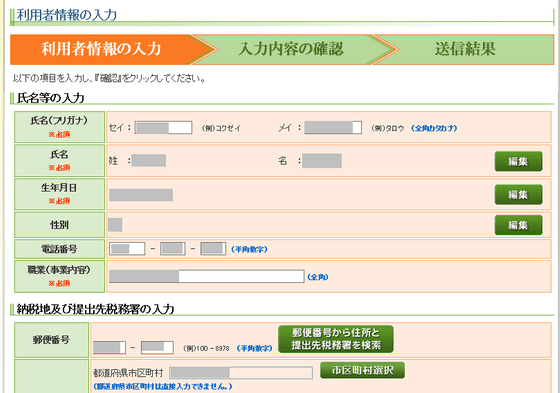

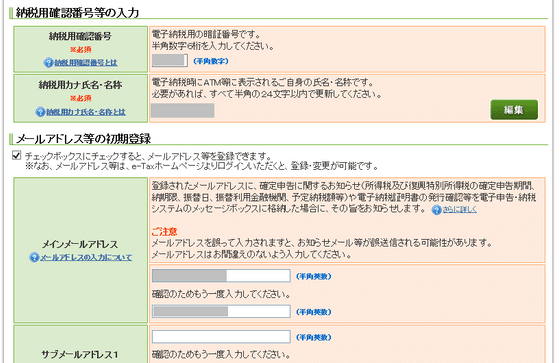

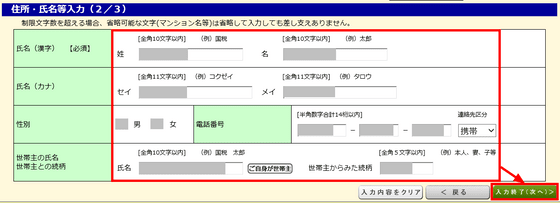

We will fill in missing parts as we can ask for additional information.

Tax payment confirmation number is a personal identification number required for electronic payment. Please enter with the 6 digit number and make a note so as not to forget it. Also, because it was said that we will notify you about the final tax return, we will also register your email address.

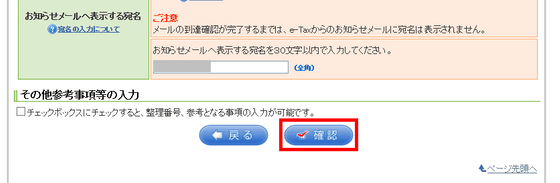

When all input is completed, click "Confirm" at the bottom.

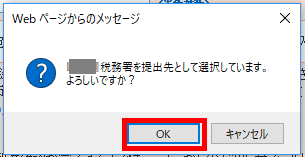

Confirm that there is no mistake in the tax office to which you are submitting, so please check and click "OK".

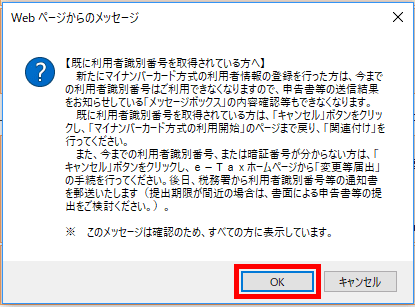

Also, a message saying "You are using e-Tax in the past and you do not need to register again if you have a user identification number" is displayed. Since this is the first use this time, click "OK".

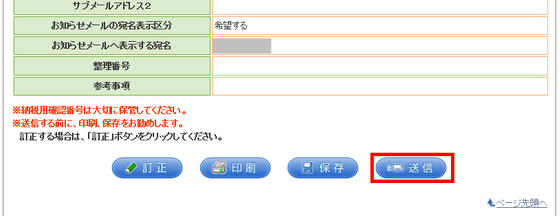

As you move to the screen where input contents can be listed, please check the contents and click "Send".

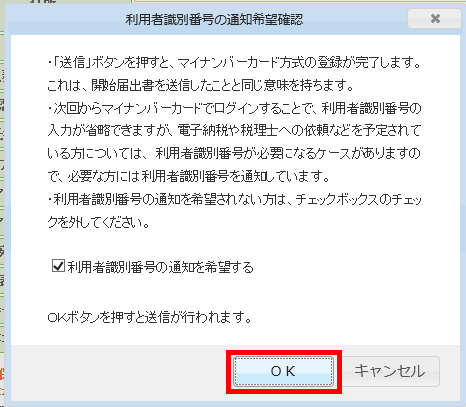

We will notify you of the content that "you will have sent a start notice when you send it." Confirm it and click "OK".

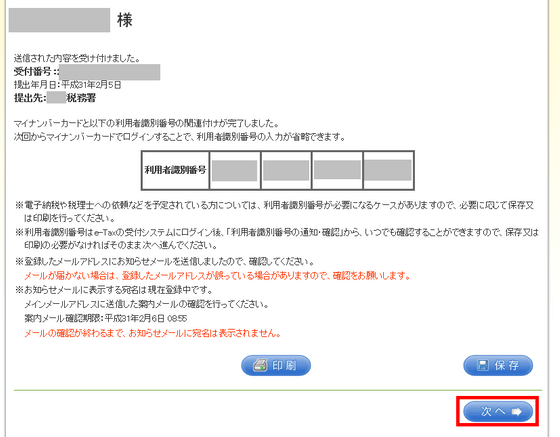

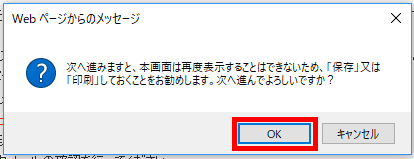

Confirm the contents and click "Next". Since this screen can not be redisplayed, please save and print at this point if necessary.

Click "OK".

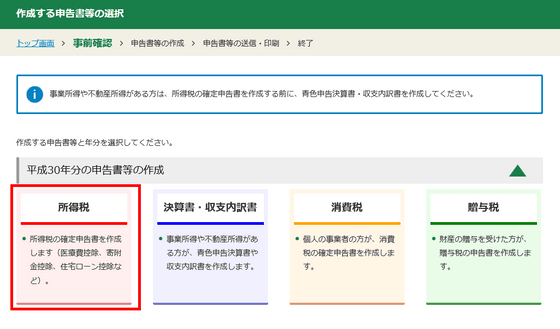

◆ Create Declaration Form - Select the declaration to create. Click "Income tax" this time.

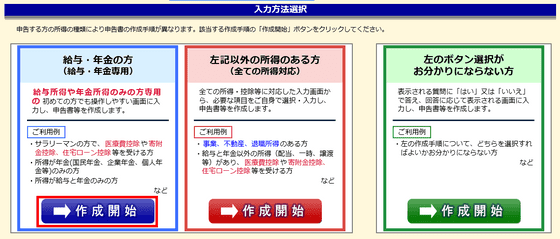

Procedures vary depending on the type of income. People who have business income, real estate income, retirement income and so on need to select the red button on the right. Since this is salary income only this time, I will click the blue "Create start" on the left side.

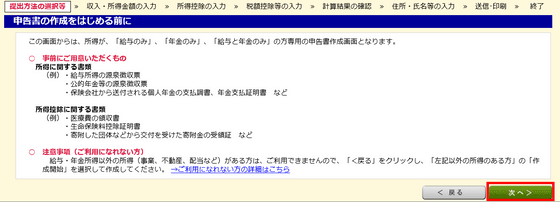

As the notice is issued, please confirm and click "Next".

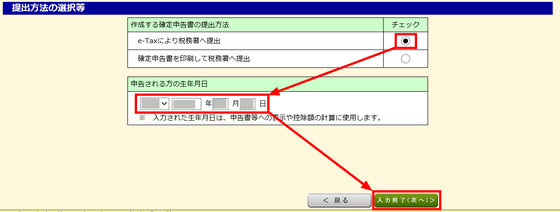

The selection screen of the submission method will be displayed. For this time, select "e-Tax", enter your birth date and click "End input (next)".

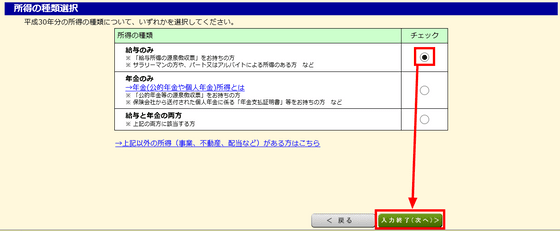

You are told to choose the type of income. For this time, select "Salary only" and click "End input (next)".

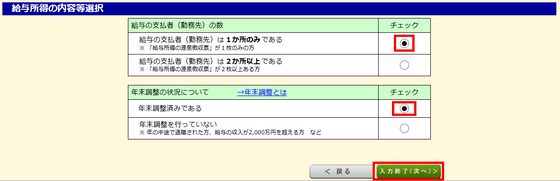

I will be asked about the number of work placement and the year-end adjustment, so I will select the appropriate one. For this time, check "I'm working on 1 place" and "I have adjusted year-end" and click on "End input (next)".

