Coinbase's Brian Armstrong aims to 'make billion worlds make virtual currency world within 5 years'

As a virtual currency company, Brian Armstrong CEO of " Coinbase " who gathers the expectations of Wall Street investors as virtual currency unicorns with a corporate value of more than 1 billion dollars (about 110 billion yen) We anticipate the arrival of digital financial markets and have the ambition to create a world where 1 billion people will use digital encryption technologies such as virtual currency in the next five years.

Coinbase: A Bitcoin - Boom Beneficiary Plots Its Next Move | Fortune

http://fortune.com/longform/coinbase-bitcoin-brian-armstrong/

Coinbase, which was born in San Francisco, USA in 2012, became the first universal currency (encryption currency) company to become "unicorns" with a corporate value of over $ 1 billion (about 110 billion yen). This coinbase was made by Brian Armstrong, CEO of Airbnb.

Armstrong CEO with technician's parents grew up in an intellectual environment and became familiar with nature and technology. Armstrong boy thought that he wanted to transform society as well as Apple's Steve Jobs and Intel's Andy Grove succeeded using IT as a tool to transform society. However, Armstrong, who graduated from college, sometimes feels that "Internet revolution has already occurred and it may have been too late to be born."

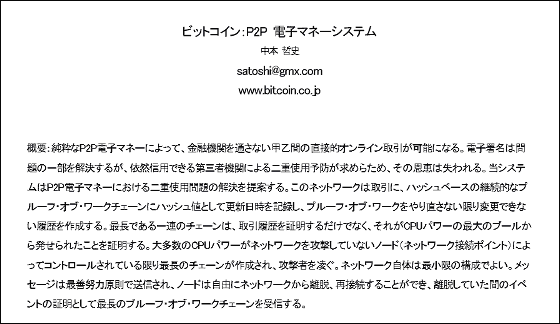

When Armstrong was surfing the web at his parents' home at Christmas 2009, I met a 9-page paper written by an anonymous person named Satoshina Kamoto. This was a paper that produced the virtual currency Bitcoin (bit coin) and the technical thought on the key block chain that realizes the virtual currency. Armstrong CEO seems to be fascinated by the idea of "currency circulating in a world that the government and banks can not reach" written in the paper.

And when we went on a trip to Buenos Aires in Argentina, when we saw employees who were forced to replace the seal in order to change the price of the restaurant due to the sudden inflation caused by the economic crisis, we did not reach the control of the greedy country It seems that he felt the charm of the digital currency once again as a way to exchange wealth at a place. In order to realize the world in which virtual currency proposed by Nakamoto circulates, it was a mechanism that anyone needed most easily to exchange virtual currency. Since the virtual currency was for some maniacs at the time of 2012, it was in a state where it was not possible to exchange virtual currency without professional knowledge.

Mr. Armstrong quit Airbnb in 2012 and began to develop "Coinbase" as a mechanism to purchase virtual currency online. Mr. Armstrong designed Coinbase to purchase virtual currency using the user's traditional bank account as if shopping online. Coinbase was born as a payment tool like PayPal or Venmo in that it facilitates the purchase of bit coins that required expertise until then.

Coinbase, which stores complex encryption keys on behalf of users, said that when released in the second half of 2012, it will have one million customers in just one year. Nonetheless, the virtual currency at that time has a hue of being a tool that can be used for drug dealing, fraud, money laundering and other outrageous acts, and it seems that it took quite a while to help users comply with laws and regulations.

Having received a $ 25 million (about 2.5 billion yen) investment from venture capital Andriessen Horowitz in 2013 when the virtual currency was still underground still has become a big challenge not only for Coinbase but also for the virtual currency business Thing. "Armstrong is curious and is constantly seeking advice," Chris Dixon of Andriessen Horowitz said, Armstrong said he is an avid person to improve and continue improving oneself doing.

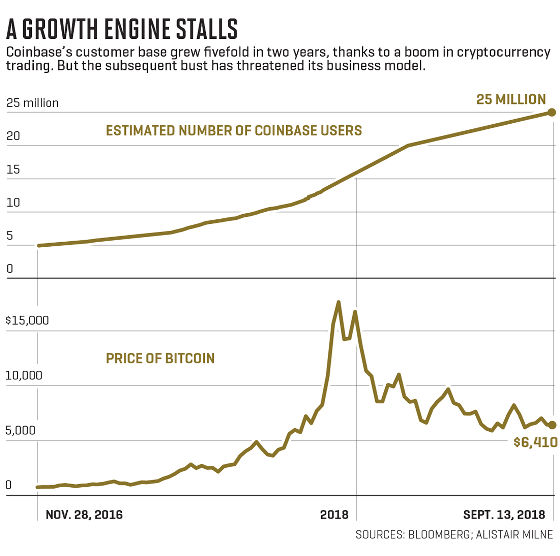

In 2017 a situation could be called a "bubble" in which the virtual currency exchange rate including bit coins soared 20 times. According to Armstrong CEO, Coinbase has acquired more than 50,000 new users per day in the virtual currency bubble. Because of this, the Coinbase website crashed and it became a hellish experience for Coinbase engineers who are being kept on maintenance. Some engineers and service staff seemed to even work 18 hours a day. It seems that user's complaints were severe as it is fatal that transactions can not be performed smoothly in virtual currency with high volatility, and dozens of users have filed complaints against the US Securities and Exchange Commission is.

