Is AI a bubble?

As IT giants are investing heavily in AI, David Kahn, an investor who mainly deals with AI-related companies, analyzes whether such investment is a 'bubble' or in line with actual demand.

AI's $600B Question | Sequoia Capital

AI's $200B Question | Sequoia Capital

https://www.sequoiacap.com/article/follow-the-gpus-perspective/

Khan posted his first analysis in September 2023 and his second analysis in June 2024. In his first analysis, he estimated the AI-related revenues expected by major companies and startups based on infrastructure investment in AI, and argued that the actual revenue growth rate of AI-related products was not at all up to the expected revenues, resulting in excessive investment.

After NVIDIA surpassed Microsoft to become the world's most valuable company in June 2024, Khan decided to redo the calculations.

NVIDIA becomes world's largest company with market capitalization of $3.34 trillion, surpassing Microsoft - GIGAZINE

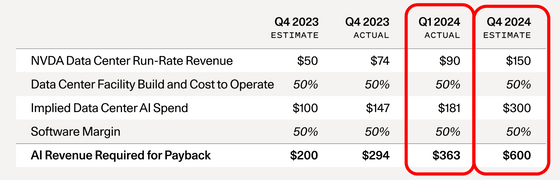

If AI investment is not a bubble, revenue from AI-related products should exceed investment in AI, and there should be a profit on the investment. Mr. Khan created the following table based on NVIDIA's financial statements.

In the first quarter of 2024, NVIDIA's sales run rate for GPUs for data centers was $90 billion (approximately 14 trillion yen). Since GPUs account for about half of the cost of a data center, if we work it out backwards, the AI-related costs for the entire data center are $181 billion (approximately 29 trillion yen), and considering the profits to be secured on the software side, the entire AI industry needs $363 billion (approximately 59 trillion yen) in revenue to make a total profit.

NVIDIA's data center GPU sales run rate is estimated to be $150 billion (about 24 trillion yen) in the fourth quarter of 2024, so in order for AI-related investments to be profitable, the entire AI industry will need to earn $600 billion (about 97 trillion yen) in revenue by the end of 2024.

Even OpenAI, which has the largest revenue in the industry , has a sales run rate of $3.4 billion (approximately 550 billion yen) as of June 2024 , while other startups are all companies with less than $100 million (approximately 16 billion yen). Even if we assume that giant companies such as Google, Microsoft, Apple, and Meta generate $10 billion (approximately 1.6 trillion yen) in new AI-related revenue and that Oracle, ByteDance, Alibaba, Tencent, X, Tesla, etc. can generate reasonable AI-related revenue, it is still far from $600 billion.

Given this situation, Khan concluded that AI infrastructure is overbuilt. While he said that 'AI is likely to be the next technological revolution,' he argued that if his predictions are correct, investors are likely to suffer losses.

On the other hand, there are also benefits to overinvestment, such as the price of GPU computing falling, stimulating innovation, and allowing startup founders to gain experience. 'Those who remain calm in moments of speculative fever have the opportunity to build companies of fundamental importance,' Khan concluded his post.

Related Posts:

in Note, Posted by log1d_ts