It is reported that Apple will perform identity verification and fraud prevention by Apple ID with 'Postpay with Apple Pay'

At the keynote speech of the developer event WWDC22 held on June 7, 2022, Apple will offer interest-free installment payments with Apple Pay and Apple Wallet, Apple Pay Later . Announced. It is reported that this 'deferred payment with Apple Pay' will be verified by the credit information used on the credit card and the FICO score , and at the same time, the identity will be verified by the Apple ID.

Apple Goes Deeper Into Finance With Buy Now, Pay Later Offering --WSJ

https://www.wsj.com/articles/apple-goes-deeper-into-finance-with-buy-now-pay-later-offering-11654939801

The ugly economics behind Apple's new Pay Later system --The Verge

https://www.theverge.com/2022/6/8/23157184/ugly-economics-behind-apple-buy-now-pay-later-system-bnpl

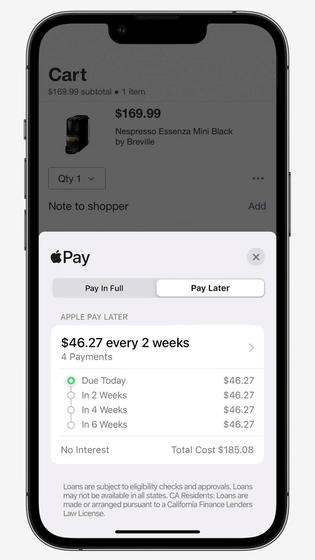

The non-interest-bearing, installable post-payment method is called 'Buy Now, Pay Later (BNPL)' and has been rapidly adopted in online shopping in Europe and the United States in recent years. Apple's 'Postpay with Apple Pay' is also one of the services of this BNPN method, and four installments are settled with the debit card registered in Apple Wallet over 6 weeks.

Apple already offers a credit card service 'Apple Card' that can be used only in the United States. The Apple Card is a MasterCard brand and is funded by Goldman Sachs to approve applicants and raise loans.

Apple announces its own credit card 'Apple Card' that works with iPhone-GIGAZINE

'Postpay with Apple Pay' is different from traditional credit card installments in that there are no interest fees or late damages. A major feature of 'Postpay with Apple Pay' is that it is targeted at users who do not use credit cards in consideration of the possibility of incurring debt due to interest rate fees and late damages. However, if your debit card's account balance is insufficient, the bank issuing the card may charge you a fee.

According to the Wall Street Journal, Apple finances applicants with credit information and its scoring FICO score, like banks, to approve customers without the risk of making significant losses with 'deferred payment with Apple Pay.' It is planned to check the situation and check the identity and fraud prevention with Apple ID. This means that Apple will do the same work as a bank or other financial institution on its own.

'Postpay with Apple Pay' is offered only in the United States at the time of writing the article. It's unclear if 'Postpay with Apple Pay' will be offered in Japan, but there is already an official plan to purchase Apple products affiliated with the BNPL payment service 'Postpaid Paydy'.

The IT news site The Verge warns that incorporating 'Postpay with Apple Pay' into the iPhone will make BNPL-style payments routine and pose a great risk to consumers. Is ringing.

One study found that 73% of users of BNPL-based payments were Generation Z , born between 1997 and 2012, of which 43% were overdue at least once. .. In another survey , 32% of users said they had skipped rent, utilities, and child support to prioritize BNPL payment claims.

'The'Postpay with Apple Pay', which connects dangerous things like BNPL to Apple's brand, conflicts with Apple's goal of providing customers with generally satisfying technology and services,' The Verge said. doing.

Related Posts:

in Mobile, Web Service, Posted by log1i_yk