Stripe is publishing methods to lead to success such as 'Why does SaaS spread all over the world?' 'Sales model of SaaS' 'Basic equation of SaaS'

Stripe Atlas: Software as a Service, as a Business

https://stripe.com/atlas/guides/business-of-saas

◆Why is SaaS spreading all over the world?

・Customers

Stripe says that 'customers love SaaS because it 'just works'.' SaaS doesn't require you to install anything to use the service, which makes it attractive. Hardware failures and operational errors common to non-professional maintained equipment do not result in useful data loss, but are achievable by the vast majority of IT departments and individuals in the case of companies adopting the SaaS model. You can achieve numbers that greatly exceed numbers.

Also, for users who are undecided about which software to adopt for the long term, or who only need the software for a short period of time, SaaS is generally more affordable than software sold under other billing models. The hurdles for introduction are low.

・For developers

Developers prefer SaaS primarily because of the delivery model. Most SaaS are continuously developed and run on a company's infrastructure. Software companies historically do not control the environment in which their code runs, and this is a major source of both development friction and customer support. All software installed on the customer's hardware has differences such as system configuration, interference with other installed software, and operator error, which must be taken into account during the development phase. and should be treated as a customer service issue. Companies that sell software in both SaaS and locally installable models receive 10x more support calls from customers who have installed their software locally.

・For companies and investors

Businesses and investors prefer SaaS because the economics of SaaS business are very attractive compared to selling software licenses. Income from SaaS is typically periodic, allowing companies and investors to predict the cash flow of their SaaS business. They can plan for their cash flow so that they can trade future cash flow with the cash they have now and invest in current growth. This has made SaaS companies the fastest growing software companies in history.

◆ SaaS sales model

There are two ways to sell SaaS. Sales models dictate almost everything about SaaS companies and products. One of the classic mistakes of running a SaaS business is the mismatch between your product or market and the SaaS model you chose to sell it in.

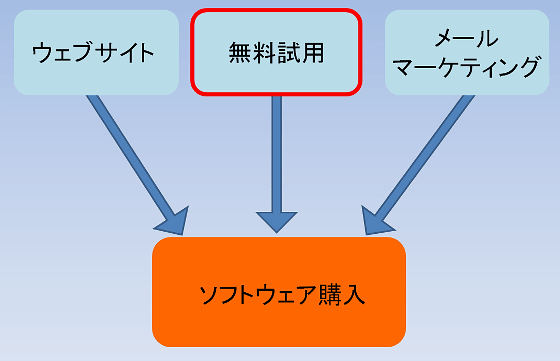

◆ Sales in the low-touch SaaS model

Low-touch SaaS models allow the majority of customers to make purchases without ongoing one-on-one human interaction. The primary sales channel is software website and email marketing, and the most common sales channel is the free trial of the software. Free trials are very easy to get started and are actively optimized for sustainable use of SaaS by customers.

Low-touch SaaS may involve sales teams, but they are often structured as customer success teams with little focus on convincing software purchases. Our Customer Success team focuses on ensuring that users in the free trial phase successfully transition to paid users during the trial period.

Low-touch SaaS customer support optimizes the product by creating educational resources across the customer base to avoid incidents that require human intervention, and human support only as a last resort. That said, many low-touch SaaS companies have great customer support teams. The economics of a SaaS business depend on long-term customer satisfaction, so we invest relatively heavily in the department responsible for customer support.

Low-touch SaaS typically retails for $20-$500 for

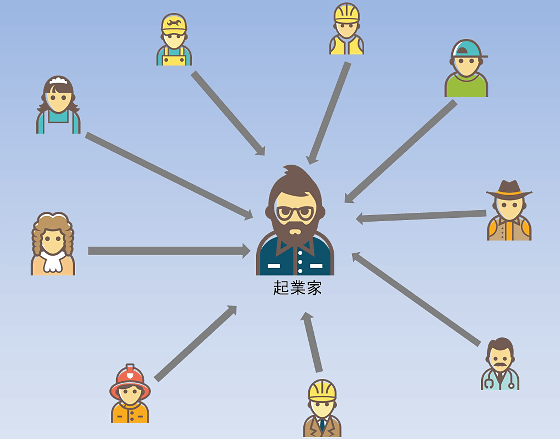

◆ Sales of high-touch SaaS

Some customers need help deciding whether or how to adopt a product. A high-touch SaaS business is designed around the process by which companies adopt software, keep it running well, and use it continuously. In most cases, the heart of the organization is the sales team, with 'Sales Development Representatives (SDR)' who are in charge of the software completion, and 'Account Managers (AE)' who are in charge of the sales process for specific customers. ', 'Account Manager (AM)' who is in charge of maintaining happiness and continuing the performance of individual accounts. Also, the sales team is usually supported by the marketing team, whose primary job is to create a pipeline for the sales team to sell their products.

