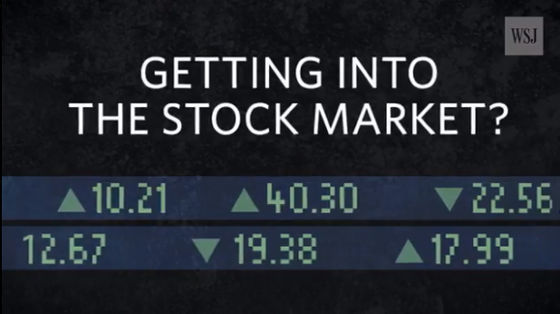

"Quantz" in which algorithms make investment decisions rather than humans dominates Wall Street

Financial engineering is tied to computer science, and it is now time for computers to do much of Wall Street trading, not by humans. Build a trading computer algorithm that danced as a leading role in the financial world "QuantitiesAbout Wall Street Journal, we create and describe a movie that is easy to understand.

What's an Algorithm, and How Do Quants Use Them?

Do you want to participate in the stock market?

You will meet authorities of Wall Street (Financial District). That is "algorithm".

The algorithm is a "rule" for computers to do something and is useful for deciding and making decisions.

For example, let's consider the calculation of "credit score" that financial institutions aim for individual creditworthiness.

In calculating the credit score, the algorithm will rate individuals from various personal information such as mortgage balance and credit card debt.

Also, when asset management advisors form a customer portfolio ... ...

We use an algorithm to decide how much money to invest in which financial product.

The decision based on that algorithm is based on all information of the individual from age to the loan balance of the scholarship.

But Wall Street computer engineers are the cutting edge of computer algorithms.

From the word Firm (company) that makes "Quantitative" (quantitative) judgment ... ...

It is called "Quants" for short. Quantz refers to analytical and anticipatory behavior by an algorithm backed by financial engineering and experts who do it

Quantz uses an algorithm instead of intuitive prediction. And we do millions of transactions every day.

Now, 27.1% of the stock trading done in Wall Street is due to Quantz.

Because it was 13.6% in 2013, I can see well the rapid expansion of the influence of Quants in Wall Street.

Quantz will build an algorithm to predict "what kind of behavior would a human trader do?"

Its purpose is of course to gain a profit by defeating a human trader.

However, there are voices concerned about the magnitude of Quons' algorithm's influence on the trading market.

In the subprime loan crisis in 2007, it is remembered that the major financial company Quantz Fund posted a large loss.

The "flash crash" that the Dow Jones Industrial Average average plummeted by 9% in just a few minutes in 2010 is what clarified the risk of trading by the algorithm.

Expanding transactions by means of algorithms is also to create thousands of unemployment. There are also expectations that hundreds of thousands will lose their jobs in the financial industry by 2025.

This prediction was issued ten years ago, and its future is "now" in 2017.

Even algorithms may not be able to predict how financial transactions that replace humans will go.

·bonus

As a documentary on Quants, "Quants - The Alchemists of Wall Street" is published on YouTube and the algorithm is a mathematical model trying to quantify human economic activity and the enormous Risk has been verified.

Quants - The Alchemists of Wall Street - (vpro backlight documentary - 2010) - YouTube

The actual situation of Quants in Wall Street is explained in the following books.

Physicist, I will go to Wall Street. - Rolling to Quants | Emanuel Derman, Emanuel Derman, Hiroyuki Moriya, Yoko Nagasaka, Yukio Funemi | Book |

Related Posts: