SoftBank's Arm plans to start mass production of AI chips in the second half of 2025, with SoftBank also investing in part in the initial development costs of several hundred billion yen

It has been reported that

SoftBank's Arm plans to launch AI chips in 2025 - Nikkei Asia

https://asia.nikkei.com/Business/Technology/SoftBank-s-Arm-plans-to-launch-AI-chips-in-2025

Arm to develop AI processors — prototypes ready for spring 2025, says report | Tom's Hardware

Arm plans to launch AI chips in 2025, Nikkei reports | Reuters

https://www.reuters.com/technology/arm-holdings-plans-launch-ai-chips-2025-nikkei-reports-2024-05-11/

SoftBank Sells Off Vision Fund Assets as Son Pivots to AI, Chips - Bloomberg

https://www.bloomberg.com/news/articles/2024-05-10/softbank-sells-off-vision-fund-assets-as-son-pivots-to-ai-chips

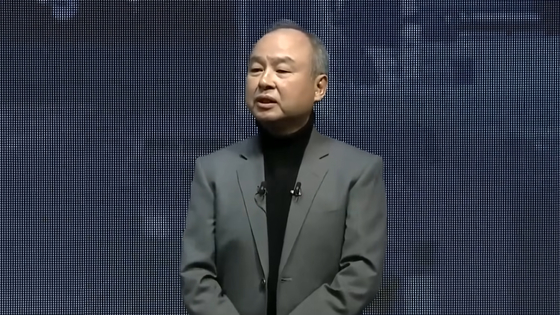

Masayoshi Son, CEO of SoftBank Group, said at a symposium in July 2023, 'AI that surpasses human intellectual capabilities can solve problems, just like using a crystal ball to predict the future. Japan must create the crystal ball that shines brightest at the center of that AI.' SoftBank is promoting industrial innovation under the 'AI revolution' that Son aims for.

SoftBank has been reported to be promoting 'Project Izanagi,' an investment of about $64 billion (about 10 trillion yen) to transform the company into a major AI conglomerate. As part of this, the Nihon Keizai Shimbun has reported that SoftBank will establish an AI chip division at Arm, in which it holds 90% of the shares, with the aim of building a prototype by spring 2025 and starting mass production from fall 2025 onwards.

SoftBank founder Masayoshi Son to invest 15 trillion yen to set up 'Project Izanagi' AI semiconductor venture to compete with NVIDIA - GIGAZINE

The initial development costs for the AI chip, which will amount to hundreds of billions of yen, will be borne by Arm, with SoftBank also expected to invest. It has also been pointed out that once the mass production system for AI chips is in place, the AI chip business may be spun off from Arm, leaving Arm and operated as a new company under SoftBank.

Mass production of the AI chips will be handled by contract manufacturers, and SoftBank is said to be already in negotiations with TSMC and others regarding manufacturing, aiming to secure production capacity.

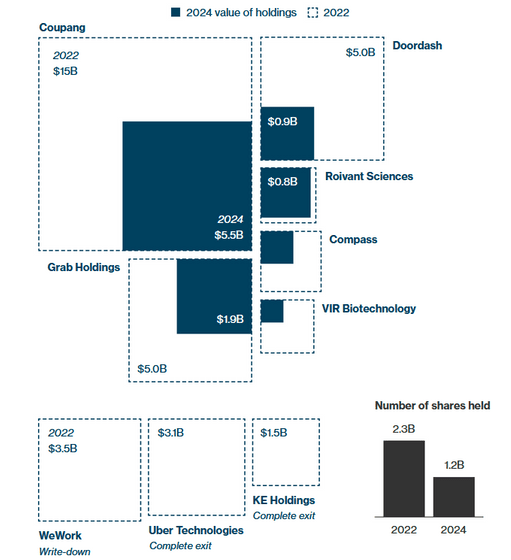

SoftBank has previously invested in venture companies, acquired shares, and engaged in venture capital business with the aim of obtaining large capital gains when the companies go public in the future. However, since 2021, SoftBank has sold shares in companies such as Coupang Inc., DoorDash Inc., and Grab Holdings Ltd., whose shares were trading below their listing prices, and as a result, SoftBank's portfolio in the U.S. stock market has shrunk by about $29 billion (about 4.25 trillion yen).

It was also reported that SoftBank Vision Fund has laid off more than 100 staff members, slowed new investments to a fraction of their previous pace, and is using its remaining staff to sell assets and reverse losses.

A source said the reason for this is that the fund is selling assets from its portfolio in preparation for expanding into AI and related hardware businesses.

According to the Nihon Keizai Shimbun, the AI chips manufactured by Arm will be used in data centers that SoftBank plans to build in the United States, Europe, Asia, and the Middle East in 2026. These data centers will require huge amounts of electricity, so SoftBank may also enter the power generation business. In addition to building wind and solar power plants, it has also been reported that SoftBank is considering research into power generation using nuclear fusion, a next-generation power generation technology.

Related Posts:

in Hardware, Posted by log1r_ut