"Robot adviser" computer advises asset management has already been put into practice for wealthy people

A computer that makes thousands of times of ultra-high-speed stock trading at a time less than 1 second and gains marginAs is well known, high performance computers are indispensable for investment. And high-performance computers have already begun pointing investment decisions towards wealthy people as investment advisors, and the fact that they are spreading rapidly has been clarified.

The Rich Are Already Using Robo-Advisers, and That Scares Banks - Bloomberg Business

(Voice automatic playback)http://www.bloomberg.com/news/articles/2016-02-05/the-rich-are-already-using-robo-advisers-and-that-scares-banks

Kendra Thompson, manager of consulting firm Accenture, has already begun offering Bloomberg Business the advice of computers to investors to investor decisions and Charles Schwab Corp has provided 15% of the total asset advisory work He said the computer is operating as a "robot advisor" and raises sales of at least 1 million dollars (about 120 million yen).

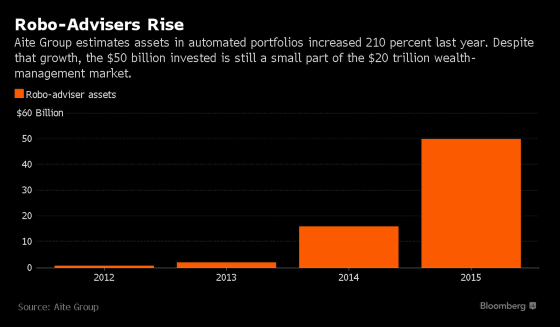

According to Bloomberg Business, robot advisors mainly said that services to high net worth are beginning.Aite GroupGraphically summarizes the situation that the asset management value of robot adviser is increasing significantly every year, according to which the money to be managed expands to 50 billion dollars (about 6 trillion yen) by 2015 Has become clear.

According to Mr. Thompson, financial companies such as Morgan Stanley, Bank of America, Wells Fargo and others continue to be exposed to the pressure to lower the fee for stock transactions from customers. So as securities companies and banks have increased the performance of computers to reduce the burden of advisors advising investors about equity investment in order to reduce costs, tools that utilize artificial intelligence have also appeared, and at last the customers Is a self-service system that allows you to obtain information on investment. On that extension, a robot advisor, not a human but a computer, makes investment decisions.

According to Bloomberg Business, the fee for robot advisors is far cheaper than the "human" investment advice service which takes 1% of the assets under management fee. AT Kearney, a consulting firm, estimates that the amount of assets managed by robot advisors will rise rapidly to 2,200 billion yen (about 260 trillion yen) by 2020.

Morgan Stanley has clarified a policy to rush to develop robot advisors to reinforce securities sales operations, but considering the speed of evolution of computers, mainly artificial intelligence, computers will realize yields higher than human Even though it may be thought that it will not take a while, it is not surprising that the future will come when the computer will make investment judgment tasks and human advisors will be willing to support computers.

Related Posts:

in Software, Posted by darkhorse_log