Is Son justice a genius investor or not?

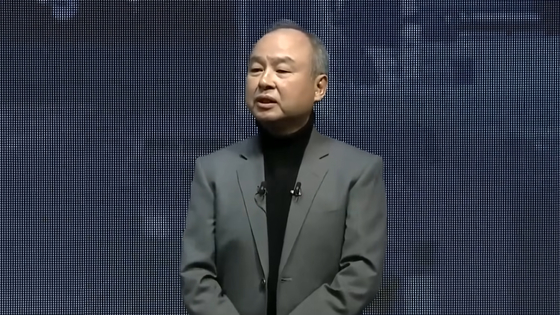

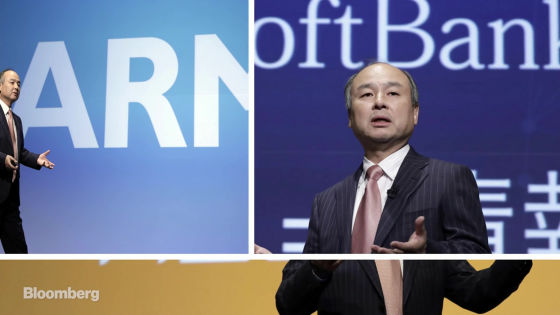

In M & A we call the major players in the acquisition negotiation "Deal Maker". What is known as the best deal maker in technology companies M & A is Softbank's topMasayoshi SonMr. Bloomberg explains how Mr. Sun Chan, who has a call with a rare genius investor, has become the world's best deal maker.

How Masayoshi Son Became an Eccentric Dealmaker - YouTube

Masayoshi Son is one of the most influential deal makers (contrivance) of the present age.

When Donald Trump gets elected president, earlier than Japanese officials in JapanSuccessful visitationIt is a new place to memorize.

A grandchild known by the nickname of "Masa" can be said to be a brilliant venture capitalist taking a big risk.

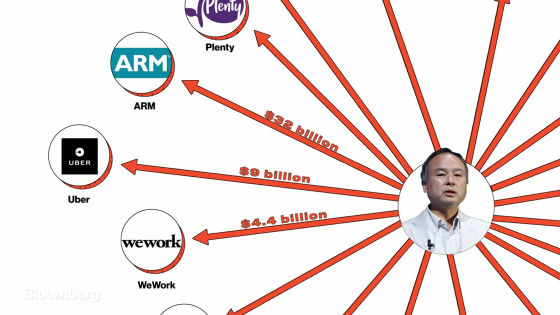

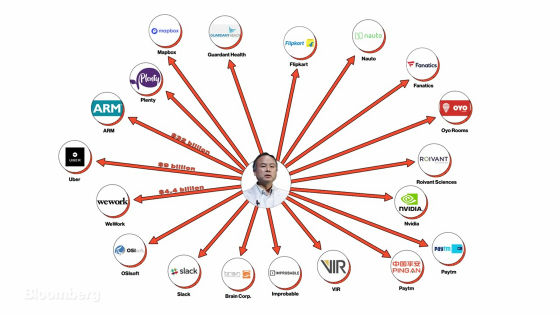

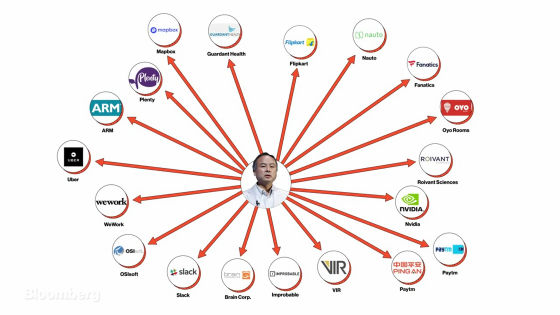

My grandchildren are tremendously huge, such as $ 32 billion for ARM (about 3.5 trillion yen), $ 9 billion for Uber ($ 990 billion), WeWork $ 4.4 billion (about 480 billion yen) I am investing.

And the list of high-tech investment is still going on.

Some Softbank CEO thinks about grandchildren that it is a "bastard" person who reclaims the highest profit.

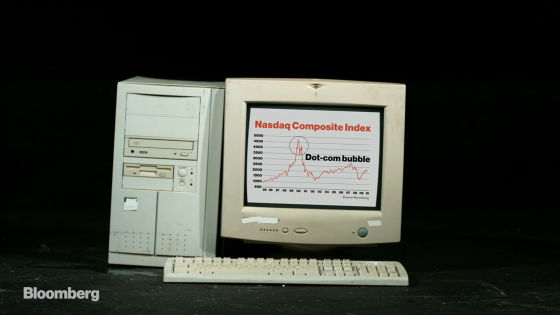

OnceDot com bubbleThe grandchildren suffered the world's biggest loss of $ 70 billion (about 7,700 billion yen).

No one likes or dislikes that grandchildren are trembling investments in Silicon Valley and the world.

