Sales of the major virtual currency exchange 'Coinbase' in 2020 will be more than 130 billion yen, revealed by materials for direct listing on NASDAQ

In December 2020, the cryptocurrency (virtual currency) exchange 'Coinbase', which announced its intention to list its shares, submitted a document called 'Form S1' necessary for listing to the US Securities and Exchange Commission. Coinbase's business performance is also strong, as Bitcoin, which is a representative of virtual currency, has been active in trading, such as reaching the

Document

https://www.sec.gov/Archives/edgar/data/1679788/000162828021003168/coinbaseglobalincs-1.htm

Coinbase Reveals $ 322M in Profit For 2020 Ahead of Landmark Public Debut --Decrypt

Coinbase has filed to go public on the NASDAQ --The Verge

https://www.theverge.com/2021/2/25/22300835/coinbase-s1-bitcoin-going-public-profit-revenue-invest-crypto

Coinbase was founded in 2012 by Brian Armstrong, an engineer of the private lodging service Airbnb, as a mechanism for purchasing virtual currency online. You can understand how it was founded and how it went around as cryptocurrencies became major by reading the following articles.

Coinbase's Brian Armstrong aims to 'create a world where 1 billion people use cryptocurrencies within 5 years'-GIGAZINE

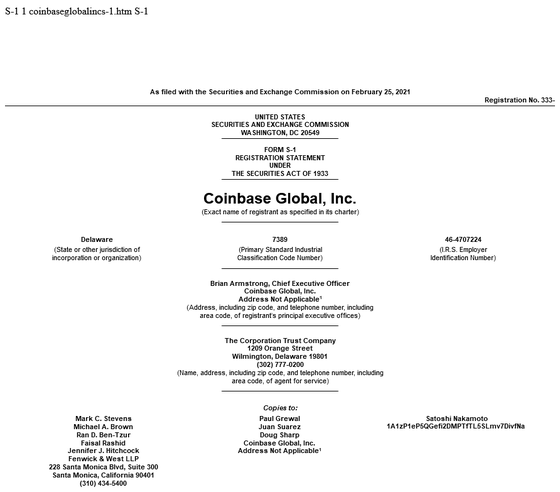

Coinbase's main revenue comes from transaction fees, and it was not clear until now how much it was, but since the documents necessary for listing the stock were submitted, it is concrete. Amount has been revealed.

According to the materials, the total transaction value on the platform is 456 billion dollars (about 48.3 trillion yen), and sales in 2020 alone will be 1.27 billion dollars (about 134.6 billion yen). The profit was 322 million dollars (about 34.1 billion yen).

Companies from Silicon Valley often do an initial public offering (IPO) when they go public, but Coinbase chose to go public directly. Until now, direct listing was a method of listing only existing shares, and if new shares were to be issued, IPO was to be conducted, but in December 2020, the Securities and Exchange Commission will issue new shares even if it is directly listed. It seems that he chose this method because he made it possible.

The existing Coinbase shares are owned by venture capital firm Andreessen Horowitz co-founder Marc Andreessen with more than 5.5 million shares and Brian Armstrong CEO with more than 2.7 million shares. Armstrong CEO holds 21.8%, co-founder Fred Elsam 9%, Andreessen 14.2%, and Fred Wilson, who has invested from the beginning, holds 8.2%, 11 people. It is said that 54% will be exercised by the management team consisting of and the board of directors.

As CEO Armstrong struggled at the beginning, cryptocurrencies have long been like 'underground servants' and have been seen by investors and the financial industry as such, but electric car maker Tesla is 1577. The position has changed significantly, such as purchasing 100 million yen worth of Bitcoin. The listing of Coinbase this time is also expected to be a big step for cryptocurrencies.

Related Posts:

in Web Service, Posted by logc_nt