Alibaba's IPO is Yahoo! Is it the light or the dark that gives to the future?

ByEric Miraglia

America's Internet related service companyYahoo!China's largest EC site holding 24% of the stock "Ari Tomoe Group(Alibaba) ", in the summer of 2014IPOTo be listed on the stock exchanges in the United States. By Alibaba's listing, Yahoo! Because it is stipulated that at least half of the shares held are to be released, Yahoo! This IPO is attracting a lot of attention as it makes up for the future going on in the future.

How Can Yahoo Be Worth Less Than Zero? - Bloomberg View

http://www.bloombergview.com/articles/2014-04-17/how-can-yahoo-be-worth-less-than-zero

Yahoo! which is a long-established store of Internet related services Established in the United States in 1995, it provides various services including the operation of portal site and develop business all over the worldconglomerateis. So-calledDot com bubbleBy the time it was a synonym for Internet service Yahoo! However, after that, the achievement in the United States of America was sluggish, and now it is Japan's largest portal site in capital relationship in terms of market capitalizationYahoo! JAPAN, The largest in ChinaBtoBIt is a situation that does not reach EC site · Alibaba for.

Yahoo! whose performance has deteriorated In July 2012, we entrusted management rebuilding with former "Google's face", Mr. Marissa Mayer, as CEO,Maier's CEO is undergoing major reform. Although Mr. Mayer's management skill has gained a certain evaluation, such as strengthening the mobile advertising business, the former Yahoo! It is the present situation that it is far from the figure of. However, Yahoo! announced in January 2014 In the fourth quarter of 2013, although we declined by 2% compared to the same period last year, we have achieved a substantial increase in profits as dividend income from our own Alibaba shares.

Alibaba and Yahoo! The capital relationship of Yahoo! in 2005 Started investing a total of 1 billion dollars (about 120 billion yen) in Alibaba and acquiring 40% of Alibaba shares. In other words, the market capitalization of Alibaba at that time was estimated to be about 300 billion yen, Alibaba was Yahoo! It was a small company compared to the company. However, after that, the Alibaba Group led by the agile manager CEO Jack Maher was also expected to boost economic growth in China, and in addition to Alibaba, the business such as the consumer EC site tao bao (Taobao) and online payment service Alipay (Alipay) Expanding and keeping sluggish Yahoo! It will grow to the presence which overtakes the market capitalization of quickly.

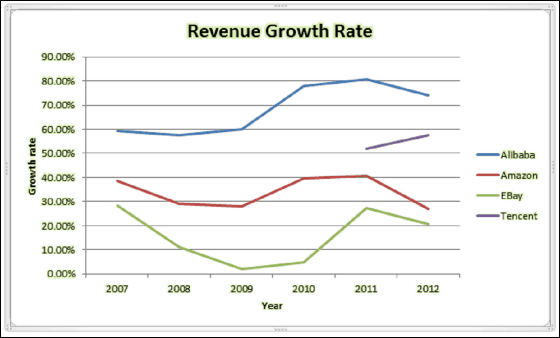

This is a graph showing growth rates of Alibaba (blue), Amazon (red), eBay (green). Alibaba always keeps on tremendous growth rate more than 50% over the previous year.

Alibaba grew into a huge corporate group, but SOFTBANK's senior grandson Masayoshi was the first to pay attention to Mer CEO's skills. In 2000, the grandchild CEO who had talks with Mer CEO decided to invest 20 million dollars (about 2.2 billion yen) in Alibaba in just six minutes, and then from Softbank Yahoo! We sold the Taobao shares to Yao! In exchange for that Taobao stock Has acquired Alibaba shares, grandchild CEO Yahoo! It made a big contribution to Ali Baba's alliance.

Although it was a rapidly growing Alibaba, most of the stock was softbank · Yahoo! It is a big problem for Mr. CEO to be held in a company in the US and Japan, somehow Yahoo! We will try to repurchase the shares held by the negotiations will be difficult. So in November 2011, Yahoo! suffered from management difficulties In contrast to Mr. Ma, the CEO plans to take over the acquisition with his grandchild CEO. Yahoo! JAPAN · Yahoo! Yahoo! which is the creator of China , Softbank · Alibaba Group holding that child to be swallowed by the world, but eventually the acquisition did not come true.

ByWorld Economic Forum

Yahoo! Alibaba is "chicken laying eggs of gold" and it is true that I do not want to let go of shares, but the necessity of always wanting to get cash by selling Alibaba shares due to management difficulties was also fact. However, in terms of how much to estimate the value of the Alibaba Group that is not listed, the gap between the views of both sides was large and the negotiations were difficult, but finally Yahoo! Will sell 40% of the owned Alibaba shares at 7.1 billion dollars (about 560 billion yen). Also, at this time, Yahoo! The remaining 24% of the Alibaba shares which had left at hand at the end of 2015 had an agreement to sell 12% of that amount to Alibaba or let go of it through the market if Alibaba carries out the IPO and lists it It was.

And finally in April 2014 CEO will finally release the Ali Baba Group on the New York Stock Exchange, and along with this, Yahoo! It is planned to let go of Alibaba stock further. Alibaba's transaction volume is expected to rise to 25 trillion yen in 2013, and the amount of funds raised by IPO exceeds 16 billion dollars (about 1.6 trillion yen) of Facebook to the highest ever value of 20 billion dollars ( It is also expected to reach the scale of 2 trillion yen). There are even analysts anticipating that Alibaba's market capitalization will go from $ 160 billion (about 16 trillion yen) to $ 200 billion (about 20 trillion yen). If the market value of Alibaba is estimated to be 200 billion dollars (20 trillion yen), Yahoo! Through the sale of Alibaba shares, Yahoo! It is likely to acquire more than half of cash, which is $ 16 billion (about 1.6 trillion yen) in the book value of all assets.

ByJkenning

Yahoo! It is no doubt that the sale of Alibaba shares will be an opportunity to gain huge amounts of funds. However, there are indications that selling Alibaba shares may not be worth the price of the huge amount of funds. It was about 20 dollars in January 2013 Yahoo! The stock price has risen significantly to about 36 dollars as of April 2014. The soaring price of this stock price is not expectation of Mayer 's skill or Yahoo! It is not expectation of the future of Yahoo! It is obvious that it is nothing but an expectation of the "chicken who lay the golden egg" that it carries. Investors who can not invest in the unlisted Alibaba group are Yahoo! As we were investing indirectly by buying stocks, if you could trade Alibaba shares on the market Yahoo! It is enough to think that there is no use for stocks.

It is said that the relationship between Mr. CEO and Mr. Sun Chie is good and the anticipation of Alibaba that wants to appear in the global EC market and SOFTBANK wanting to be in the global mobile market are overlapped in many places and the possibility that both companies will collaborate in the future Whereas Yahoo! Most views that it is outside the mosquito net. Yahoo! I got a huge amount of money with Alibaba's IPO Is it possible to revive by making use of the funds and whether the Alibaba Group which raised funds by IPO can continue to make a breakthrough in the future? No one knows the future in the world of IT business with intense and vicious rise and fall. However, Alibaba's IPO seems to be definitely a major event that can not be removed in talking about the future of the IT industry.

Related Posts:

in Note, Web Service, Posted by darkhorse_log