What is the reason why there were various groups that survived without disappearing?

Of joint purchase type coupon siteGrouponWas born in the United States in 2008, was a very momentous service gathered a lot of attention for a while from the appearance, but few years from the establishment as well as hearing that name less often It was. Grouply rapidly gaining popularity and quickly losing momentum of groupup is often taken as "past evil", but Fortune columnist Dan Primak said "There are many parts to be evaluated "We are pushing a column to dispute.

Let's stop laughing at Groupon - Fortune

http://fortune.com/2015/01/26/lets-stop-laughing-at-groupon/

Within two years of the establishment of the group in 2008, Groupon had been evaluated that it had asset value of more than 1 billion dollars (about 85 billion yen at that rate) from venture capital. At that time, Google bought about 600 million dollars (about 50 billion yen at that rate), but Groupup shows momentum to refuse this. When listed on the Nasdaq market in 2011, the total stock price released at about 12.6 billion dollars (about 1 trillion yen at the time of that time) is the closing price of $ 23 billion (about 1.85 trillion yen at that rate ), It was a groupup that seemed to have started a good start, but its momentum did not last long.

The stock price slumped around June 1, 2012, about one year after the IPO, and the valuation amount fell to less than 60 billion yen proposed by Google from the acquisition. In 2013, the founder and CEO Andrew Mason has been dismissed for reasons of poor performance.

ByThe DEMO Conference

And for several years, Groupup 's hints are being forgotten from people' s memory. It is not an exaggeration to say that it is even in the situation that Groupup is getting into a topic only when it makes a past failure a laughing story while startup companies of a scale comparable to Groupbon's achievements are appearing one by one.

However, in response to this situation, Mr. Primak says, "From my point of view, laughing about Groupup is not a valid evaluation." Mr. Primak still has a valuation of Group 4.4 billion (about 580 billion yen), that it has reached a higher valuation than any venture capital judged in the past,EBITDABoth have continued to grow since listing, and because we have cash holdings and realities of no-debt management, we believe that Groupon is a "successful company".

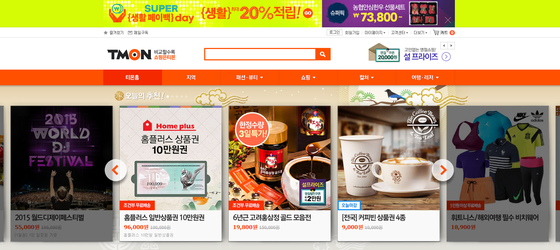

The current groupup is doing well with the good result sales business and the acquisition of the ticket monster "joint purchase site of the Korean coupon jointly with the Korean market which had been withdrawn at once,Stock prices also performed wellIt is being told that it is doing.

Mr. Primak's thinking Groupup's best point is "the timing of the public offering," he says that is still the reason he can continue his business. Groupup has posted a deficit of $ 95.4 million (about 8 billion yen) in 2012, but at this time he was able to survive because he had ample funds gained through the public offering in 2011 about. If it is not publicized by this point, funds will bottom out, and the possibility that the company had disappeared without being able to overcome the crisis can not be denied.

Related Posts:

in Note, Posted by darkhorse_log