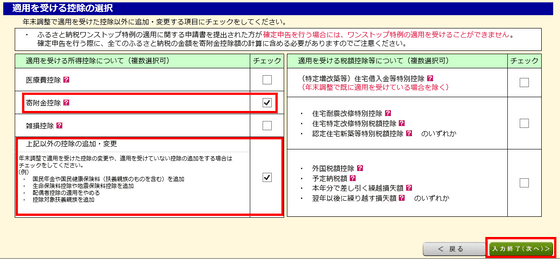

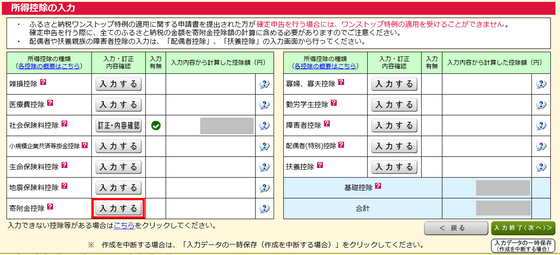

Please check the items you are planning to declare that are not applied by year-end adjustment. When making a final return, since the one-top special case of the hometown tax payment is not applied, it is necessary to add the amount of all the hometown tax payment to the calculation again. For this time, please check the "donation deduction" of your home payment and "Add / change deduction other than the above" for deducting life insurance fee and click "End input (next)".

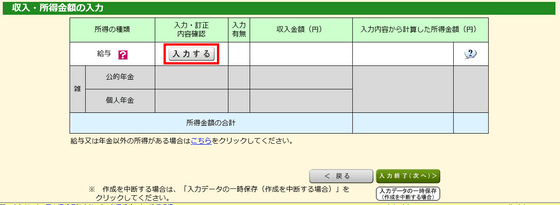

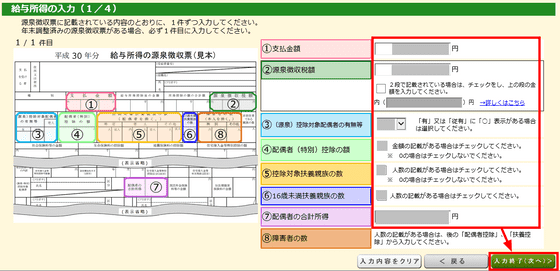

We will move on to the input screen of income and income amount. Click "enter" in the salary column.

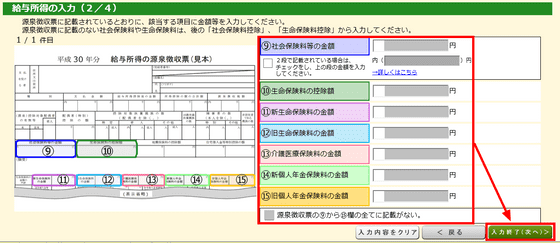

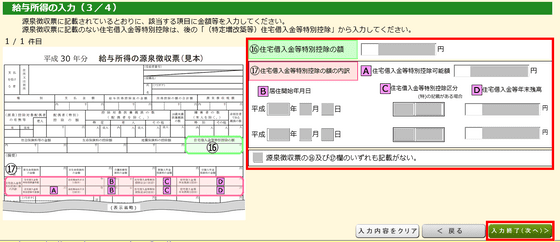

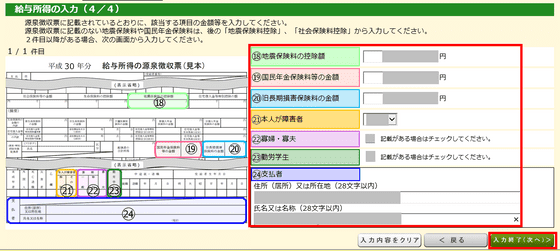

While comparing the sample of the left withholding slip and the number of the right column, we will enter the contents of the withholding slip at hand. After inputting, click "End input (next)".

I will copy the contents of the withholding slip in the same way. If there is no description in the corresponding column, check the check box in front of "No statement of withholding tax voucher" at the bottom.

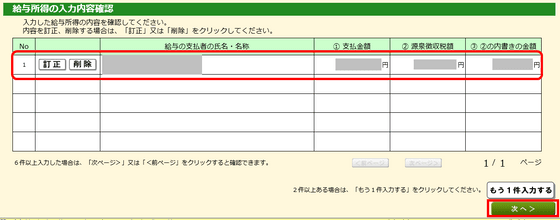

When input is completed, it will be a confirmation screen, so please confirm and click "Next".

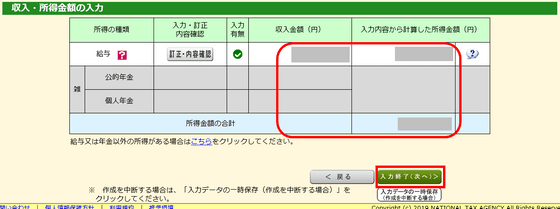

We will return to the input screen for income and income amount. Confirm the contents and click "End input (next)".

