India is promoting its own card brand, 'RuPay,' to rival Visa and Mastercard

The two major international brands, VISA and Mastercard, are accepted at many stores around the world. However, in India, the Payments Corporation of India is working hard to promote its own card brand,

India's digital payments strategy is cutting out Visa and Mastercard | TechCrunch

https://techcrunch.com/2025/01/09/india-rupay-upi-payment-push-is-cutting-out-visa-and-mastercard/

RuPay Credit cards, Debit Cards & International Cards | NPCI

https://www.npci.org.in/what-we-do/rupay/product-overview

Government announces measures to promote the use of cashless payment methods (India) | Business Brief - JETRO's overseas news - JETRO

https://www.jetro.go.jp/biznews/2021/12/fd8873c513205a3f.html

RuPay Contactless - YouTube

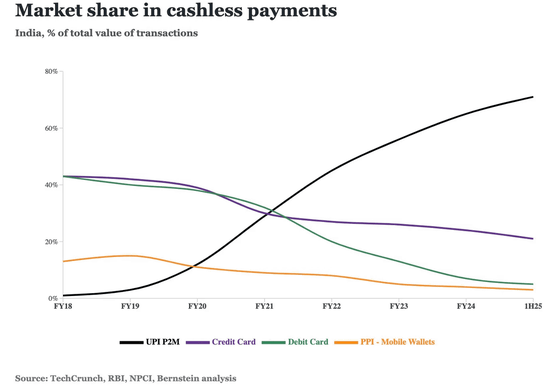

In India, the Unified Payment Interface (UPI) is becoming more widespread, allowing consumers and retailers to bypass card networks by directly connecting bank accounts via QR codes and phone numbers. More than 13 billion transactions are processed per month through UPI, accounting for 71% of total transactions and 36% of total consumer spending in India. Below is a graph showing the share of cashless payments in India from fiscal year 2018 to fiscal year 2025. In 2018, credit cards and debit cards accounted for over 40% of payments, but over the past four years, they have been completely overtaken by UPI's P2M (person-to-business payments).

One card brand that has gained popularity due to the success of UPI is 'RuPay,' which has been launched by the Payments Corporation of India since 2012. In the first seven months of fiscal year 2025, RuPay was used for payments of 638 billion rupees (approximately 1.16 trillion yen), double the amount used in 2024. In terms of credit card transactions alone, it will account for 28% of the total in India, almost three times the 10% in 2024.

Credit, Debit, International, Prepaid and Contactless Card | RuPay

The RuPay brand offers a variety of cards, including credit cards, debit cards, and prepaid cards, but a unique feature of credit cards is that fees are only charged when making payments of 2,000 rupees (approximately 3,650 yen) or more.

Retailers have to pay fees when cashless payments are chosen, but the average credit card transaction made through UPI is less than 1,000 rupees (about 1,820 yen), so the 'no fees for transactions below 2,000 rupees' is a pretty good deal.

In 2024, the Reserve Bank of India ordered financial institutions to choose the card network for their credit cards, barring exclusive agreements with global networks.

As a result of these efforts, the number of RuPay credit cards issued accounted for half of all new credit cards issued in India in June 2024.

In order to fight RuPay, Visa and Mastercard have partnered with fintech companies to support UPI-compatible terminals used in over 10 million stores in India. TechCrunch, a news site, commented that 'only a few years ago, it would have been unthinkable for Visa or Mastercard to take this kind of initiative, such as working with small stores.'

Related Posts:

in Note, Posted by logc_nt