Why is only the second service "Square" made by CEO of Twitter where selling is rumored is growing fast?

byJohn Verive

Twitter is struggling to generate revenue, frequentlyTalk of saleIs being reported. On the other hand, it is a founder of TwitterJacques DorseyThe mobile payment service "Square" established by Mr. Masaru continues to advance rapidly in recent years. Why Twitter is sluggish and Square has succeeded in monetizing is said to be "timing and control issues" according to the New York Times.

Square, the Twitter Boss's Other Company, Could Pass It in Value - The New York Times

https://www.nytimes.com/2017/10/25/technology/jack-dorsey-twitter-square.html

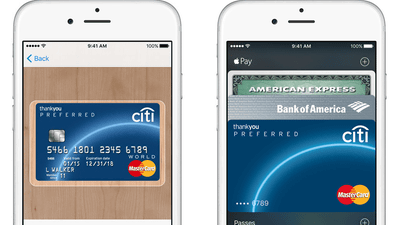

In 2009, the service "Square" which makes iPhone a payment terminal for credit card has started. Square has been available in Japan since 2013, and you can see the state of settlement from below. Even small businesses without equipment can easily make credit card payment is a breakthrough.

I actually tried using "Square leader" which can make iPhone, iPad etc. substitute for credit card payment cash register - GIGAZINE

Jack Dorsey, the founder of Twitter, leads such Square. Mr. Dorsey established Twitter in 2006 and once again withdrew from the CEO, but will return again as a "provisional CEO" in 2015. After that, Mr. Dorsey, who assumed office as CEO, is currently CEO of both Twitter and Square companies as of 2017. According to the New York Times, Mr. Dorsey is working on Twitter in the morning and Square's afternoon in the morning and Square in the afternoon, and in the afternoon it will be walking between the two companies in San Francisco.

byDavid Shankbone

Although Twitter has users around the world and is widely used, it is struggling to generate revenue,Looking for a sellerIt was also reported. On the other hand, although it was Square that was not high in evaluation at the beginning, in recent years it has increased its value. The following graph shows the market capitalization of purple for Twitter and blue for Square, and before 2016 you can see that the market capitalization of the two companies that had a big gap is almost the same at the time of article creation.

Even after Mr. Dorsey returned as CEO in 2015, Twitter is struggling with cash flow. On the other hand, Square, which began with mobile payment using the iPhone, succeeded in providing a broader range of financial services. Twitter's revenue in the second quarter of 2017 was 5% lower than the previous year, Square said it is up 26%.

As to why Twitter and Square are so different in the situation, the New York Times sees it as "timing and control issues". In the process of making Square from 1, Mr. Dorsey was able to take advantage of the lessons learned from the failure on Twitter. Meanwhile, Twitter returning in 2015 has too many internal problems, such as the treatment of executives and the vision of each person's strategy, which makes it impossible to get along well. Mr. Dorsey thinks that "Because the confusion born inside the early Twitter is no longer controllable", Square is always making decisions about employment and remuneration for people, said Square's founding EngagedRandy ReadingHe explains.

French-based consultancy companyCap GeminiPredicts that the market for electronic payment services will grow at a pace of 10.9% per annum from 2015 to 2020, and it can be said that Square is making a breakthrough in response to this wave. But Square's goal is not just to succeed with just a "payment service". In the summer of 2017, we submitted a bank establishment report in Utah State, USA, and we are doing new developments as an alternative to major banks.

On the other hand, remittance service for individual users "Square CashAlso starting from 2014. Square Cash is a personal remittance service under PayPal "VenmoAn application that is often described as a rival of ". Venmo's popularity was high until now, but in the past few months Square Cash downloads have exceeded Venmo as both iOS apps and Android apps. Including the design of the app Square Cash has made a different selection from Venmo and the New York Times has seen that using a debit card network instead of bank transfer also worked advantageously. By using the debit card's network it has become easier to transfer money to bank accounts and collect service usage fees. With this choice, Square Cash has been chosen for low-income users who do not have many credit cards.

Keith Lavoire, who served as Square's COO until 2013, said Square Cash "reflects Mr. Dorsey's ability to simplify complexity-required products."

There is a voice that Square needs to lower the use fee in order to expand business in earnest, but business fund advance payment service without repayment term "Square Capital"Square-related business is a place where many people expect growth. On the other hand, analysts are concerned that Mr. Dorsey is taking the time to Twitter, not Square, but in this regard Mr. Dorsey said, "Focusing on one thing, overlooking the other It does not mean that it will not happen "and it shows the intention to continue working on Twitter.

Related Posts:

in Note, Software, Web Service, Posted by darkhorse_log