Next I will declare the contents of my old hometown tax payment. Click "Enter" in the column of donation deduction.

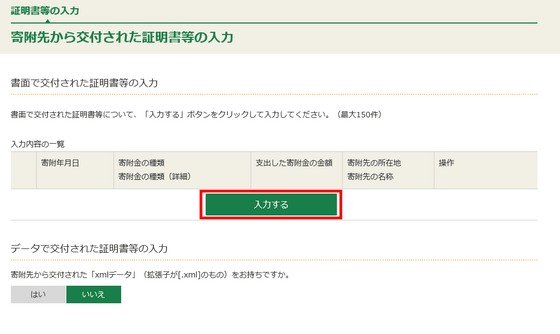

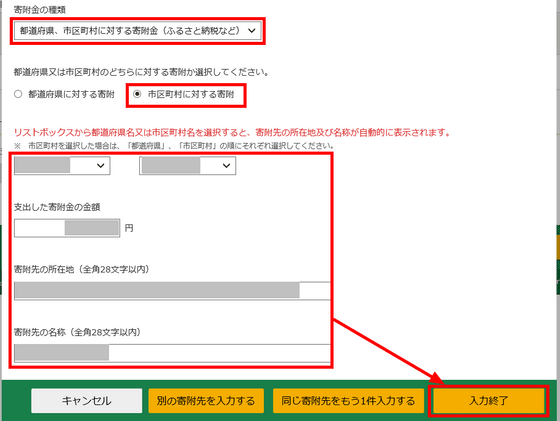

Since this time it was delivered in writing, click "Enter" in the "input of certificate etc. delivered in writing" column.

Choose "donation to prefectures, municipalities and municipalities" as the type of donation, choose whether the target is prefecture or municipality, and copy the contents of the document sent from the municipality. Click "End input" when you are done.

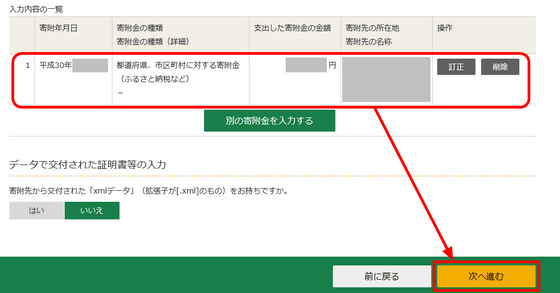

Confirm the entered information and click "Next".

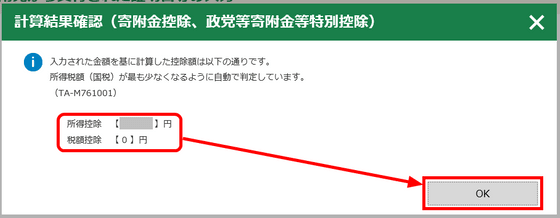

It calculates and displays how much it is deducted. Confirm it and click "OK".

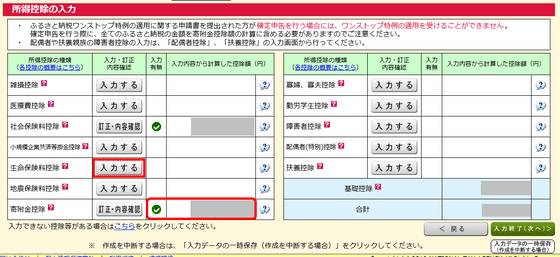

I will return to the "Input of income deduction" screen. The contents entered in the column of "donation deduction" are reflected. Next I will enter the life insurance fee deduction.

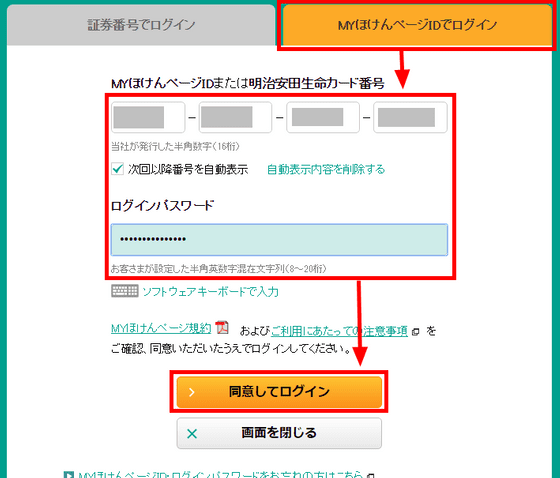

This time we will deduct the insurance premium of Meiji Yasuda Life. Leave the e-Tax page intact, open a new window, and access " MY Homepage ". Click "Login".

Enter your ID and password and click "Login".

