Atlassian's market valuation for Confluence and Jira is wrong and criticized for not being so valuable

Atlassian, based in Australia and known for its agile software development tools Jira Software and collaborative tools Confluence, was certainly profitable when it was a start-up, but rather after it matured. It has been pointed out that it is losing money and the market is overvalued.

Atlassian is unprofitable — the market has its valuation wrong

Atlassian is 20 years old and unprofitable | Hacker News

Adam Schwab , co-founder and CEO of travel agency Luxury Escapes and columnist, pointed out.

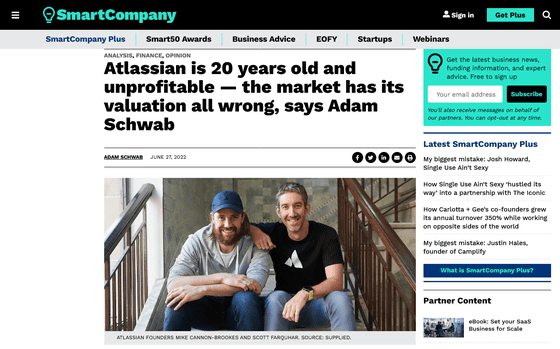

Atlassian is a company created by Mike Cannon-Brooks and Scott Farker in 2002. Startups often rely on venture capital to grow, but Atlassian's first round of investment was before its listing in the United States in 2015. For this reason, co-founders and co-CEOs Cannon-Brooks and Farker each own about 21% of the shares.

Atlassian's corporate value peaked in October 2021, with the $ 162 billion recorded at that time being one of the best Australian companies. Cannon-Brooks and Farker have become Australia's leading millionaires with total wealth of over $ 70 billion.

However, not only Atlassian but also technology industry companies have been declining since October 2021, Netflix, a major streaming service, has decreased by 72% from the peak, Zoom has decreased by 79%, Meta has decreased by 56%, etc. It has become. Atlassian also fell by 40%, but still maintains a high corporate value of 11 times compared to when it went public in 2015.

According to the April 2022 revenue report, Atlassian's revenue has increased from $ 1.5 billion to $ 2.04 billion over the past nine months due to subscription growth. thing. But on the other hand, profits are being offset by losses in the legacy business, Schwab said.

Schwab points out that Atlassian's problem is not only that it's 'unprofitable,' but that the business is growing much slower than before, and marketing costs are high to achieve growth.

Ten years after its founding, Atlassian has been able to achieve rapid, profitable growth, driven by products, with little marketing money, but boasts of 'no sales reps.' Atlassian is spending $ 600 million (about $ 81 billion) on sales and marketing in 2022, and has lost more than $ 500 million (about 67.6 billion yen) in the last nine months. As of the same 20 years since the establishment of Atlassian, Microsoft has sales of 6 billion dollars (about 810 billion yen), net income of 1.5 billion dollars (about 200 billion yen), and Google has sales of 145 billion dollars (about 20). Net income is 31 billion dollars (about 4.2 trillion yen).

'It's like Benjamin Button in the tech field, where you can make a profit, mature and lose money as a start-up,' Schwab said.

Atlassian has been evaluated by the market as 20 times as much as sales, but Salesforce with similar growth potential and profitability has sales of 31 billion dollars while market capitalization is 185 billion dollars (about 25 trillion yen). And it is said that the evaluation is less than 6 times. If Atlassian is priced similar to Salesforce, Cannon-Brooks and Farker will each have a holding of $ 3 billion. However, he must still be Australia's most successful entrepreneur.

Related Posts:

in Note, Web Service, Posted by logc_nt