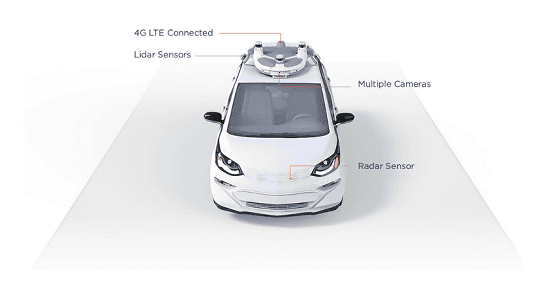

SoftBank invested 245 billion yen in GM's automatic driving development unit "Cruise", spurring the start of unmanned taxi business in 2019

GM (General Motors), which aims to commercialize "unmanned taxi" unnecessary for driver in 2019, is an investment fund led by SoftBank group "SOFTBANK VISION & FUNDAnnounced that it will receive a capital contribution of 2.25 billion dollars (approximately 245 billion yen) from SVF (SVF).

GM's Cruise gets $ 2.25 B from SoftBank's Vision Fund, $ 1.1 B from GM | TechCrunch

https://techcrunch.com/2018/05/31/gms-cruise-gets-2-25b-from-softbanks-vision-fund-1-1b-from-gm/

SoftBank Flips the Venture - Capital Script Again With GM Deal | WIRED

https://www.wired.com/story/softbank-flips-venture-capital-script-gm-deal/

GM announced on May 31, 2018 local time that SVF was 2.25 billion dollars (about 245 billion yen) against GM Cruise Holdings (Cruise), a group company that is pursuing the development of automatic driving car technology under its umbrella, Announced that it was decided to do a huge amount of equity investment. At the same time, Cruise also received a $ 1.1 billion (about 120 billion yen) contribution from GM and aims to start an unmanned taxi business in 2019.

First of all, at the completion of the partnership, $ 900 million (about 98 billion yen) is invested from SVF against Cruise, and the remaining 1.35 billion dollars (about 150 billion yen) is added at the stage when actual preparation for commercialization is completed It is going to be introduced. Once all investments are completed, SVF will own 19.6% of Cruise's shares.

About this announcement, CEO of Mary BARRA of GM "Cruise and GM team have made wonderful progress over the past two years." "Working with SVF is" zero accident "" zero emissions "There will be a strong partner on pursuing the vision of" zero congestion "."

Michael Ronen, partner of "SoftBank Investment Advisers" who is a wholly-owned subsidiary of SoftBank and advises on the operation of SVF said, "GM has dramatically reduced accidental casualties, emissions and congestion We have made remarkable progress toward realizing the dream of fully automatic driving. "" We are extremely impressed with the advancement of technology by Cruise and GM team, and we will see a change in the history of the automated driving industry in the future We are looking forward to helping you lead the way. "

SVF is an investment fund based in the UK and was founded on May 20, 2017 by Mr. Masayoshi Son Softbank Group and Mr. Muhammad Bin Salman of Vice Crown Prussia of Saudi Arabian Public Investment Fund. Unlike the trends of huge funds, which is said to be 10 trillion yen scale, unlike the trend of huge funds until now, it is characterized as having a style of investing heavily in the early stages of startup called "early stage".

What is great about "SOFTBANK VISION FUND" | Forbes JAPAN (Forbes Japan)

https://forbesjapan.com/articles/detail/18258

The threatening industry, Masayoshi Son's "entrepreneurial" investment technique | Forbes JAPAN (Forbes Japan)

https://forbesjapan.com/articles/detail/18259

Softbank Vision Fund's explanation of how it works became a study of transcendence so that detailed notes will be readable

https://irnote.com/n/n6cce40fceeaa

The background that the investment of hundreds of billions of yen is decided is considered to be due to the expectation that the certainty of the business is commensurate with the investment, and the fact that "the start of the unmanned taxi business in 2019" has become a certain reality It is likely to become. On the same day GM announced, Alphabet's automated driving car development company Waymo will strengthen its partnership with Fiat Chrysler and announce that it will supply 62,000 mini-vans of plug-in hybrid "Chrysler Pacifica" This is also showing remarkable movements.

Waimo Expands Partnership with Fiat - Chrysler - Approximately 60,000 Additional Supplies - Bloomberg

https://www.bloomberg.co.jp/news/articles/2018-05-31/P9M4KV6TTDS001

Related Posts: