You should not use ambiguous words such as 'maybe' in business expectations

When predicting something, ambiguous phrases such as "probably" "probably" "usually" "sometimes" are very useful, but there is room for interpretation of "possibility" that the term points. A data analyst who thinks that "words that differ meaning depending on interpretation should not be used in business" is said to be able to increase the accuracy of prediction only by self restraint on using ambiguous words.

If You Say Something Is "Likely," How Likely Do People Think It Is?

https://hbr.org/2018/07/if-you-say-something-is-likely-how-likely-do-people-think-it-is

In March 1951 the CIA's evaluation division announced a document that evaluated the possibility of the Soviet Union's attack on Yugoslavia as "serious possibility". Dr. Sherman Kent, a historian at Yale University who wondered what "serious possibility" meant, confirmed the possibilities to members of the evaluation department with concrete figures. Dr. Kent himself said that he got a wide response from "20%" to "80%" from members of the evaluation division who created the document on "serious possibility" thought to be "65%". Dr. Kent thought that there is a big problem in expressing it as a "vague word" whose interpretation varies greatly depending on the person about the possibility of a serious threat that could have a major impact on the world situation.

Even now nearly 70 years since Dr. Kent revealed concern, "ambiguous words" that leaves room for interpretation to express the possibilities in the business, investment and political world is preferred. Professor Phil Tetrock of the University of Pennsylvania believes that responsibility can be avoided by using ambiguous words to predict the cause.

However, in order to prevent discrepancies in communication, it is desirable to avoid using these "ambiguous words". So, data scientist Andrew Mahinsin and Professor Michael J. Mabshinsin Columbia Business School show three important minds to hone their predictions by eliminating "ambiguous words" in business .

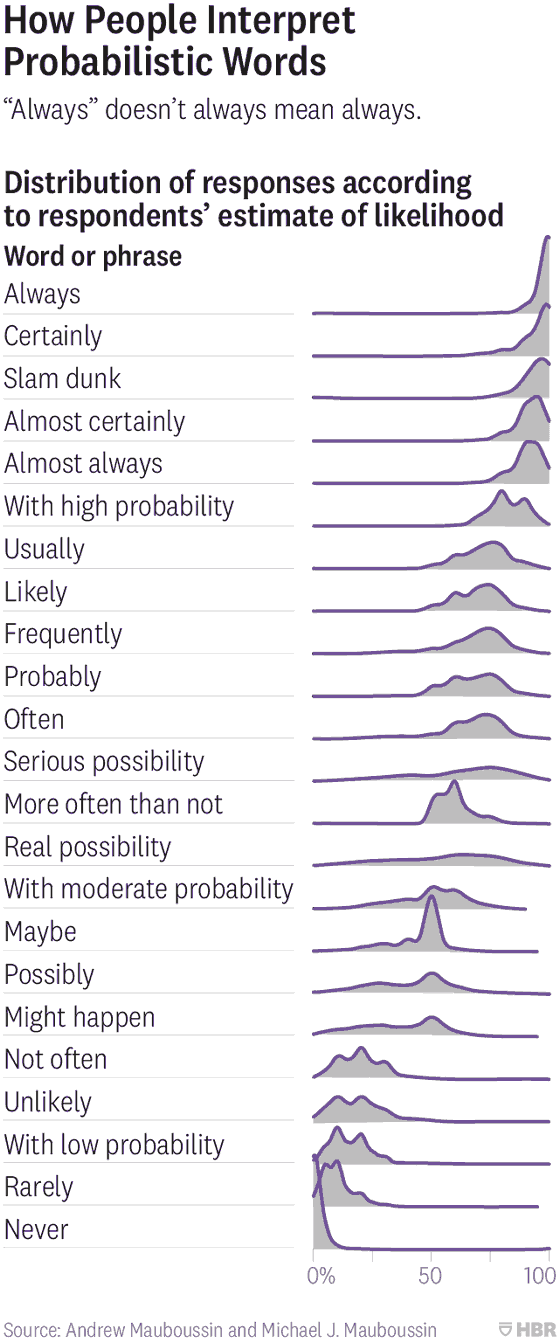

· 1: Expression by words, not words <br> Professor Mabushin et al. Are trying to clarify to what extent this type of "ambiguous words" that can lead to confusion in communication is likely to be taken as probability , We conducted a questionnaire survey on the probability (numerical value) that vague words would show. The following graphs were obtained from the results of a questionnaire survey for 1,700 public citizens. The probability shown by each word is different in individual feeling, so "width" can be seen, but it will be a rough guideline.

As a result of the survey, there are relatively narrow interpretation words such as "Always" where most people feel highly likely, or "Never" which feels unlikely to have any possibility at all, while "We" "" Probably "" Often "and others, we found that there are words that can differ greatly in how people perceive it.

Therefore, in business, it is said that interpretation should be stopped from being expressed by people in different terms, and expression should be based on uniquely determined "number (probability)". According to Professor Mabushin, in "ambiguous words" there is a difference in interpretation between the difference between men and women and whether the English is the mother tongue or not. In important matters where mutual understanding is indispensable, it seems that we should confront probability rather than ambiguous words expressing frequency.

· 2: Approach to fix subjective probability <br> In some experiments , 50 problems were answered which was answered in the form of ∘ or ×, whereas the average percentage of correct answers of the participants was 60% , The average of the answer rate which was confidently answered "correctly answered" was 70%. From here we can see that people tend to have too much confidence in their judgment.

Given that there are such characteristics, you can see that it is difficult to quantify the probability of thinking that you can happen. Therefore, Professor Mabushin recommends to image a concrete "bet" when comparing the probability value, and compare it with the result.

For example, consider a case where competitors are planning to launch new products that may affect their sales. Here, in order to start out the possibility of the competitor's new product being successful, you first receive "1 million dollar (about 100 million yen) bonus if the rival's product fails." If the new product really succeeds It is impossible to imagine the situation that I can not get money ".

Then, I imagine "25 green marble and 75 blue marble, close my eyes and pick one, if you can get $ 1 million if the stone is green, but nothing if the stone is blue I will imagine the case that I can not get it. " If you participate in these two "bets", you have to consider which one you choose. If you feel that marble betting is better, there is less than 25% chance that rival companies will fail new products.

Of course, you can change the proportion of marble color according to the situation OK. By using something objective benchmark, it seems to be useful for finding subjective probabilities.

· 3: Get feedback to improve forecasting - It is important to accurately forecast the future in various situations including business. It is important to be a good predictor and it is necessary to train in order to improve the accuracy of the forecast, but it is not enough to merely make many predictions. By continuing to compare the forecast with the reality, Professor Mabushin thinks that training is needed to improve prediction accuracy.

Even then, for example, Facebook is not an expectation that leaves room for subjective interpretation such as "Facebook will stay in the dominant position of social network for a long period of time", "Facebook will be 2.5 billion monthly users in one year from now The probability of keeping a person is 95% "It should be expressed in a method that can be accurately quantified. Also, it is useful to use online services such as " Good Judgment Open " and " Metaculus " to do this training.

Related Posts:

in Note, Posted by darkhorse_log