Samsung's profits plummeted by 95% to the lowest level in the past 14 years, the slump in semiconductor demand hit directly

On April 27, 2023, Samsung announced its financial results for the first quarter of 2023, which ended March 31. The price of memory chips has continued to fall and demand has remained sluggish, which has led to a significant drop in profits this term, but Samsung predicts that 'demand will recover in the second half of the year and business will recover.'

Samsung Electronics Announces First Quarter 2023 Results – Samsung Global Newsroom

(2nd LD) Samsung Electronics logs worst quarter in 14 years amid memory chip glut | Yonhap News Agency

Samsung earnings: Q1 profit plunges amid weak memory chip demand

According to Samsung's announcement, operating profit for this term was 640.2 billion won (about 63.746 billion yen), a 95% decrease from 14.12 trillion won (about 1.406089 trillion yen) in the same period last year. That's what I'm talking about. This was the lowest operating profit since the first quarter of 2009, when

In addition, net profit decreased by 86.1% year-on-year to 1.57 trillion won (about 156.343 billion yen), and sales decreased by 18% to 63.74 trillion won (about 6.34841 trillion yen). I didn't wave.

A particular blow was the slump in the Device Solutions (DS) division, which oversees the main chip business. As a result of sluggish global demand for semiconductors and a large accumulation of inventories, the division recorded a deficit of 4.58 trillion won (about 455.863 billion yen) for the first time in 14 years. Samsung explains why the performance of the DS division has deteriorated, ``due to sluggish demand in the memory business, lower operating rates in the foundry business, and continued sluggish demand and inventory adjustments from customers''.

Supply chain disruptions caused by the pandemic have left industries with severe semiconductor shortages, but now overstocking is plaguing chip makers as rising inflation has forced consumers to buy less products such as smartphones. increase.

The financial market took this announcement calmly, as Samsung also predicted a significant decline in operating profit in its earnings forecast announced in early April. SK Kim of Daiwa Securities Capital Markets told news media CNBC, ``Samsung announced disappointing numbers in the first quarter, but at the same time, it has made a meaningful cut in the face of a serious downturn in memory chips. The market has since responded positively to the news.'

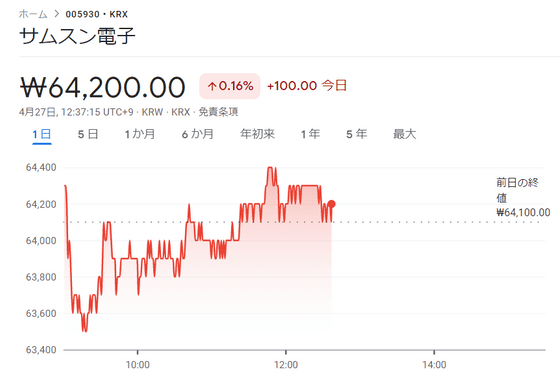

Samsung's stock price at the time of writing the article has increased by 0.16% from the previous day's closing price and has remained almost flat.

by Google Finance

Samsung expects the chip market to shrink by 6% from the previous year in 2023, noting that the tough year will continue, but that seasonal spending trends will lead to a gradual recovery in market demand from the second half of the year. provided an outlook for

Related Posts:

in Hardware, Posted by log1l_ks