Illustrate what will happen to the supply of crude oil if Russia continues the war as it is

As the situation in Ukraine deteriorates, the price of crude oil has fluctuated due to the import ban on Russian crude oil from the United States and Europe. Devil's Advocate, an energy blog, explains how crude oil supply is expected to be if Russia's invasion of Ukraine continues as it is, using a number of charts.

There are not enough BTUs-by Viscosity Redux

Devil's Advocate predicts that there will be a 'shortage of crude oil' given that the conflict between Russia and Ukraine will continue. Below is a wide variety of graphs cited as the rationale.

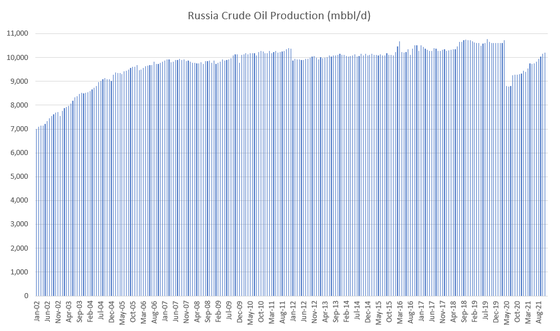

First of all, the amount of crude oil produced by Russia is about 11 million barrels / day. This is the third largest output in the world after Saudi Arabia in the United States.

By JODI

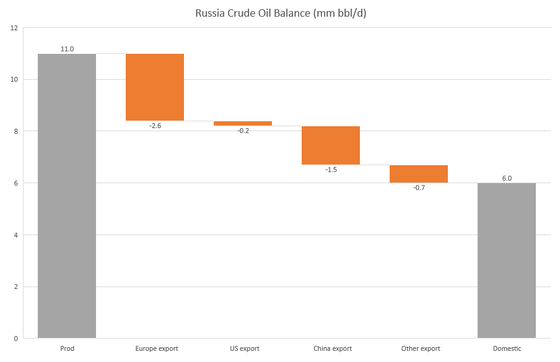

Of this crude oil produced, about 6 million barrels / day is consumed in the home country. The amount exported is about 5 million barrels / day.

By Bloomberg, EIA, JODI, IEA

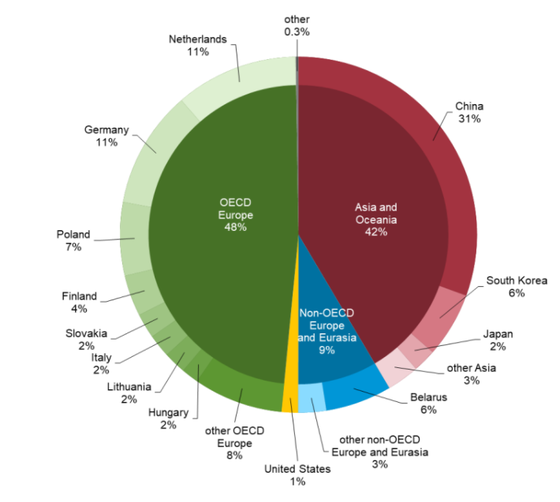

Looking at the breakdown of exports, exports to OECD member countries account for 48%, and exports to Asia and Oceania account for 42%. The breakdown of 42% for Asia and Oceania is 31% for China and 2% for Japan.

By EIA

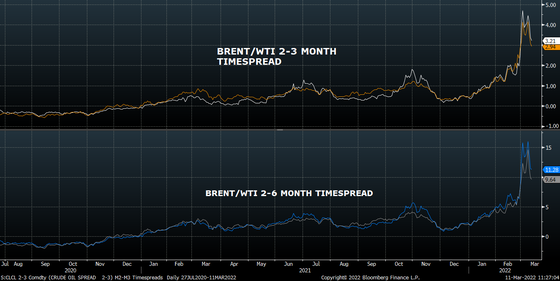

Crude oil was not covered by the sanctions imposed by the United States and the EU at the beginning of the invasion of Ukraine. As a result, futures prices soared due to concerns that sanctions would extend to crude oil in the future, but this soaring soon subsided.

