AI bubble threatens to burst as 145 trillion yen market capitalization of seven tech companies disappears

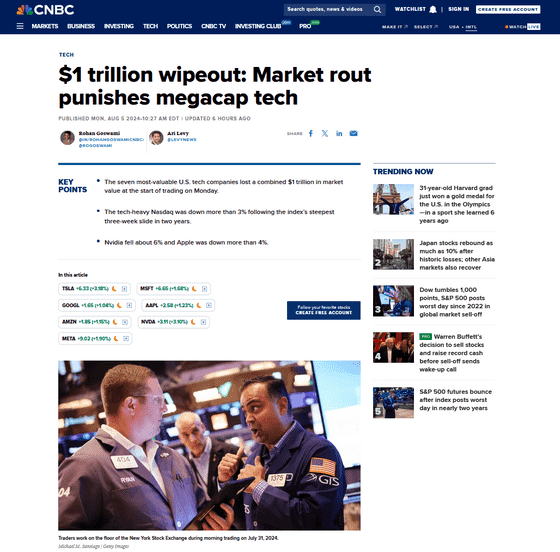

Due to a backlash against the overheating of the AI market and concerns about the economy, it was reported that the stock prices of high-tech companies such as NVIDIA and Apple temporarily fell by a total of $1 trillion (about 145 trillion yen) in trading on August 5, 2024.

$1 trillion wipeout: Market rout punishes megacap tech

According to CNBC, NVIDIA's market capitalization fell by $300 billion as soon as trading began. The stock price recovered half of its losses during trading hours, eventually closing down 6.4%.

In addition, Apple and Amazon's valuations plummeted by $224 billion and $109 billion, respectively, at the start of trading. In the end, Apple fell 4.8% to a loss of $162 billion, while Amazon fell 4.1% to a loss of $72 billion.

In addition to these, Meta, Microsoft, Alphabet and Tesla also fell, causing the market capitalization of the top seven tech companies in the U.S. to drop by $995 billion in the first few minutes of trading. As trading progressed, the stock prices of each company recovered some of their value.

Elsewhere in markets, the Nikkei average fell 12% since the end of last week, its biggest drop on record surpassing the day after Black Monday in 1987, on concerns of a recession following poor economic data, while Bitcoin fell 11%, leading the decline in virtual currencies and related stocks.

Investors in the technology industry have been nervous about the worsening market environment since mid-July 2024, with the Nasdaq stock market for emerging companies experiencing what has been called the worst three weeks of sluggishness in history by early August. CNBC points out that 'this is a stark contrast to a few months ago, when investors cheered when Meta CEO Mark Zuckerberg and Google CEO Sundar Pichai announced they would invest heavily in AI infrastructure.'

In particular, NVIDIA, the biggest winner of the AI boom in GPU manufacturing, had a market capitalization of $3 trillion in June 2024, surpassing Apple and Microsoft to become the world's most valuable company. At the time of writing, the company's market capitalization was around $2.5 trillion.

Some analysts have warned that these companies may be overinvesting in AI. Goldman Sachs, for example, said in a June report that companies investing heavily in AI are barely matching the results they've seen. Elliott Management, one of the world's largest hedge funds, has also reportedly advised clients that Nvidia is in a 'bubble' and that the hype around AI is overblown.

NVIDIA, which has been gaining attention amid the AI boom, is scheduled to report financial results at the end of August 2024. The company has recorded revenue growth of over 200% over the past three quarters.

◆ Forum is currently open

A forum related to this article has been set up on the official GIGAZINE Discord server . Anyone can post freely, so please feel free to comment! If you do not have a Discord account, please refer to the account creation procedure explanation article to create an account!

• Discord | 'Did the stock price fluctuations have any impact?' | GIGAZINE

https://discord.com/channels/1037961069903216680/1270308825685037108

Related Posts:

in Note, Posted by log1l_ks