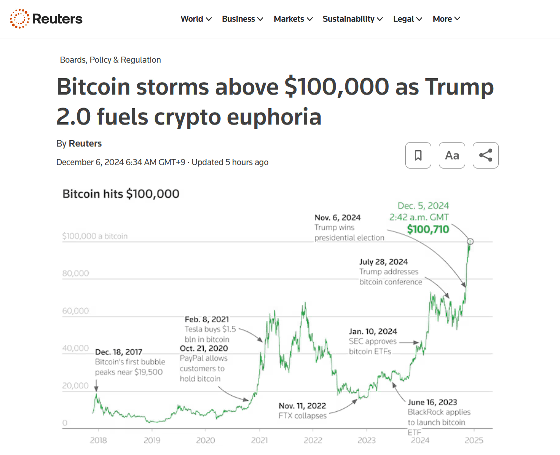

Bitcoin prices have risen by more than 120% since January 2024, topping $100,000, likely due to factors including the election of President-elect Trump, ETF demand, and the April halving.

On December 5, 2024, the virtual currency Bitcoin surpassed the 100,000 dollar mark for the first time in history. The reasons behind this include the birth of President-elect Trump, demand for Bitcoin ETFs, and the halving in April 2024.

Bitcoin storms above $100,000 as Trump 2.0 fuels crypto euphoria | Reuters

Bitcoin (BTC) Exceeds Record $100,000 on Trump's Pick of Atkins for SEC - Bloomberg

https://www.bloomberg.com/news/articles/2024-12-05/bitcoin-btc-nears-record-100-000-on-trump-s-pick-of-atkins-for-sec

Bitcoin price hits $100K for first time in history

https://cointelegraph.com/news/bitcoin-price-hits-100-000-first-time-new-all-time-high

Bitcoin price hits $100,000 for the first time

https://www.nbcnews.com/business/markets/bitcoin-100000-rcna181008

December 5th was a major milestone in the history of virtual currencies, as the price of Bitcoin surpassed $100,000 for the first time. Considering that one Bitcoin was trading at about $44,000 (about 6.6 million yen) as of January 1st, the price has risen by more than 120% in just 11 months.

The significant rise in Bitcoin prices is believed to be the result of a combination of factors. The biggest of these is believed to be the election of Donald Trump in the US presidential election in November. Trump has set a friendly policy towards virtual currencies, and Bitcoin investors have high hopes for Trump, with Bitcoin hitting an all-time high immediately after his election .

In fact, Trump has announced that he will nominate Paul Atkins, CEO of a cryptocurrency company and well-known cryptocurrency advocate, to be the next chairman of the Securities and Exchange Commission (SEC).

President-elect Trump nominates cryptocurrency advocate Paul Atkins as next SEC chairman, Bitcoin surpasses $100,000 mark for first time - GIGAZINE

Trump also appointed David Sachs, known as one of the 'PayPal Mafia,' a group of businessmen from PayPal, as 'White House AI & Crypto Czar.' Sachs will be responsible for policy guidance to make the United States a global leader in AI and cryptocurrency.

President-elect Trump appoints former PayPal COO David Sachs as 'White House AI and cryptocurrency czar' - GIGAZINE

The rise in Bitcoin prices since the beginning of 2024 has also been influenced by the SEC's approval of 11 applications for exchange-traded funds (ETFs) that invest directly in Bitcoin on January 10.

The fact that ETFs investing in Bitcoin can now be traded on traditional financial markets has made it easier for individual investors who have not previously invested in virtual currencies, as well as institutional investors such as pension funds, to access digital assets. Demand for Bitcoin ETFs has been steadily growing in the United States, with a net inflow of $32 billion (approximately 480 billion yen) in 2024 alone.

Another factor cited is the 'Bitcoin halving ' that took place in April. Approximately once every four years, when 210,000 blocks are generated in Bitcoin, an update is implemented in which the mining reward is halved, and this is called the halving. At the halving in mid-April 2024, Bitcoin's mining reward was reduced from '6.25 BTC' (approximately 60 million yen) to '3.125 BTC' (approximately 30 million yen).

When the halving occurs, the number of new Bitcoins issued is halved, reducing the supply and increasing the scarcity value of each Bitcoin. Therefore, it is said that the price of Bitcoin will rise when the halving occurs.

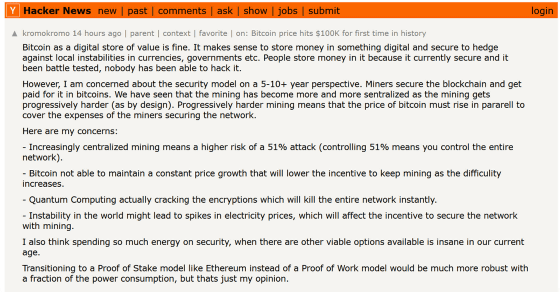

Regarding the recent Bitcoin boom, the social news site Hacker News has expressed the opinion that, 'While converting funds into Bitcoin makes sense as a way to hedge against the risk of currency or government instability, there are concerns about the model of 'ensuring the security of the blockchain through mining and allocating Bitcoin to miners in return.''

According to this user, there are problems such as 'As mining becomes more centralized, the possibility of a 51% attack increases,' 'Bitcoin cannot maintain a constant price growth, so as the difficulty increases, the incentive to continue mining decreases,' ' Quantum computing will decrypt Bitcoin's encryption and instantly destroy the entire network,' and 'Instability in the world situation will lead to higher electricity prices, reducing the incentive to mine.' Although improving the performance of quantum computers is certainly a challenge, Bitcoin already has mitigation measures built in .

According to digital asset research firm CCData , cryptocurrency trading volume, including spot and derivatives trading , is expected to exceed $10 trillion (approximately 1500 trillion yen) for the first time in history in November 2024.

Crypto Trading Volume Surged to $10 Trillion for the First Time in November - Bloomberg

https://www.bloomberg.com/news/articles/2024-12-04/crypto-trading-volume-surged-to-10-trillion-for-the-first-time-in-november

In 2011, the price of Bitcoin exceeding $4 (approximately 320 yen at the time) was a hot topic, showing how quickly its value was rising.

Bitcoin hits US$ 4, after being mentioned on CNN yesterday | Hacker News

https://news.ycombinator.com/item?id=2501006

Related Posts:

in Note, Posted by log1h_ik