Is my grandchild just "just lucky"? Or is it a "genius on investment in the future of technology"?

Bloomberg's technology reporter Pavel Alpeiev will explain whether the grandson is a genius investor or not. It is a person who has been chasing after 10 years on grandchildren and Softbank.

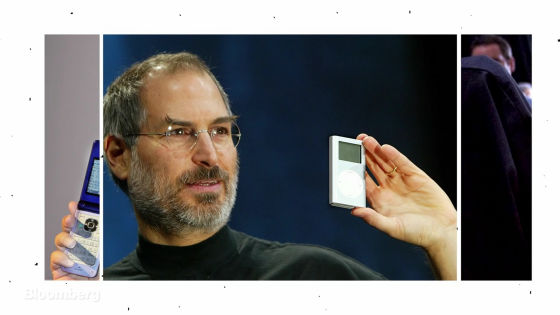

An easy-to-understand example telling the grandchildren's foresight is "iPhone".

My grandson visited Steve Jobs who made Apple leap on the iPod.

And I showed the sketch of the terminal which made the iPod mobile phone function. It is a proposal that I want Apple to make "mobile phone with music function".

Jobs who had already begun to develop the iPhone refused the grandchild's "plan".

However, at this time the grandchild succeeded in attaching an appointment to get an exclusive sales right of Apple's mobile phone in Japan. In this way, iPhone became an exclusive sales of SOFTBANK for a long time from the landing of Japan, and SOFTBANK as a cellular phone carrier will grow greatly.

However, this was not the first big deal (big deal) for my grandchildren.

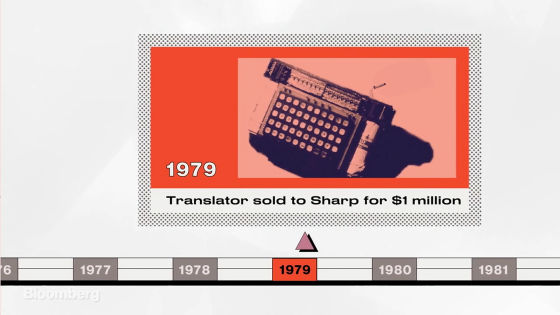

My grandchild who entered the University of California at Berkeley around the age of 20 invented a digital translator with voice capabilities and sold it to Sharp for $ 1 million (about 200 million yen at that rate).

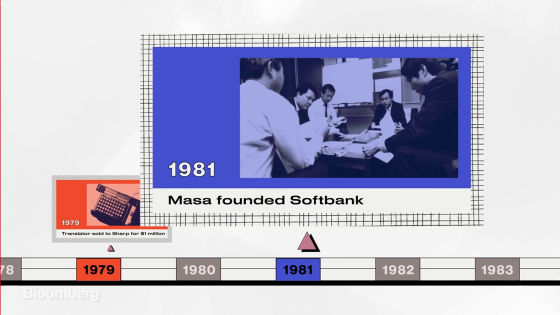

Based on the funds obtained here, grandchildren established Softbank.

Nowadays the name "Softbank" is widely known as a mobile phone carrier in Japan.

A very short period of dot com bubble, my grandchild became the richest man in the world.

However, when the dot com bubble burst, grandchildren have lost almost all their assets. It was my grandchild who was on the verge of bankruptcy, but I managed to beat the big pinch.

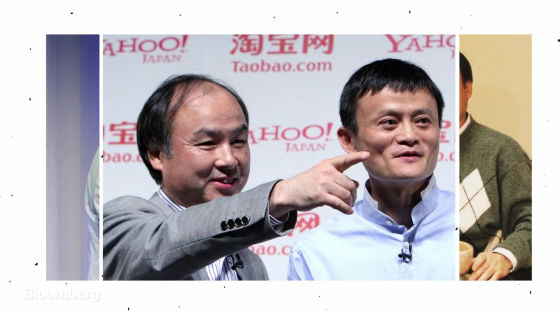

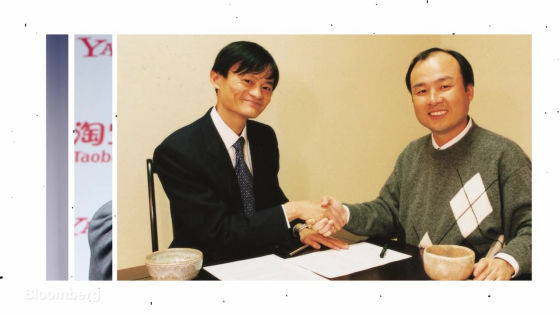

One of the most important transactions, which tells the grandchildren's skills, was held in 2000.

The opponent was a completely unknown Chinese youth at that time. It is now Jack Ma, who leads the huge Alibaba group. On a youngster's mother, my grandson invested 20 million dollars (about 2.2 billion yen).

"I understood that I have charisma and leadership from his way of talking and dressing," the grandchildren are talking about then.