By Bloomberg

Regarding these Russian crude oils, Devil's Advocate predicts that 'the distribution volume will decline in the future.' Until now, the amount that was on the market was shipped before the invasion, so the distribution volume did not decrease, but it is the opinion that the distribution volume in the future will be affected by the invasion of Ukraine.

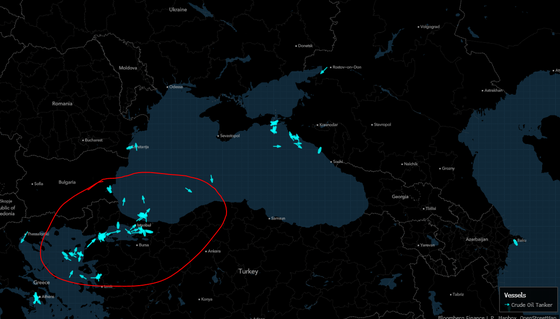

According to Bloomberg, in the second week of March 2022, about a quarter of Russia's largest state-owned fleet, Sobcomflot's oil tankers, were idling along the European coast after unloading. Normally, after unloading, they should have returned to the port to reload crude oil, etc., but it seems that they have temporarily canceled their navigation because there are no more sales destinations for crude oil due to the suspension of crude oil imports.

By Bloomberg

According to Devil's Advocate, 70% of Russian crude oil shipped by sea is undecided. And since Russia is expected to reach the upper limit of crude oil stockpiling within a month, Devil's Advocate's view is to 'narrow down the output itself' in the future.

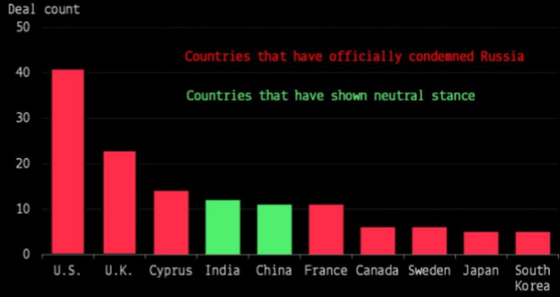

If Russia wants to sell before it overflows with crude oil, it has no choice but to sell to China and India. Looking at Russia's investment in crude oil and gas, the United States, the United Kingdom, Cyprus, etc. occupy the top positions, but the following countries represented by the red bar graph are participating in crude oil sanctions. And the top countries that have not participated in crude oil sanctions are China and India.

By Bloomberg

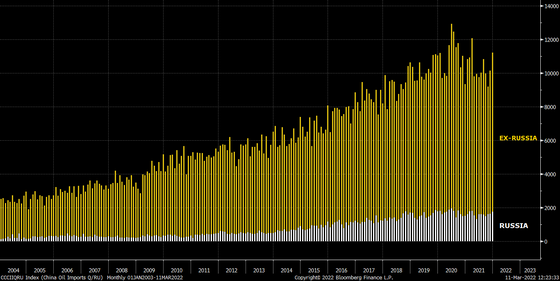

Currently, China imports about 1.5 million barrels / day of crude oil from Russia, but since it imports about 3 million barrels / day of crude oil of similar quality in total, it imports only one to Russia. It is possible to increase imports from Russia by about 2 million barrels / day.

By Bloomberg

However, in reality, China has not increased the purchase of Russian crude oil.