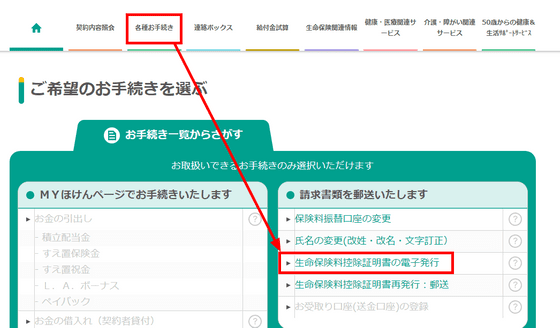

Click "Electronic issuance of life insurance premium exemption certificate" on "Various Procedures" page.

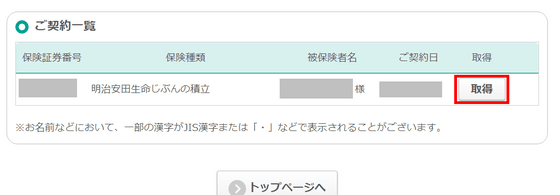

Since contracted insurance comes out, click "Acquisition". A file of the format "○○. Xml" is downloaded.

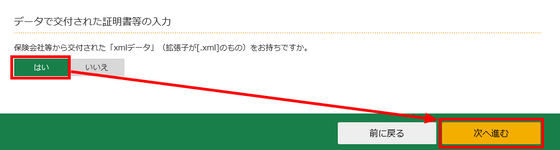

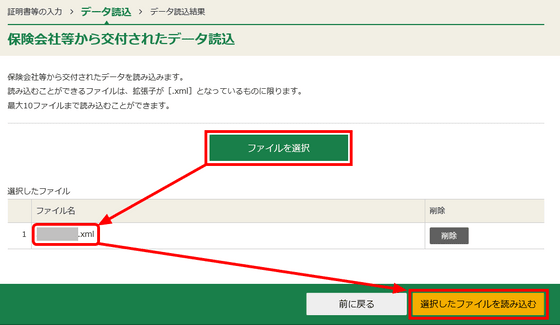

Return to the window of the e-Tax that you opened, select "Yes" in "Enter certificate etc. delivered with data" and click "Next".

Select the "○○. Xml" file you downloaded earlier and click "Load Selected Files".

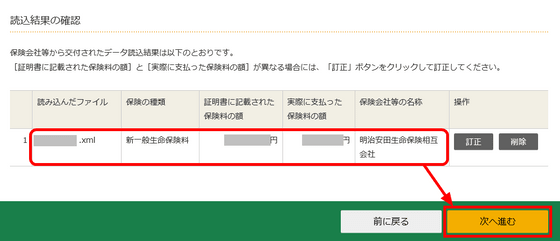

Confirm the imported content and click "Next".

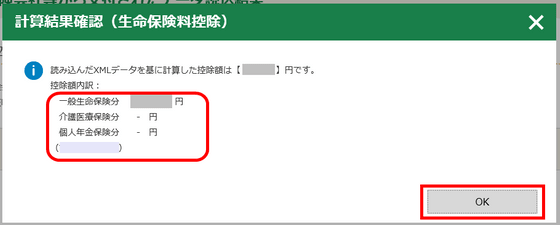

As the deduction amount is displayed, confirm it and click "OK".

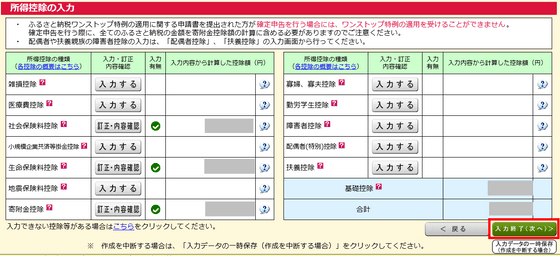

I will return to the "Input of income deduction" screen. Please enter other fields as necessary, and click "End input (next)" in the lower right when input is completed.

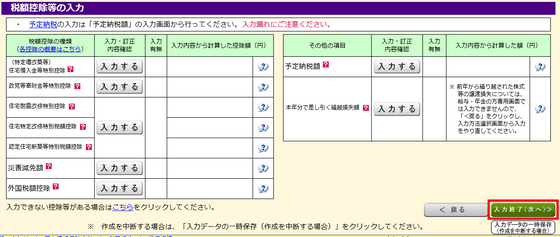

Input of tax deduction etc. is carried out as necessary. Click "End input (next)" when you are done.

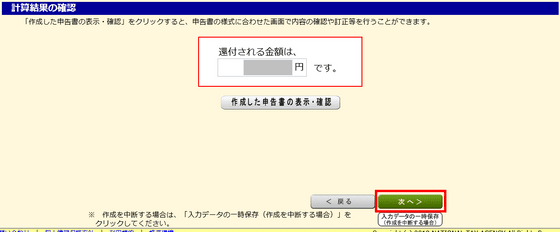

Income tax calculation results are displayed. This time it is refunded. Confirm and click "Next".

