Investment God Warren Buffett lists "21 must-read books"

ByFortune Live Media

He is one of the world's leading investors and wealthians and is the largest shareholder of Berkshire / Hathaway, the world's largest investment holding company, who will serve as Chairman and CEO of the companyWarren BuffettMr. is also known as a reader. Mr. Buffett who spends reading on 80% of the day even though it has succeeded, sometimes reading 1,000 pages a day, 21 books that I have listed as "must read" in Sydney · Morning Herald paper is summarized.

21 books Warren Buffett thinks you should should read

http://www.smh.com.au/business/markets/21-books-warren-buffett-thinks-you-should-read-20161103-gshv25.html

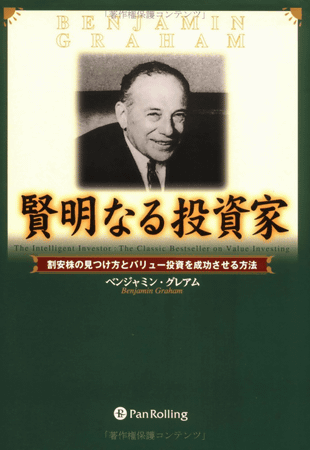

◆ 01:Wise investor: Benjamin Graham(Title: The Intelligent Investor)

From this book that I got it at the age of 19, Mr. Buffett was able to get an intellectual framework on investment. Mr. Buffett recalls that he met "this book was the most fortunate moment in my life." About the knowledge gained from this book Mr. Buffett said, "In order to make investment successful throughout the lifetime, it is not necessary to have unprecedented IQ and business foresight, even insider information, what you need is a decision It is an intelligent framework that is reasonable for deciding and its ability to not be compromised by emotions.The book explains that point clearly and what you need is discipline in emotion. I am talking.

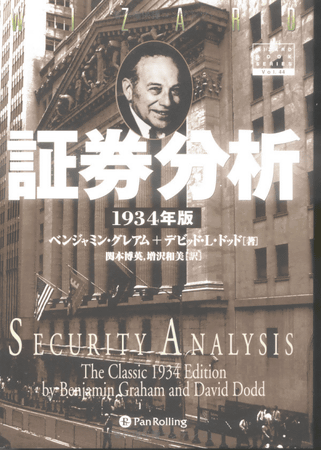

◆ 02:Securities analysis: Benjamin Graham, David Dodd(Title: Security Analysis)

The second listed book is also from the same author as the first. Mr. Buffett recalls that this book allowed "a road map of the investment that has been engaged over the past 57 years". For Mr. Buffett, Mr. Graham of the author is a person who gave me a big influence after my father, "Ben (Graham) is a wonderful teacher, is a genius."

◆ 03:Gain unusual profits with stock investment (Wizard Book series): Phillip · A. · Fisher(Title: Common Stocks and Uncommon Profits)

Mr. Buffett suggests that "I am an enthusiastic reader of Phil (A. A · Fisher) and I will recommend his book to you" even though the investment style is different from Mr. Buffett . In his book, Mr. Fisher says that it is not enough to stare at the company's financial statements, but to evaluate the management structure of the company.

◆ 04:Geitner memoir - The truth of the financial crisis: Timothy F. Geithner(Title: Stress Test: Reflections on Financial Crises)

Mr. Buffett evaluated Mr. Geithner's book, former US Treasury Secretary, as "a book to be read by all managers". There are many books showing corporate management in harsh circumstances, and there is no other thing other than this book that wrote management in a catastrophic situation of the country's fiscal situation.