There are many great products sold in high-touch SaaS, but technology and products are generally considered less important than sales in the high-touch SaaS business. Customer support varies greatly across high-touch SaaS companies, but the common denominator is the expected high utilization of customer support. Support usage per term and account is expected to be much higher than low-touch SaaS services.

In principle, high-touch sales to consumers can be made, as insurance is sold primarily through commissioned agents. Also note that in SaaS businesses, the overwhelming majority of high-touch services are sold to businesses (B2B). Having a wide range of customer profiles, ACV and other data within B2B makes the process easier.

Inexpensive SaaS services typically have an ACV of $6,000 to $15,000 when sold to “small and medium businesses (SMBs)” in a high-touch model, but this can be higher. The exact definition of an SMB varies greatly depending on who you ask, but it's 'a business sophisticated enough to successfully deploy $10,000 software.'

High-end SaaS services are aimed at very large companies or governments, often called 'enterprises'. If you asked any high-touch SaaS entrepreneur what their most important metric was, they would say “ARR (Annual Recurring Revenue).” ARR is the total annual revenue after deducting temporary income such as setup costs and consulting services. As the economics of SaaS become more attractive over time, one-off incomes, especially relatively low-interest one-off incomes, are of little interest to entrepreneurs and investors.

Also, a small high-touch SaaS business looks worse than a low-touch SaaS business. Because visibility is a customer acquisition strategy in low-touch SaaS and not optimal in high-touch SaaS.

◆ Basic equation of SaaS

The SaaS model works by fundamentally financializing software. Instead of selling a product at a fixed price, we sell software with probabilistic and predictable cash flows as if it were a financial product.

There are more sophisticated ways to formalize a SaaS business, but they require masters of business administration level competence. If you make simplifying assumptions such as ignoring the time value of money, it can be formulated with just high school level mathematics, so if you only want to learn one thing about SaaS business, learn the formula below. please give me.

A person's revenue = number of customers x average lifetime revenue per customer

Number of customers you get = Acquisition (whether you're grabbing the attention of low-touch SaaS prospects or identifying and featuring customers with high-touch SaaS) x conversion rate (percentage of prospects who convert to paying customers)

Average lifetime revenue per customer (Lifetime Value (LTV)) = Amount you pay per specific period of time (e.g. 1 month) x Length of time you continue using the service

Average revenue per user (ARPU) = average revenue for an account over a specific time period

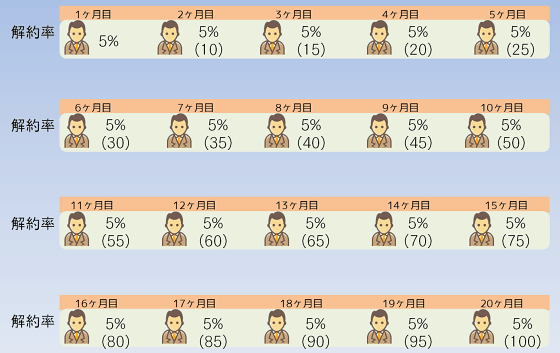

Churn rate = Percentage of customers who do not continue to pay for services

(For example, if 200 customers paid in January and only 190 paid in February, their churn rate is 5%.)

Customer lifetime can also be calculated as the sum of an infinite geometric series with some simplifying assumptions. This is simply taking the inverse of the churn rate. For a product that loses 5% of its customers every month, the product has an expected customer lifetime of 20 months. If you charge each customer a fee of $30 a month, that means an expected lifetime revenue of $600 per new registered customer.