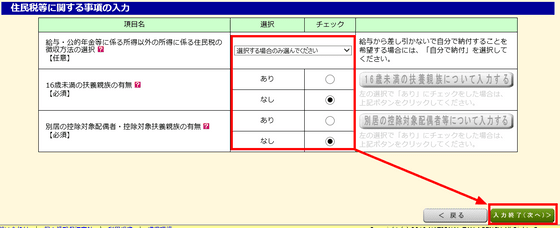

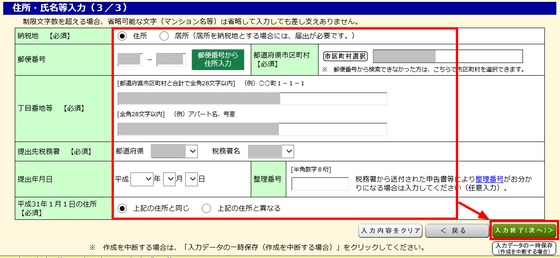

Because you are asked about matters related to resident tax, select the appropriate one and click "End input (next)".

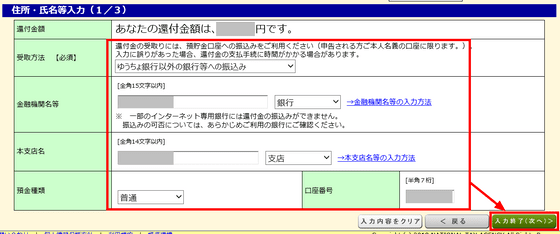

Since it will be refunded this time, we will enter the necessary information for refund.

Finally, enter my number and click "End input (next)".

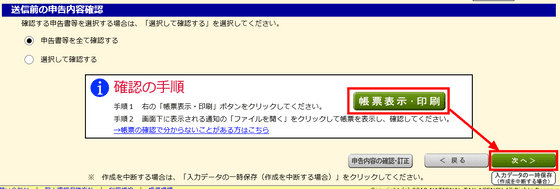

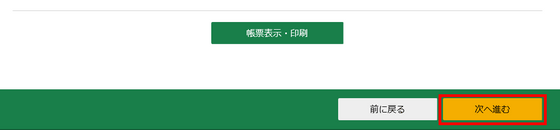

If you want to check the contents before sending, you can download the input content in PDF format by clicking "Form Display / Print". When you confirm, click "Next".

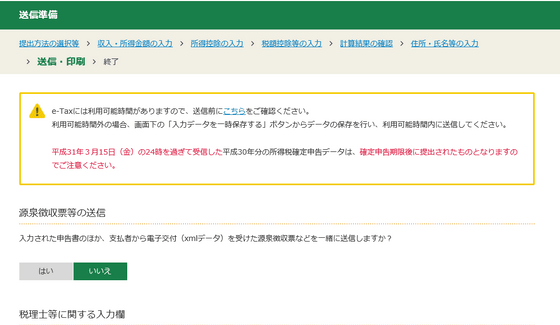

We will move on to the "Preparation to send" screen. Simply enter the information you want to send at the same time, if any.

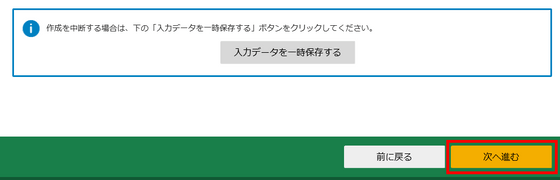

Scroll to the bottom and click "Next".

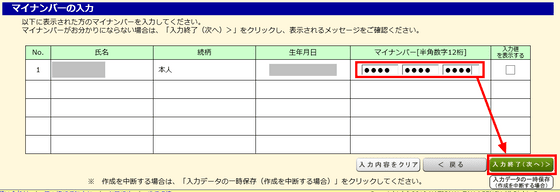

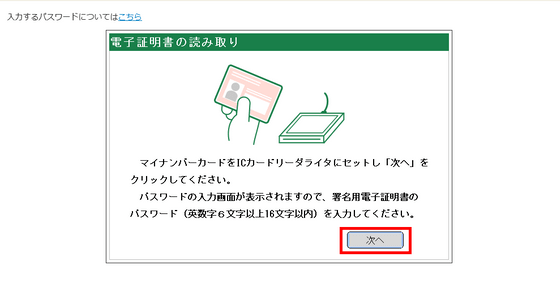

Read the information necessary for transmission from my number card. Please set My Number card in IC card reader and click "Next".

