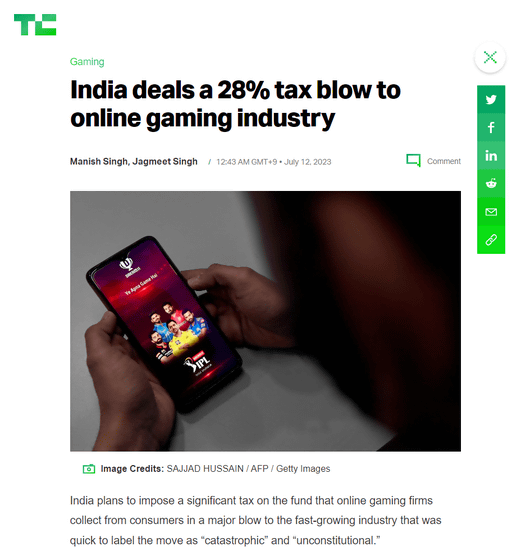

The Indian government decides to impose a tax of 28% on online games and shocks the industry

The Indian government has announced that it will impose a 28% tax on online games with a market size of $ 1.5 billion (about 210 billion yen) in the country. Along with this, ticket prices for real sports such as cricket may increase.

India deals a 28% tax blow to online gaming industry | TechCrunch

gst council: 28% GST on online gaming 'unconstitutional, irrational, egregious', says industry - The Economic Times

https://economictimes.indiatimes.com/tech/technology/28-gst-on-online-gaming-unconstitutional-irrational-egregious-says-industry/articleshow/101675764.cms

india: India's online gaming industry hit with 28% tax - The Economic Times

https://economictimes.indiatimes.com/tech/technology/indias-online-gaming-industry-hit-with-28-tax/articleshow/101675723.cms

'Implementation of 28% GST rate will bring challenges to online gaming industry' | Mint #AskBetterQuestions

https://www.livemint.com/economy/implementation-of-28-gst-rate-will-bring-challenges-to-online-gaming-industry-11689091580915.html

In India, fantasy sports that play with real money betting on national sports such as cricket are gaining popularity, and there are cases where popular cricket teams support fantasy sports development startups. However, there are growing concerns that game apps can cause addiction and lead to economic losses.

In response to these concerns, in early 2023 the Indian government amended its IT law to crack down on online games that offer gambling services. Along with this, the Indian government has ordered the establishment of a self-regulatory body for the gaming industry. However, Indian online games have escaped regulation by claiming they are 'skill-based games'.

In response, in July 2023, the Goods and Services Tax Council (GST), headed by the Indian government's Finance Minister, announced that it would impose a 28% tax on online games, casinos, and horse racing. GST should not distinguish between ``games that compete for skill'' and ``games that compete for luck'', and has imposed high taxes on online games that have escaped regulation as ``skill-based games''. will be imposed. Finance Minister Nirmala Sitharaman, chairman of the GST, said that the high taxation of online games as a whole was 'decided after extensive discussion.'

Online gaming is one of the fastest growing consumer internet businesses in India, with a valuation of over $8 billion backed by investment firms Tiger Global and Alpha Wave Global. Dream Sports and Sequoia India-backed Mobile Premier League have successfully raised billions of dollars together.

Roland Landers, CEO of the All India Gaming Federation, an industry group representing players in India's popular fantasy sports such as Mobile Premier League, Gameskraft, Paytm First Games, Zupee, Nazara and Rush, said the GST decision was 'unconstitutional. Yes, it's irrational, and it's terrible.'

``This decision will wipe out the entire Indian gaming industry and lead to the loss of hundreds of thousands of jobs, and only anti-national illegal offshore platforms will benefit from this tax,'' Landers said. I am referring to

Aditya Shah, CEO of India Plays, an Indian game application developer, said, ``The introduction of a 28% tax rate will pose a serious challenge to the gaming industry. It should have an impact, ”he said, suggesting that the burden of taxation may have to be resolved by raising the price of real sports tickets.

In India, online game revenue is expected to reach about $ 2 billion (about 280 billion yen), most of which was from games that allow betting using real money. The graph below summarizes the earnings of the Indian online game market by year, and you can see that the market size is expanding steadily.

???? Government set to impose 28% GST on total prize pools/face value of online games

— Madhav (thearcweb.com - sign up!) (@madhavchanchani) July 11, 2023

Big setback for players like Dream11, MPL, Gameskraft, Games 24x7

Online gaming was pegged to reach about $2 billion in revenues, mostly driven by real money platforms

Source: EY pic.twitter.com/GBeM5HqHHh

India's Finance Minister Nirmala Sitharaman said the GST will work with India's IT ministry to develop an online gaming category. ``We will continue to follow what the Ministry of Electronics and Information Technology (MeitY) wants to introduce as a regulation,'' he said.

Amrit Kiran Singh, CSO of Gameskraft , noted that some industry experts noted that an 18% tax rate would have been beneficial to the gaming industry, noting that over 200,000 jobs were created by the online gaming industry. I said I need to keep

Related Posts:

in Game, Posted by logu_ii