◆ 05:Letters from Buffett - "Managers" "Entrepreneurs" "Bible for Bonusers" | Lawrence A Cunningham(Title: The Essays of Warren Buffett)

If you want to know Mr. Buffett's thought flow, it can be said that it is the most reliable method to hit the book that he wrote. Among them, Mr. Buffett said, "It is a waste of energy to think about that it becomes a big advantage in intelligent conflict situations such as chess, bridge of playing cards, and the choice of stocks to invest," What is there other than having a partner who has been taught? "

◆ 06:Jack Welch Our management (Nikkei Business Paperback): Jack Welch (1st volume),(Second volume)(Original title: Jack: Straight from the Gut)

Mr. Buffett, who led GE (General Electric) for 20 years and highlighted Jack Welch as "legendary manager" highly appreciated as "intelligent, full of energy, site-based" in 2001 Berkshire Hathaway announced(PDF)Letter to shareholdersAmong them, he wrote in Mr. Welch's book, "Be sure to get it!" In the must read.

◆ 07:Breakthrough managers - Extraordinary success achieved by eight unconventional CEOs (Wizard Book series): William N. Thorndijk, Jr.(Title: The Outsiders)

Berkshire Hathaway in 2012(PDF)Letter to shareholdersMr. Buffett evaluated this book as "a wonderful book about the CEOs who excelled in capital distribution". In the middle of writing, Mr. Buffett also has a chapter on Mr. Tom Murphy of Berkshire Hathaway, "the best figure among the business managers I met". In addition, Economic Journal Forbes calls this book "one of the most important business books in America".

◆ 08:The Clash of the Cultures: Investment vs. Speculation: John C. Bogle(Foreign books)

In the same letter to shareholders in 2012, he is the founder of the mutual fund company "Vanguard Group"Index FundIt is also recommended by John Bougle, the creator of the book. You should not forget that the recovery to the average level (of the stock price) will occur in the book.Therefore it is not always the case that tomorrow will rise in the same way because some stocks got excited In the long run, As the market returns to a fundamental return, it should not chase after a group of investors "or" Time is a friend, impulse is an enemy.Open positionWe must take advantage of the merit of having multiple in the market movement. Otherwise, words that are rich in knowledge are written, such as buying stocks after price rise and selling stocks after price drops.

◆ 09:Where do people and companies mistake? --- Exploring the essence of success and failure "10 stories": John Brooks(Title: Business Adventures: Twelve Classic Tales from the World of Wall Street)

In 1991, Microsoft's Bill Gates asked Mr. Buffett for a letter of recommendation, but Mr Buffett mentioned the book. Later, Mr. Gates recalls that this book reminded me that the principle of "building the winning business is always the same". In addition, Mr. Gates said, "There is no problem even if there is no perfect product, plan, presentation, instead, we need to have the correct personnel to lead the plan correctly and to execute it," he said. It shows that it plays a big role.

◆ 10:Where is the investor's yacht? (Wizard Book Series): Fred Shweed Jr.(Title: Where Are the Customers' Yachts?)

Mr. Buffett(PDF)Letter to shareholders in 2006"This book is the most funny content in books on investments written so far, and it explains many important messages about the theme with a light touch." In the book whose first edition was 1940 years old and old, the person who visited New York watched the bankers and the yachts of the brokers side by side and asked "Where is the customer's yacht?" Worth knowledge on Wall Street Still continue to be appealing.

◆ 11:Keynes persuasion thesis: J · M · Keynes(Title: Essays in Persuasion)

Economics owner,KeynesAbout this book that gathered the theory by Mr. Buffett said that this book is "must read" as Mr. Buffett can "get knowledge about stocks and markets by reading Keynes."

◆ 12:Money and common sense: John C. Beagle(Title: The Little Book of Common Sense Investing)

Mr. Buffett says that he should first read this book before asking for advice from the financial advisor. As mentioned earlier, Mr. Borgle, who created the index fund and the founder of the Vanguard group, is explaining the importance of index investment from his own experience.

◆ 13:Poor Charlie's Almanack: The Wit and Wisdom of Charles T. Munger (Abridged)(Foreign books)

He served as Vice Chairman of Berkshire HathawayCharlie MungerBooks summarized by Mr. Mr. Buffett said, "Although the researchers have discussed the question" Munger is Borjamin Franklin's Reborn? ", This book shows the answer," said Mr. Munger's achievement, I will describe the meaning of it.

◆ 14:20 most important teachings of investment - hidden common sense to become a smart investor | Howard Marks, Yoshiko Iruii | book | mail order | Amazon(Title: The Most Important Thing Illuminated)

Book co-founder of Asset Management Company "Oak Tree Capital Management" written by Mr. Howard Mr., President. Mr. Marks said he had decided not to write a book until the day he retires, but Mr. Buffett had longed for an early plan. About that content Mr. Buffett calls it "an informative book that is rarely seen". Mr. Marks explains techniques for investors to succeed with their own experiences.

◆ 15:Dream Big (Sonho Grande): Cristiane Correa(Foreign books)

In this book, a story about 3 people who established Brazilian investment company "3G Capital" is drawn. Among them, two management styles that have led to 3G capital success, "elitism" and "cost cutting" are explained, and Mr. Buffett recommends this book at the shareholder meeting of Berkshire Hathaway in 2014 I will.

◆ 16:First a Dream: Jim Clayton, Bill Retherford(Foreign books)

Author Jim Clayton was born in Tennessee's peasants' house and later built up the nation's largest residential builder, Clayton Holmes. Berkshire Hathaway also invests in Clayton Holmes and seems to be highly appreciating Mr. Clayton's skill.

◆ 17:Great sin of Wall Street - Those who deceive investors can not forgive!: Arthur Levitt(Title: Take on the Street)

(PDF)Letter for shareholders in 2002In Mr. Buffett, the accounting firmArthur AndersenTaking an example of the decline of the accounting standards and accounting auditing standards at the time commentary on the corruption. I am evaluating that details are shown in this book.

◆ 18:Nuclear terrorism - now a scary scenario that is here: Graham Allison(Title :)

According to Alison of author, nuclear attack against the United States is unavoidable unless America changes its policy. In order to realize this, "no loose nukes", "no new signs of nuclear possession" (new nascent nukes) and "no new nuclear states"Three NOs(3 of nuclear weapons) "is necessary. Mr. Buffett calls it "a must-read for those interested in national security."

◆ 19:The Making of the President 1960 (Harper Perennial Political Classics): Theodore H. White(Foreign books)

Mr. Buffett said in 2016POLITICO interviewHe says that he likes to read books on politics, especially those published in 1961 and that won the Pulitzer Prize. In the book, in the 1960 American presidential election, Kennedy won the preliminary election, it is said that it is written in a glimpse of the fact that winning the main battle and winning the president is won.

◆ 20:Limping on Water: My 40-year adventure with one of America's outstanding communications companies: Philip Beuth, K. C. Schulberg(Foreign books)

Over the lifetime, America's will become the world's largest broadcasting station laterABCAnd Autobiography of Mr. Phil Beuce who offered his career to Capital Cities. Mr. Buffett said, "Capital Cities can be said to be a company that demonstrates the brilliant standard of compatibility between ethical entrepreneurial activity and incredible management performance in the future.The achievement of these two" feats " · Mr. Murphy and Mr. Dan Burke, Mr. Buus's books show that spectacle to the readers as if seeing the game from the ring side ".

◆ 21:Warren Buffett's Ground Rules: Words of Wisdom from the Partnership Letters of the World's Greatest Investor: Jeremy C. Miller(Foreign books)

This book, which Mr. Buffett compiled a letter sent to Buffett Partnership Limited's partner who was headed by Mr. Buffett from 1956 to 1970, explains how Buffett invested based on Mr. Benjamin Graham's teaching It is said that it is the content which understands whether it built a strategy. Mr. Buffett is sending tribute words to Mr. Miller of the author as follows. "Mr. Miller has investigated and dissected Buffett Partnership Limited and has done a wonderful job of describing how that culture led to Berkshire Hathaway, interested in investment theory and practice If it is people, you will surely know the interestingness of this book. "

Related Posts:

in Note, Posted by darkhorse_log