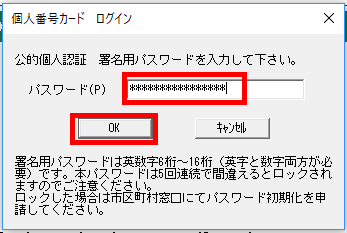

Enter "Public personal identification signature password" and click "OK".

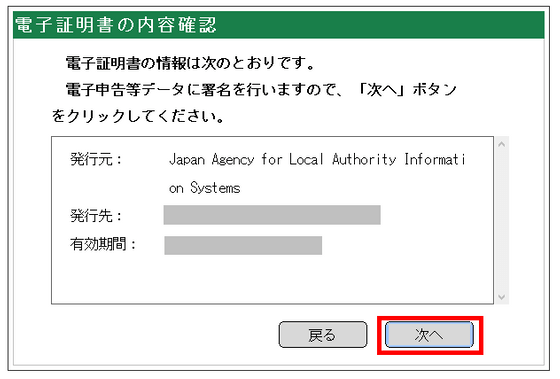

The information of the electronic certificate is displayed. Click "Next".

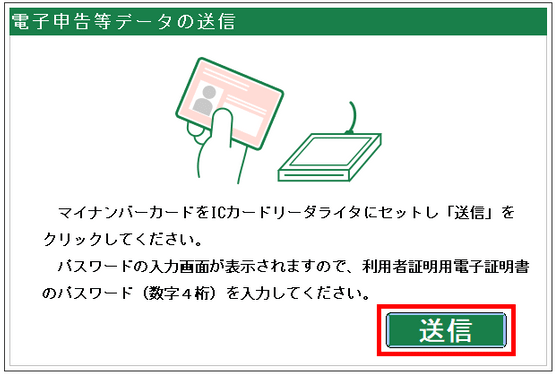

I have to read my number card again. Please set My Number card again in the IC card reader and click "Send".

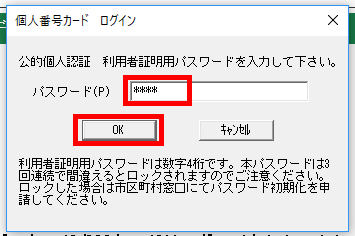

Next, enter "Password for public personal authentication user certification" and click "OK".

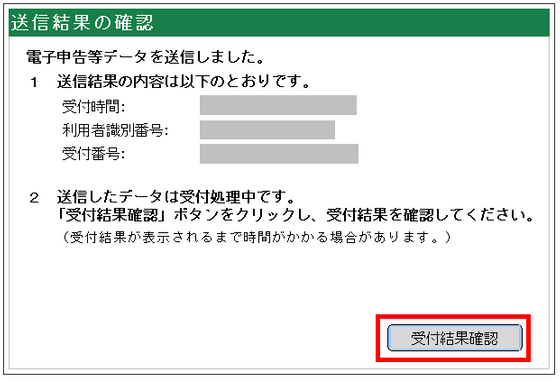

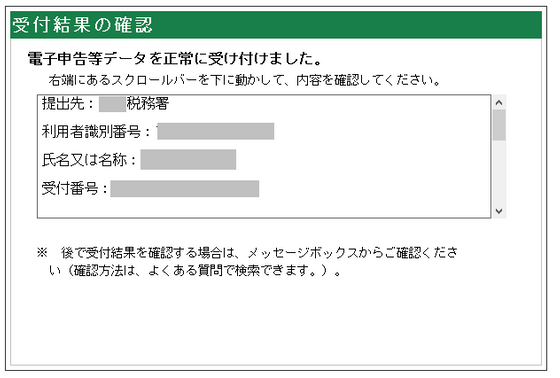

Transmission is complete. When you click "Confirmation of receptionist" ...

You can check the reception result.

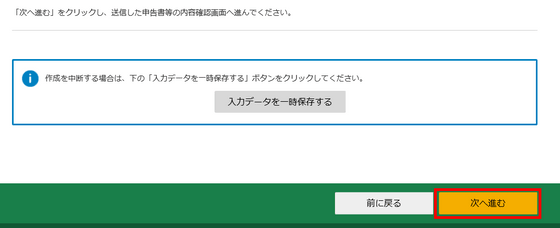

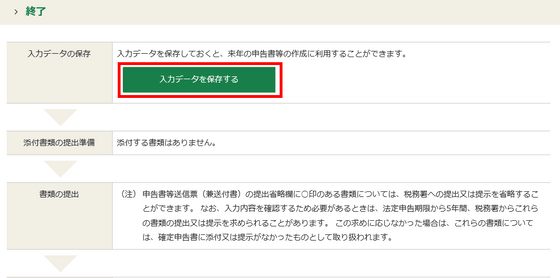

Scroll the screen as it is and click "Next".