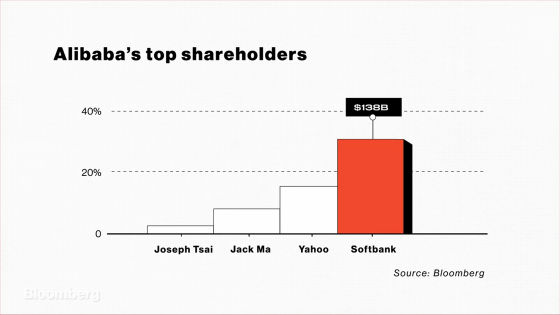

The money SOFTBANK has invested in Alibaba is now worth $ 138 billion (about 15 trillion yen). This is an investment that produced the greatest return in history.

Although it may be said to be lucky if it is a big success, grandchildren are actively investing huge amounts of money in technology today. As of 2017 startups invested do not go down to 100 companies.

It includes gold eggs Uber and Didi.

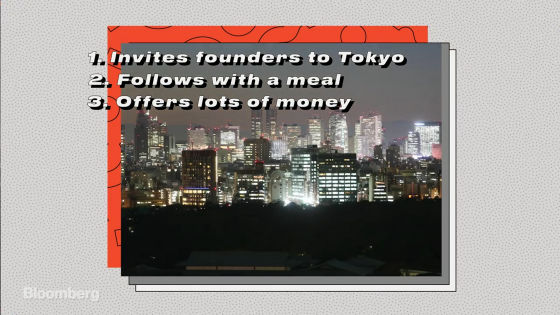

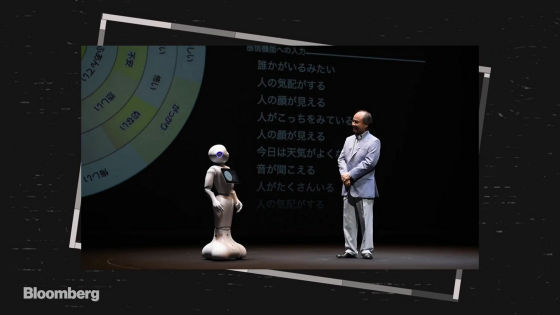

My grandchild is known for having a unique investment style. It is "inviting founder to official event in Tokyo" "dinner together" "to present big money."

So grandchildren pour a lot of money into startup one after another.

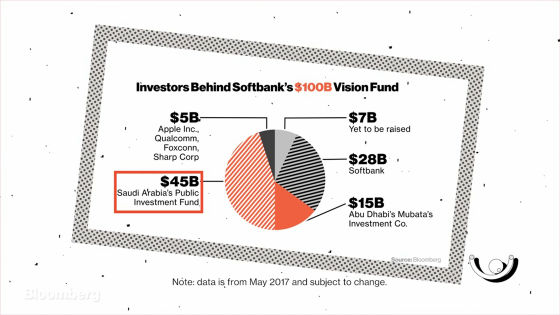

The source is planned to invest 100 billion dollars (about 11 trillion yen)SOFTBANK VISION & FUND(SVF)". Investment in Technology Startup As the largest scale SVF in history, so many people such as Apple, Qualcomm, Foxconn and others participate in the investment.

Among them, the greatest existence is "the Middle East"

The investment group led by Mr. Muhammad Bin Salman of Saudi Arabia is SVF 's biggest bunker and will finance how much $ 45 billion (about 4.9 trillion yen) will be invested.

"The negotiation time with Salman's deputy crown prince was 45 minutes," he said.

"In short, it is $ 1 billion per minute (about 110 billion yen)"

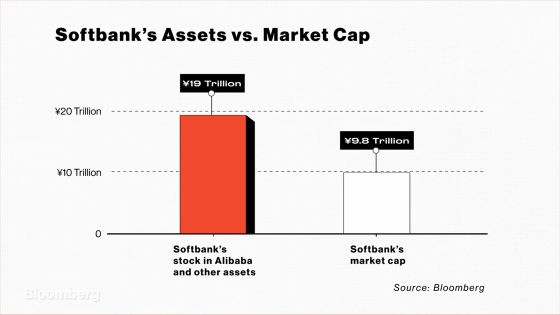

However, SOFTBANK has a value of 19 trillion yen owned by investment companies such as Alibaba, which is the fact that SOFTBANK's own market capitalization exceeds 9,800 billion yen.

This is nothing but evidence that "many investors are not buying SOFTBANK's prospects."

There are also criticisms that "grandchildren can not get the next Alibaba" not only the opinion that "the next Alibaba can not be obtained" but also "we are drifting the wealth that we have built up."

Apart from whether or not to believe in grandchildren's strategy, it is true that grandchild's investment style has changed from the dot com bubble in the 1990s. The investee company is not a venture company but a company that has already proven its ability to survive.

"Whether grandchildren are suitable as genius investors probably depends not on whether we can provide enough returns but on whether we can have a big impact on society," Alpayev says.

Related Posts:

in Video, Posted by darkhorse_log