US Securities and Exchange Commission sues Ripple, which develops the world's third largest crypto asset

The US

SEC.gov | SEC Charges Ripple and Two Executives with Conducting $ 1.3 Billion Unregistered Securities Offering

The Securities Act of1933 requires securities traded in the United States to be registered with the SEC. However, the virtual currency XRP handled by Ripple is not registered in the SEC. As a result, the SEC has filed proceedings against Ripple and CEOs Brad Garlinghouse and former CEO Kristian Larsen , alleging that investors were unable to obtain sufficient information on XRP.

The issue in this proceeding is whether XRP is a 'securities' that must be registered with the SEC or a 'currency' that does not need to be registered. For example, Bitcoin, which is the largest in the market, continues to create new coins through the mining process , while XRP trades 100 billion units, which does not increase or decrease. In addition, XRP of about 64 billion are held by the ripple, a lot of XRP also Larsen and Mr guard ring house owns it with. In addition, approximately 48 billion XRPs are reserved for regular sale by Ripple. For these reasons, the SEC claims that XRP is a 'securities' rather than a 'currency.'

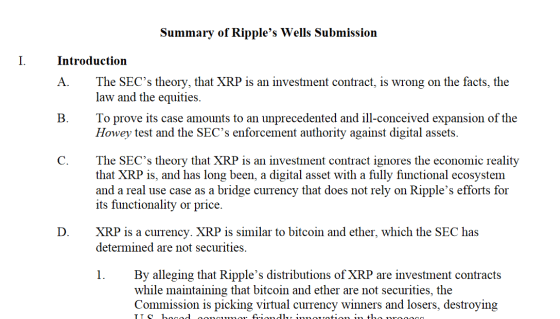

Ripple responded to the proceedings because XRP was recognized as a currency by the U.S. Department of Justice in 2015, and investors are not trading XRP for profit from Ripple. Insists on the legitimacy of the XRP transaction.

Summary of Ripple's Wells Submission

(PDF file) https://ripple.com/wp-content/uploads/2020/12/Ripple-Wells-Submission-Summary.pdf

Related Posts:

in Software, Posted by log1o_hf