In addition, sophisticated phishing scams and precise bank fraud began targeting virtual currency users by multiplying the height of virtual currency fever. Coinbase, aiming at spreading virtual currency, was required to tackle advice and enlightenment on the site more than ever so as to compensate for user's lack of knowledge. Coinbase seems to have spent 10% of revenue to solve fraud related problems.

In addition, virtual currency officials were at the mercy of the movement of "whale" possessing a large amount of virtual currency and sometimes even controlling the market price. One whale sold several million dollars (hundred million yen) of the virtual currency Ethereum (Ethiariam) at a stake on the exchange GDAX operated by Coinbase on June 21, 2017, so 1 ETH ranged from 320 dollars to 10 cents "Full crash" occurred that plummeted. Coinbase at the time Coinbase at the time such a "panic sell" occurred, no mechanism for emergency stop of trading was introduced, users who issued a large loss due to automatic order due to the plummeting market appeared It was. Ultimately Armstrong decided to rescue these users and compensates for the loss.

Also, Coinbase does not support the new currency when the new currency Bitcoin Cash (Bitcoin Cash) is born at the bit coin Segwit (division riot) that occurred in 2017, received a complaint from the customer and received the policy I had a change. In this case, insider allegations that Coinbase employees had bought new currency in anticipation of price rise before the official announcement of new currency support occurred, Coinbase added to deal with sudden removal of related Slack channel I was told. Whether trading virtual currency based on internal information is illegal as an insider trading is gray because the financial regulation of the virtual currency is not well developed. Coinbase concluded that there was no employee's insider trading in this case, but it is a mistake that it was a case that the difficulty of internal control of the organization was highlighted in the transition period until the virtual currency market matures. Looks likely.

Number of coinbase users (above) and bit coin price quote (bottom)

In the virtual currency bubble, Coinbase hit a difficult aspect inside and outside the company, but the trust from investors remained undisturbed, Armstrong CEO gained 100 million dollars (about 11 billion yen) in August 2017, Successful procurement, established a position as a leading company of virtual currency companies with a corporate value of 1.8 billion dollars (about 200 billion yen).

Armstrong, who got the investment, is working to strengthen human resources by inviting Tina Batnagar from Twitter and Mr. Astiff Hizi from HP to quell the confusion of customer service, with about 1,000 employees We are stepping up scaffolding, for example by doubling from 2016. Armstrong said, "I thought that the CEO must be a military general, but my leadership is a bit more coordinative than it is not trying to be right, pursuing the truth I think that you should not try to become something that is not your true self, which is least leadership. "

Even in the virtual currency market where the market fluctuates wildly, when 2017 years of frenzy has passed, the market price of bit money coins and other virtual currencies has been weak. This implies a deterioration in revenue for Coinbase, a business model that collects a fee of 1.99% according to the transaction price. According to the research firm Diar, the transaction value of Coinbase has decreased to less than 5 billion dollars (about 550 billion yen) in the summer of 20 billion dollars (about 2 trillion 200 billion yen) in January 2018 It is said that. In addition, the virtual currency exchanges' competition is getting more stringent as new virtual currency services appearing that sell lower-cost fees like eToro one after another.

So, Coinbase works not only on virtual currency transactions but also on a new financial field known as a "security token" that manages and trades assets as block chain based tokens. Specifically, it is said that it is possible to buy and sell stocks with low liquidity and expensive items, even to real estate, art objects, and even private companies, which is enormously large in size and considered to be a promising market in the future.

Mr. David Sachs, vice-capitalist at PayPal's original venture capitalist, estimates the market size of the US real estate market as an example security token market and estimates that the market size is 7 trillion dollars (about 770 trillion yen). "This is like the ownership system going from analog to digital. Currently contracts and confidential information are contained in a file cabinet as a bunch of paper, the tokens digitize them," said Block Chain It expresses the security token realized by.

However, although it is a promising market for security tokens, the difficulty for opening up it is also high. It is like preaching the value of the Internet as of 1994. Just as 20 years ago many people were puzzled by new terms such as "browser" and "application", in order to appeal the innovation of block chain technology in 2018, everyone can understand it I need someone to chew and explain. In Coinbase, it is said that Balladz · Surinvivasan CTO is playing its part.

Emerging companies with technologies such as Coinbase are emerging and are starting to erode the business of major banks, but existing banks are silent and not silent hands. Financial leaders such as JP Morgan Chase and the Citi Group are investing in their own block chain project, and the competition for FinTech is getting intensified.

There is no exclusive monopoly on cryptographic trading technology, it is technologically able to lead market by gathering user's support only by exceeding others. Coinbase is developing a "Coinbase Wallet" application in anticipation of the birth of a huge cryptographic technology market to come, "I am seriously hoping that 1 billion people will use encryption technology in the next five years" , Armstrong admits the ambitious goal.

Related Posts:

in Software, Web Service, Posted by darkhorse_log