◆ Meaning of SaaS business model

・Improving the SaaS business is effective in many ways

The impact of a 10% improvement in acquisition through marketing improvements, etc. and a 10% conversion rate improvement through product improvements, effective sales techniques, etc. is not a 20% improvement (10% + 10% = 20%). , resulting in a 21% improvement (1.1 x 1.1 = 1.21).

Improving SaaS business is incredibly leveraged

SaaS margins are so high that the long-term valuation of a SaaS business is effectively tied to many times the long-term revenue. So a 1% improvement in conversion rate doesn't just mean a 1% increase in sales next month, it doesn't just mean a 1% increase in sales over the long term, it also means a 1% increase in the company's value. It can even mean a percentage increase.

・Pricing is the easiest way to improve your SaaS business

Improving acquisition, conversions and churn will require major cross-functional efforts. In pricing, you usually want to replace small values with big ones. Pricing is explained in more detail on the following pages.

Stripe Atlas: Software as a Service pricing

https://stripe.com/atlas/guides/saas-pricing

・The SaaS business will eventually change gradually

There is a point where the business hits a revenue plateau . This is predictable in advance and is subject to the following formula:

Number of customers in plateau = acquisition x conversions / churn rate

A SaaS business that loses its ability to improve acquisition, conversion, and churn will almost certainly stop growing. Even if you're doing everything right, a SaaS business that stops growing without being able to cover fixed costs like engineering team salaries will collapse.

・SaaS business can grow capital-intensive

A SaaS business requires significant upfront costs, especially if you grow aggressively. The marketing and sales teams also drive the marginal cost per customer and the company's total spending. Marketing and sales costs attributed to a customer are incurred early in the interaction with that customer, and revenue is generated later to pay for those costs. In other words, a SaaS company optimizing for growth will end up paying more than it collects from its customers in a given period of time.

But the money has to come from somewhere. For many SaaS companies, growth is financed by selling equity in the company to investors. SaaS companies are particularly attractive to investors because their operating models are so well understood.

Margins are irrelevant to first approximation

Most businesses care about their

SaaS business takes time to grow

The story of the 'hockey stick' growth curve is well-known, but it takes a very long time before a SaaS business can take off, whether it's the product, the marketing approach, or the sales approach.

・Expectations for growth differ greatly in the SaaS industry

It takes 18 months to start a SaaS business with the founding team's own funds and earn enough to run at a reasonable wage for the founding team. After achieving that point, self-funded businesses have a wide range of results for growth rates. If your revenue is growing 10% to 20% annually, it can produce very happy results for all involved.

If you start your SaaS business funded by others, you're going to lose a lot of money on the way to perfecting the model. After perfecting the model of SaaS business, you will lose more money faster to expand your business. It's counterintuitive to those in the software industry that this is a successful outcome for business. If the business can continue to grow, the accumulated deficit will not eventually become unpayable. In other words, if a business does not grow, it will fail.

And there are many companies that are less stressful than SaaS companies that are managed to grow aggressively. Those companies are like being on a rocket ship that actively burns fuel to accelerate. In other words, if something goes wrong, it explodes.

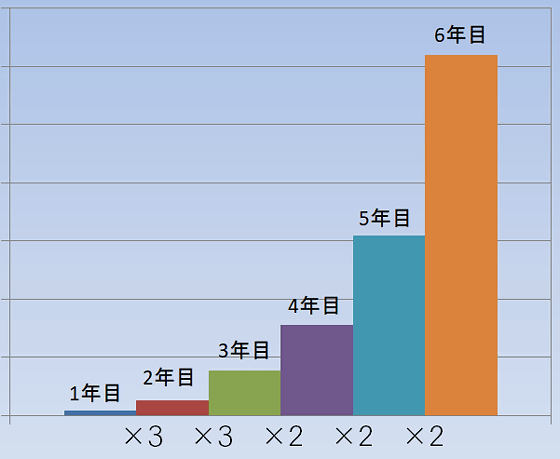

A rule of thumb for expected growth in a successful SaaS company is 3, 3, 2, 2, 2. Starting from a material baseline (e.g., $1M+ in ARR), you should triple your annual sales for two consecutive years, then double for three consecutive years. So a SaaS business growing only 20% a year early in the business is a failure in the eyes of investors.