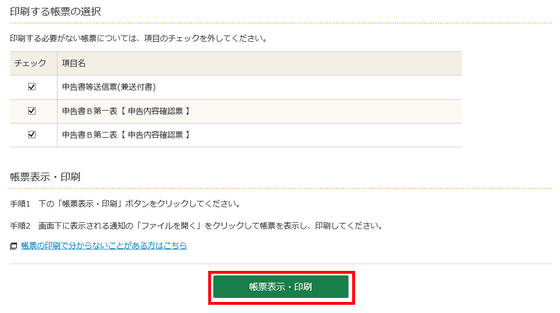

When you click "Display Form / Print" ... ....

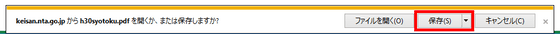

You can download a pdf file that can confirm the contents you sent.

Scroll the screen as it is and click "Next".

Clicking "Save input data" ...

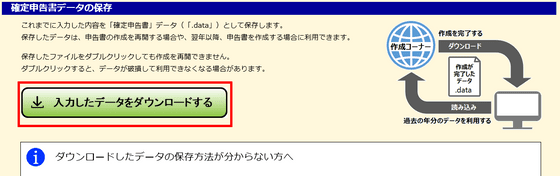

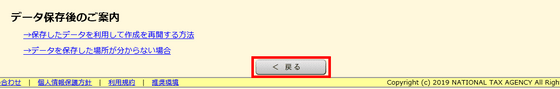

A page where "input data that can be used after the next year" can be downloaded opens. Click "Download input data".

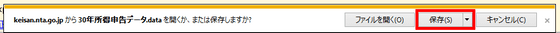

You can download "30 year income return data. Data" file.

After downloading the data, scroll to the bottom of the screen and click "Back".

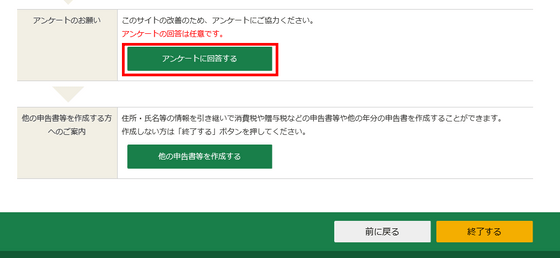

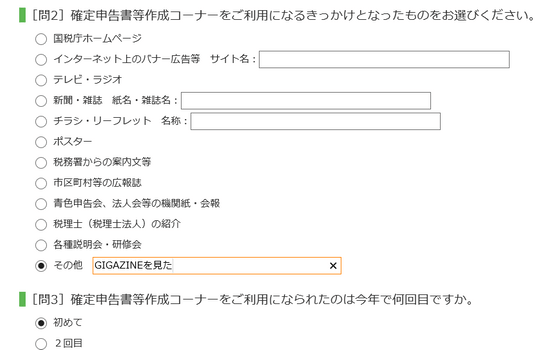

To answer the questionnaire, click "Respond to the questionnaire".

With a questionnaire that was not so long, I could answer in less than 5 minutes.

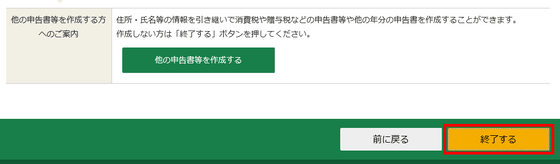

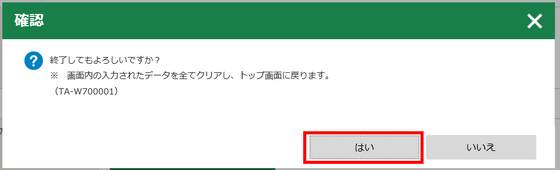

When you click "Finish" at the bottom of the screen ... ...

The confirmation screen will be displayed. If you click "Yes", the final return is completed.

It became unnecessary to prepare in advance and I felt that the fact that it was possible to finish the final return without going to the tax office greatly lowered the hurdle of the final return. If you use e-Tax, you can submit it in January 2019, but the tax office's window is declared from February 18, 2019 (Monday). In addition, the due date of the final return is Friday, March 15, 2019, and for sending using e-Tax, reception on the server side is completed by 24 o'clock on March 15, 2019 (Friday) is needed.

The IC card reader used this time is sold at Amazon at the time of article creation with tax of 2491 yen.

Amazon | Sony SONY non-contact IC card reader / writer PaSoRi RC-S380 | Sony (SONY) | External memory card reader mail order

Related Posts:

in Web Service, Review, Posted by log1d_ts