17 billion yen of funds flowed out of the virtual currency market due to hacker price manipulation, hackers claim that `` their actions are legal ''

114 million dollars (about 17 billion yen) of funds have flowed out from

Mango Markets exploiter comes clean, claims all actions were legal

https://www.theblock.co/post/177424/mango-markets-exploiter-comes-clean-claims-all-actions-were-legal

Solana-Based Decentralized Finance Platform Mango Hit by $100 Million Exploit

https://www.coindesk.com/business/2022/10/11/breaking-news-solana-based-decentralized-finance-platform-mango-hit-by-potential-100-million-exploit/

EXCLUSIVE: The Man Who May Have Milked $100+ Million from Mango Markets

https://karlstack.substack.com/p/exclusive-the-man-who-may-have-milked

The $117 million outflow was reported by OtterSec , a blockchain auditing body.

It appears the attacker was able to manipulate their Mango collateral. They temporarily spiked up their collateral value, and then took out massive loans from the Mango treasury. pic.twitter.com/2IJrB9RcEJ

— OtterSec (@osec_io) October 11, 2022

According to OtterSec's Robert Chen, Mango Markets' governance token MGNO was valued higher than it should have been. The attacker first deposits 10 million dollars (about 1.48 billion yen) into Mango Markets, and borrows and lends within Mango Markets with MGNO, which has increased by about three times due to price manipulation, as collateral, resulting in Withdrew $114 million. At the time of writing, it is unknown how the attacker manipulated MGNO's price.

Chris Brunett of independent media Karlstack participates in a personal Discord server where hackers discuss cryptocurrency and stock trading strategies. Berg has revealed that he boasted about hacking Mango Markets. Mr. Brunett's article has been confirmed by Mr. Eisenberg, and there is no doubt.

In addition, Eisenberg revealed on Twitter that he was the one who withdrew $114 million from Mango Markets.

Statement on recent events:

— Avraham Eisenberg (@avi_eisen) October 15, 2022

I was involved with a team that operated a highly profitable trading strategy last week.

Eisenberg said, ``We believe that all our actions are legitimate open market using the protocol as designed, even if the development team didn't fully envision it.'' ``This is Binance. Similar to how automatic deleveraging works on exchanges such as and Bitmex, it takes back a portion of the profits from profitable traders to ensure that all users' funds are protected,' he said. claimed that the series of transactions were legitimate.

I believe all of our actions were legal open market actions, using the protocol as designed, even if the development team did not fully anticipate all the consequences of setting parameters the way they are.

— Avraham Eisenberg (@avi_eisen) October 15, 2022

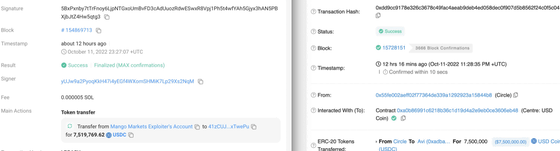

The screenshot below shows that $7.5 million (about 110 million yen) moved from Solona, where Mango Markets is located, to Ethereum via Circle . Mr. Eisenberg commented, 'I will not use the money I got and will leave it to my child when I die.'

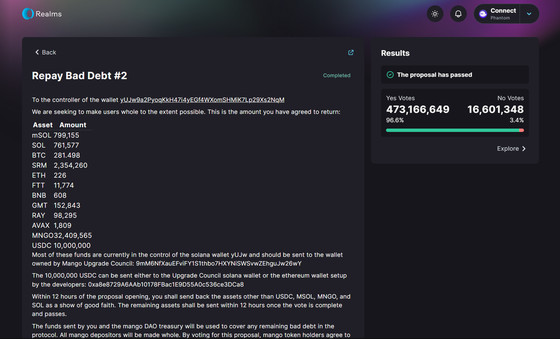

Mango Markets, on the other hand, lost much of its funds after Eisenberg withdrew $114 million, making it nearly insolvent. Therefore, Mr. Eisenberg asked Mango Markets for $ 67 million ( Approximately 10 billion yen) was proposed to be returned.

Mango DAO

https://dao.mango.markets/dao/MNGO/proposal/GYhczJdNZAhG24dkkymWE9SUZv8xC4g8s9U8VF5Yprne

MGNO, a governance token, is used for the resolution of the proposal, but since most of MGNO is in Mr. Eisenberg's hands, this proposal was passed with 96.6%. However, Mr. Eisenberg returned MGNO worth $ 8 million (about 1.18 billion yen) to Mango Markets immediately after the voting began.

Mr. Eisenberg stipulated that he would not file a criminal complaint against Mango Markets, but it is unknown whether the police will miss the series of disturbances. Eisenberg himself mentions on Twitter a bet on whether he will be arrested by December 31, 2023.

How much size would you sell me at 15

— Avraham Eisenberg (@avi_eisen) October 14, 2022

Related Posts: