The 2021 edition of the 'Global Crypto Adoption Index', which shows the countries where the use of crypto assets by the general public is popular, was announced. Why are crypto assets so popular in emerging countries?

Chainalysis, a crypto asset analysis company, has released the July 2020-June 2021 edition of the Global Crypto Adoption Index, an index that shows countries where crypto assets are actively used. A survey of 154 countries around the world analyzing purchasing power and transaction volume of individual users showed that the use of crypto assets worldwide increased significantly from 2020 to 2021, and that

Chainalysis Blog | The 2021 Global Crypto Adoption Index: Worldwide Adoption Jumps Over 880% With P2P Platforms Driving Cryptocurrency Usage in Emerging Markets

https://blog.chainalysis.com/reports/2021-global-crypto-adoption-index

Cryptocurrency: Where new bitcoin users are around the world

https://www.cnbc.com/2021/08/18/new-cryptocurrency-bitcoin-user-global-map.html

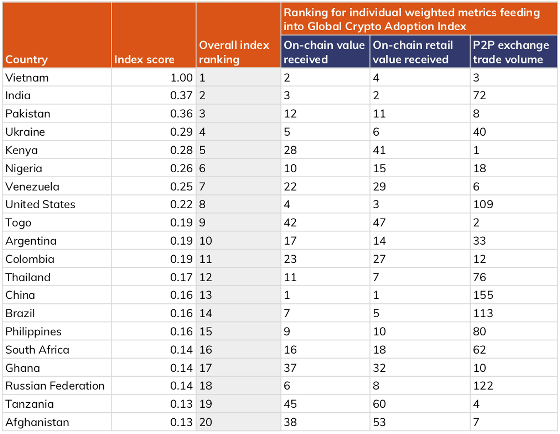

On August 18, 2021, Chainalysis announced the 'Global Crypto Adoption Index' from July 2020 to July 2021. This index has been published since 2020 by Chainalysis to provide an objective measure of the degree of adoption of crypto assets. It focuses on 'the use of crypto assets related to personal transactions and savings by the general public' rather than being influenced by factors such as the economic situation of the country itself or institutional investors. Therefore, the Global Crypto Adoption Index provides the following three metrics for calculation.

・ 1: “Total amount of crypto assets received by the country” weighted by purchasing power parity

This metric weights the total amount of crypto assets received by a particular country during the period by the Purchasing Power Parity (PPP) at an exchange rate based on the question 'How much can a particular commodity be bought?' It can reflect the value of money in each country. In other words, if there were two countries that received $ 100 (about 11,000 yen) during the same period, the country with the lower PPP per capita would be more 'cryptocurrency transaction in the assets per resident'. It is considered that the ratio is large, and it is a mechanism that ranks high in the Global Crypto Adoption Index.

・ 2: 'Amount of crypto asset transactions by individuals' weighted by purchasing power parity

The Global Crypto Adoption Index measures crypto asset transactions of 'less than $ 10,000' to incorporate the volume of crypto assets traded by individuals who are not experts or institutional investors into the index. This transaction amount is also weighted by PPP, and even if the amount is the same, countries with lower PPP will be ranked higher.

・ 3: “Transaction volume via P2P trading platform” weighted by the number of Internet users and PPP

In many emerging countries that do not have access to centralized exchanges, trading via P2P trading platforms accounts for the majority of crypto asset trading volumes. Chainalysis measured P2P trading volume of crypto assets in each country based on data from two major P2P trading platforms , LocalBitcoins and Paxful, and weighted them by the number of Internet users and PPP.

The table below shows the 'Top 20 Countries' of the Global Crypto Adoption Index calculated from three metrics. The countries are Vietnam, India, Pakistan, Ukraine, Kenya, Nigeria, Venezuela, America, Togo, Argentina, Colombia, Thailand, China, Brazil, Philippines, South Africa, Ghana, Russia, Tanzania, and Afghanistan in order from the first place. Most of them are emerging countries such as South Asia, Africa and South America. In addition, the Index score (index score) with Vietnam in 1st place as '1.00' is followed by India in 2nd place with '0.37' and Pakistan in 3rd place with '0.36', which shows that Vietnam is outstandingly high. increase.

For Vietnam, which ranked high in all three metrics, data analyst Matt Ahlborg told news media CNBC that Vietnam is

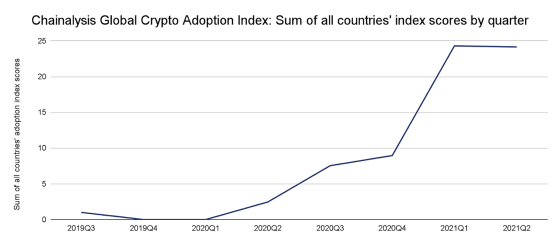

Chainalysis also points out that the use of crypto assets worldwide is increasing rapidly from this result. The graph below shows the global Crypto Adoption Index score for the entire world from the third quarter of 2019 on a quarterly basis, with a score of only '2.5' in the second quarter of 2020, but 2021 one year later. Chainalysis said it surged to '24' in the second quarter of the year.

In countries such as Kenya, Togo, Vietnam, Tanzania, Venezuela and Afghanistan, which ranked in the top 20, the volume of crypto assets traded using the P2P trading platform per capita was enormous. In these emerging countries, cash savings are unstable due to concerns about currency devaluation, so there are moves to purchase crypto assets on P2P trading platforms and try to protect the assets.

For example, Argentina, which ranked 10th overall, is facing a serious economic crisis such as repeated devaluations, defaults, hyperinflation, the epidemic of the new coronavirus infection (COVID-19), and a three-year recession. In addition to this, crypto assets are attracting attention from people as a result of restrictions on foreign currency purchases due to capital regulations in 2019.

Why is cryptocurrency mining soaring in Argentina? --GIGAZINE

In Afghanistan, which ranked 20th , attention was focused on Bitcoin even before the rebel Taliban came to power in August 2021, and some people said that they had converted their assets to Bitcoin. is. Afghanistan still has a cash economy, but the Taliban invasion has had the effect of closing banks, which could accelerate the tendency of the general public to use crypto assets.

Bitcoin in Afghanistan: Cryptocurrency, the Taliban, and capital flight

https://www.cnbc.com/2021/08/21/bitcoin-afghanistan-cryptocurrency-taliban-capital-flight.html

The Global Crypto Adoption Index is not always a perfect index, and because there is no clear data on P2P transactions in sanctioned countries, sanctioned countries such as Cuba are underestimated. Still, Ahlborg said of the Global Crypto Adoption Index, 'it's one of the best indexes we have.'

Related Posts:

in Note, Posted by log1h_ik