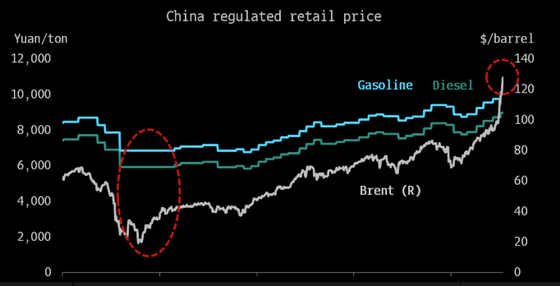

China's gasoline price stabilization policy is creating this situation. According to Devil's Advocate, the National Development and Reform Commission of China has fixed the price of gasoline sold domestically in order to stabilize the price of gasoline for consumers, and is revising the price twice a month. This system protects consumers from fluctuations in gasoline prices, but it temporarily creates a situation where the import price of crude oil exceeds the selling price, so some businesses have no choice but to stop refining. That's why.

By Bloomberg

Chinese oil companies are cautious about importing Russian crude oil in response to international criticism of Russia, and even if they reach out to Russia, they will not do it immediately. It is expected.

On the other hand, India, which is named as the buyer of Russian crude oil after China, has less than half the import scale of China in the first place, and even if it imports all Russian crude oil, it will take over all the spills. It seems that it will not reach.

By Bloomberg

Opposition to the import measures of Russian crude oil also exists in India, and the Indian daily The Hindu said, 'Finance Minister Nirmala Sitaraman has offered Russia'always sell crude oil at a discounted price'. He said that he had presented it, but said that he would 'decide the final decision based on various factors.' The decision to increase crude oil imports from Russia was 'isolated Russia' by friendly countries such as the United States and Europe. You should be aware that this is contrary to the intention to 'make it'. Foreign Minister Subramaniyam Jaishankal said in February 2022 that he would 'do not give in to one-sided sanctions demands', but in 2019 the United States We gave in to the demand and implemented a ban on the import of crude oil from

Devil's Advocate predicts that even if Russia increases exports to China and India by about 1 million barrels / day, it will generate a surplus of about 1 to 2 million barrels / day.

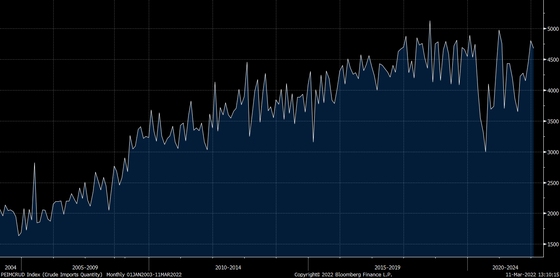

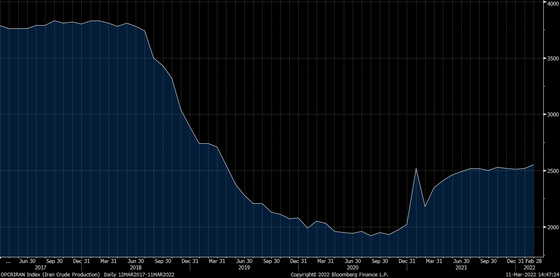

The OECD's crude oil reserves are on a downtrend, but some compensation has been made as Iran increased its oil supply by about 1 million barrels / day.

By Bloomberg

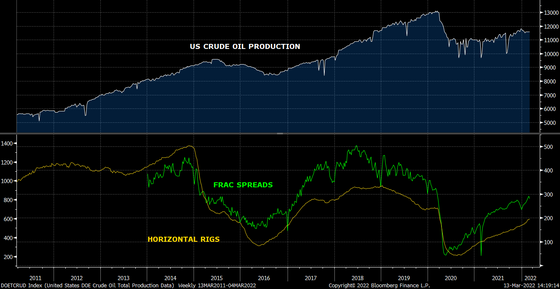

On the other hand, the United States, which has become the world's largest producer of shale oil, has announced that it has no intention of rapidly increasing its output in response to this shortage of crude oil, and it will increase its output at the same pace as before. Is expected to continue.

By Bloomberg

Under these circumstances, Devil's Advocate predicts that oil shortages will continue throughout 2022 if Russia's invasion of Ukraine and Western sanctions against it continue.

Related Posts:

in Note, Posted by darkhorse_log