◆ Benchmarks you should know

One of the most common questions SaaS business founders get is, 'Are my company numbers good?' This is a surprisingly difficult question to answer, depending on the industry, business model, stage of the company, and founder's goals. But experienced SaaS entrepreneurs have a few rules of thumb.

◆ Low-touch SaaS benchmark

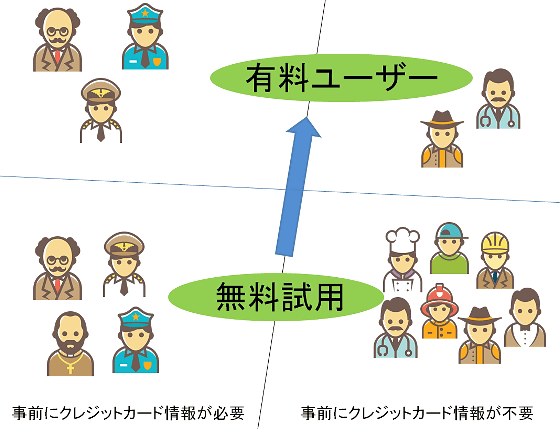

・Conversion rate

Most low-touch SaaS services employ free trials. Registration requires minimal information, including credit card information that will be charged if the user does not cancel the trial. A user who signs in for a relatively low-hurdle free trial may not be serious about evaluating software, and may have to actively decide to purchase the software later. However, users who provide their credit card numbers are scrutinized beforehand before signing up for a trial, so unless they actively declare that they are dissatisfied with the product, they are willing to accept payment. It means that there is

The conversion rate of low-touch SaaS trial when credit card information is not required in advance is as follows.

Substantially 1% or less: generally evidence of poor product-market fit

~1%: Approximate baseline for excellent execution

2% ~: very good

In addition, the conversion rate guideline for low-touch SaaS trials that require credit card information in advance is as follows.

Substantially below 40%: generally evidence of poor product-market fit

40%: Approximate baseline for good execution

60%: doing well

In general, the number of new paying customers increases when credit card information is required in advance. The number of free trial starts will decrease, but the conversion rate from free trial to paid version will increase. However, this relationship has been reversed as companies progress in activating free trial users by ensuring a better product experience, daily emails, and a positive experience using the software through their customer success team. I will continue.

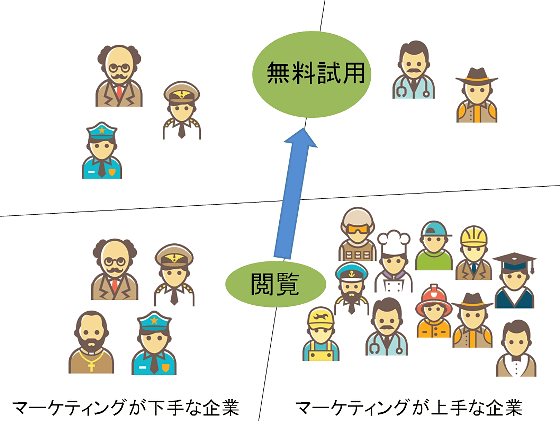

・Conversion rate from product page to trial registration

You need to measure your site's unique pageviews and conversion rate to trial registrations, but it's not a practical metric and it's hard to give you pointers from this number to what to expect. However, the conversion rate to trial registration is very sensitive to whether you are attracting high-quality visitors. Companies with good marketing have lower conversion rates than companies with poor marketing. A company with good marketing attracts more prospects, and among them there is a large percentage of prospects who are not suitable for offering products, and the absolute number is also high. Poorly marketed companies tend to be disproportionately good customers because they are only discovered by the discerning eye in the market. They are so dissatisfied with the status quo and actively looking for solutions that they will use the services of obscure companies if they are better than the current situation. The rest of the market may not be actively looking for solutions at this time.

・Churn rate

With low-touch SaaS, most customers have monthly contracts and churn rates are estimated monthly. It's certainly a good idea to sell yearly accounts because you'll have more upfront cash collected and lower churn rates, but when you report churn rates you typically generate monthly numbers because results are mixed.

Approximate churn rates are as follows:

2%: Very sticky product, strong product/market fit, and significant investment to reduce involuntary churn

5%: Percentage that seems to start roughly

7%: Likely hanging bait to prevent voluntary churn or selling to difficult markets

10%~: Evidence that product/market fit is very poor and threatens the company

Some markets structurally exhibit higher churn rates than others. Selling to informal businesses such as freelancers or 'production consumers' exposes itself to the high rates of these existing businesses, which has a significant impact on churn rates. More established businesses don't have as high a churn rate and have much less need to optimize their cash flow to the last $50.

