Which countries will earn and which countries will lose due to fluctuations in crude oil price?

The price of crude oil depends on the demand and output of crude oil, and it is changing from moment to moment. Due to such fluctuations, oil exporters and importers are getting or losing money, but the influence seems to be quite large depending on the country as well.

Dear oil helps some emerging economies and harms others - The crude curve

https://www.economist.com/finance-and-economics/2018/05/26/dear-oil-helps-some-emerging-economies-and-harms-others

Oil helps some, hurts others ... The Economist - Commodity Research Group

http://www.commodityresearchgroup.com/blog/oil-helps-some-hurts-others-the-economist/

Crude oil price (unit price of 1 barrel) changes by dozens of dollars (about several thousand yen) in one year, each time both oil exporters and oil importing countries are affected. People involved in the policy of the government are paying close attention to crude oil prices while closely watching foreign exchange fluctuations.

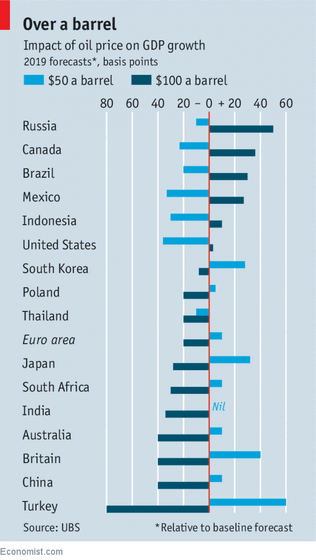

One of the world's leading financial companies based in Zurich, SwitzerlandUBS, The fluctuation in crude oil price is worldwideGDP(GDP) as a result of the analysis.

And it is a weekly newspaper in the UKeconomistThe online version of the report created a graph showing the relationship between crude oil price and GDP based on UBS data. In the graph below, the bar graph shows the expected GDP for 2019 GDP, when the oil price is 50 dollars (about 5500 yen) or 100 dollars (about 11,000 yen). When the oil price is 50 dollars the GDP is light blue bar graph, the GDP when it is 100 dollars is shown in a dark blue bar chart.

Basically, oil exporters will gain profits as oil prices rise, while oil importing countries suffer disadvantages as crude oil prices rise. However, the relationship between crude oil prices and GDP is more complicated, and it seems that "If the price of oil rises, GDP of oil importing countries will not decline".

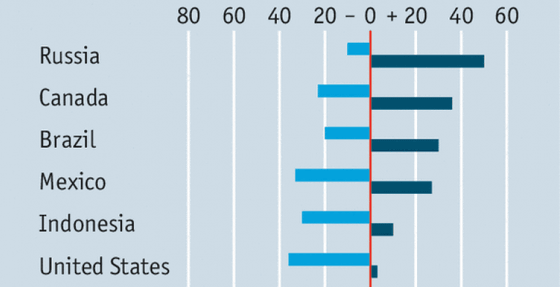

Looking at the top of the graph, countries such as Russia, Canada, Brazil, Mexico, Indonesia, and the United States will benefit from the rise in crude oil prices and will be disadvantaged by the decline in crude oil prices. Since Russia, Canada and Brazil are oil exporters, it is easy to understand that "GDP grows as exports increase".

Indonesia is not an exporter of oil, but it is an exporter of "energy" such as coal and palm oil. As crude oil price and energy prices such as coal and palm oil show linkage, Indonesia is a country that benefits from rising oil price. While Mexico and the United States are also oil importing countries, the domestic petroleum industry boasts a very large scale, and the rise in crude oil prices will benefit people engaged in the oil industry and create employment at the same time. As a result, the disadvantage incurred by the rise in crude oil prices exceeds the profits generated by the rise in crude oil prices.

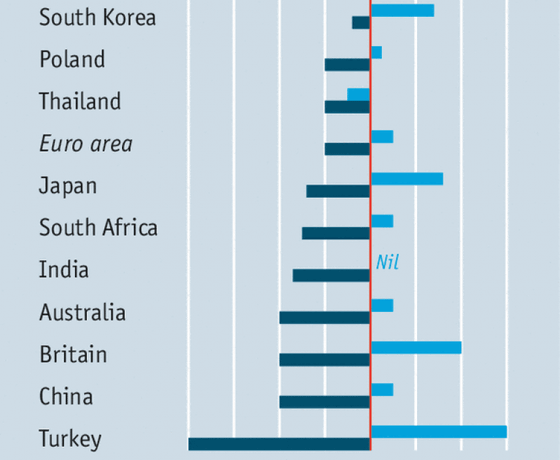

Of course, in many oil-importing countries, GDP declines due to the rise in crude oil prices, while countries such as Japan, the UK and Turkey benefit from lower crude oil prices, you can see that the damage caused by the rise in crude oil price is also very large.

According to the economist, it simply means "If the price of crude oil rises, there will be a benefit to the oil industry". For example, in the United StatesOil platformMany of them are suspended because there is no profit when crude oil price is 40 dollars (about 4400 yen). However, if crude oil prices rise to 60 dollars (about 6600 yen), they will start to operate as they can generate profits and create a large employment.

On the other hand, even if the price range of the crude oil price is the same "20 dollars (about 2200 yen)", if the crude oil price rises from 100 dollars (about 11,000 yen) to 120 dollars (about 13,000 yen) , Most of the oil platform is operating at the time of 100 dollars, so even if it reaches 120 dollars, the impact on employment is small so GDP does not change significantly.

I am an analyst at UBSArend KapteynAccording to Mr., it is said that if the oil price falls below 50 dollars (about 5500 yen) or exceeds 75 dollars (about 8,200 yen) worldwide, the economy will be adversely affected.

Related Posts:

in Note, Posted by log1h_ik