Intel's fourth-quarter 2024 sales fall 7% year-on-year but exceed expectations, and the launch of its next-generation AI chip 'Falcon Shores' is postponed

On January 30, 2025 local time, Intel announced its fourth quarter and full year 2024 financial results. Fourth quarter 2024 sales were $14.3 billion (approximately 2.2 trillion yen), down 7% from the same period last year, and full year sales were $53.1 billion (approximately 8.18 trillion yen), down 2% from the previous year, but quarterly sales exceeded expectations and losses were significantly smaller than the previous quarter.

Intel Reports Fourth-Quarter and Full-Year 2024 Financial Results :: Intel Corporation (INTC)

Intel cancels AI chip, talks painful past and simplified future | The Verge

https://www.theverge.com/news/603645/intel-earnings-q4-2024

Intel won't bring its Falcon Shores AI chip to market | TechCrunch

https://techcrunch.com/2025/01/30/intel-wont-bring-its-falcon-shores-ai-chip-to-market/

Intel's fourth-quarter 2024 sales were $14.3 billion, down 7% from the same period last year, but its loss for the quarter was only $126 million (approximately 19.4 billion yen), a significant improvement over the loss of $16.6 billion (approximately 2.56 trillion yen) recorded in the third quarter of 2024.

In addition, annual sales were $53.1 billion, down 2% from the previous year, and the loss was $18.756 billion (about 2.89 trillion yen).

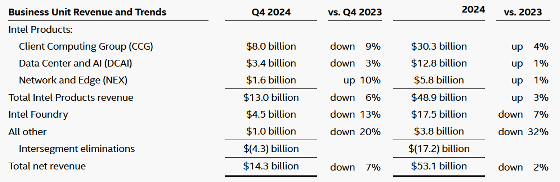

Below is a table showing how much Intel's fourth quarter and full-year 2024 sales for each business unit increased or decreased year-on-year. The 'Client Computing Group' and 'Data Center and AI' each decreased year-on-year, while only the 'Network and Edge' increased 10% year-on-year, with the three divisions increasing slightly year-on-year. Meanwhile, sales for the 'Intel Foundry' business fell 13% year-on-year and 7% year-on-year.

Michelle Johnston Holthaus, Intel's interim co-CEO, commented, 'The fourth quarter of 2024 was a positive step forward as we surpassed our guidance for revenue, gross margin and EPS. Our renewed focus on strengthening and simplifying our product portfolio, combined with continued progress on our process roadmap, positions us to better meet our customers' needs.'

'The cost-reduction plans we announced last year to improve the company's trajectory are having an impact,' said Interim Co-CEO and CFO David Zinsner. 'We are creating a culture of efficiency across our business while maintaining growing returns on invested capital and improving profitability.'

Intel also forecasts sales of $11.7 billion to $12.7 billion for the first quarter of 2025, which is the same as or slightly lower than the same period last year. 'Our outlook for the first quarter of 2025 reflects seasonal weakness amplified by macro uncertainties, further inventory digestion and competitive dynamics,' Zinsner said.

During the earnings call, Holthaus did not say whether Intel would spin off its foundry business in the future, but he said, 'Just as I need to win customer business, Intel Foundry needs to win day-to-day business,' suggesting that the foundry business also needs to improve its profitability.

According to Intel, the foundry business is expected to improve financially by increasing the production of chips using extreme ultraviolet lithography (EUV) in 2025, and plans to exceed the break-even point in operating profit by the end of 2027. Intel is a major beneficiary of the 'CHIPS and Science Act,' which supports semiconductor manufacturing companies by the U.S. government, and is reported to receive up to $7.865 billion (about 1.21 trillion yen).

Intel to receive up to $7.865 billion in CHIPS grants - GIGAZINE

Meanwhile, Intel is struggling to compete in the AI chip market, and it was revealed that it has canceled its next-generation GPU 'Falcon Shores' for high-performance computing and AI workloads. Holthaus explained that Falcon Shores is not being brought to market and is being kept only as an internal test chip, as Intel is working to simplify its roadmap and focus resources.

Related Posts:

in Note, Posted by log1h_ik