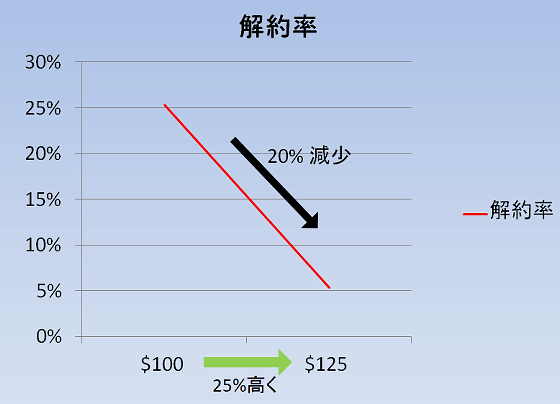

Higher pricing is more effective than entrepreneurs hope, because higher price points favor better customers. If you raise your prices by 25%, you can reduce churn by 20% simply by changing the mix of customers who buy your product. This makes many low-touch SaaS “luxury goods” over time.

◆ High touch SaaS benchmark

High-touch SaaS business has two different methods of measuring conversion rate, one with different ways of defining 'opportunity' and another with similar definitions due to differences in industry, sales process, etc. much more heterogeneous. However, churn rates are closely clustered. An annual churn rate of about 10% for a company that hasn't been around for a long time is reasonable for a company, and 7% is an excellent churn rate. Incidentally, keep in mind that high-touch SaaS businesses structurally have significantly lower churn rates than low-touch SaaS businesses.

Companies with high-touch SaaS businesses measure company account-based churn rates and revenue-based churn rates. For low-touch SaaS, the difference between the two values is insignificant and they tend to be fairly similar. High-touch SaaS businesses price their offerings by selling more usage rights, offering additional products, or the like, to increase revenue for the customer's subscription period. So many of them track revenue-based churn rates. Also, the ultimate criteria for a high-touch SaaS business is a negative revenue churn rate. The impact of upgrades, year-over-year contract size increases, and

◆ Product/market suitability

The hardest thing to quantify early in the life of a SaaS company is what Marc Andreessen dubbed 'product/market fit.' This means, 'Have you ever found a group of people who love what you make for them?'

Products with poor product/market fit suffer from relatively low conversion rates and high churn rates. On the other hand, products with a high product/market fit have significantly accelerated growth rates, have much higher conversion rates, and are generally more pleasant to work with. The SaaS entrepreneur said, 'If you have it, you'll know you have it, and if you wonder if you have it, you don't.' Other than that, I'm at a loss for words to describe the product/market suitability. It's the difference between 'a sales pitch that pushes cobblestones up a hill' and 'a customer who pulls your hand to get your software'.

It takes months, sometimes years, of trial and error to improve product/market fit. The most important theme of trial and error is talking to more customers than feeling natural. Low-touch SaaS entrepreneurs can create an excuse to talk to everyone who signs up for a free trial. This economy is unsustainable at that price point, but neither is it possible to continue to run a SaaS company with no product/market fit. So it's completely justified by how much you learn.

Achieving product/market fit is more than listening to feature requests and building those features. Listen carefully and empathize with what your best customers have in common. As a result, your product's marketing, messaging, and design will be changed to better target the needs of your best customers.

The best customers are, generally speaking, industries, sizes, user profiles, etc. that have high conversion rates, low churn rates and, in most cases, relatively high ACV. The main change that low-touch SaaS businesses focus on is launching a wide range of sophisticated products for a wide range of users and doubling down on one or two niches for the most sophisticated users.

So, Stripe has put together a way of thinking about running a SaaS business, but it is very important to find the best customers for your company, not just for SaaS business. Why don't you find the best customers by ordering article advertisements to GIGAZINE with a large number of readers and increase the sales of your company's products and services?

GIGAZINE.BIZ | Information on advertising on the IT news site GIGAZINE.

https://gigazine.biz/

Related Posts:

in Note, Software, Web Service, Posted by log1b_ok