What is the reason why hardware related to startup companies exceeding appraisal value of 1 trillion yen is increasing?

ByIntel Free Press

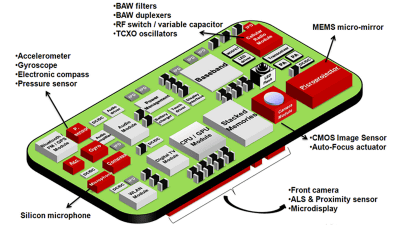

Listening to the term "startup company" is a company that utilizes the power of the Web to provide new servicesSoftware typeMany people think of companies, but in recent trends we manufacture and sell in-kind productsHardware typeCompanies have become prominent. Showing explosive growth in ChinaXiaomi(Small-rice technology, Shaomi), as the company's rapidly-growing value as a company is "$ 10 billionThere are many companies that make use of hardware as a product by many companies exceeding (about 1 trillion 200 billion) ", but why such a trend is occurring, a person leading a well-known venture capital I am talking.

Sam Altman: Why Hardware Could Yield the Next $ 10 Billion Startups - Digits - WSJ

http://blogs.wsj.com/digits/2015/03/25/sam-altman-why-hardware-could-yield-the-next-10-billion-startups/

For companies trying to launch a new business, handling hardware that requires a large initial investment is a hurdle. Therefore, it is natural choice to choose software that can start service if there is only computer and talent. However, as various circumstances have changed, nowadays some startup companies have handled hardware from the beginning, and it has become possible to see cases in which businesses succeed with less capital and talent scale than previously thought.

ByPhilippe Lewicki

However, during the startup stage, many startup companies are not blessed with necessary funds, and it is normal to press for fundraising in some way. Investing based on its foresight and high growth potential for such start-up companies is "Venture capital (VCAlthough it is an investment company called "the investment company," VC investment destinations are also changing.

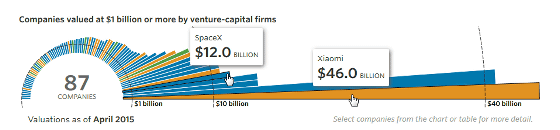

The graph below shows the companies that have raised funds exceeding 1 billion dollars (about 120 billion yen) among startups that funded from one or more VCs within the past 4 years. Xiaomi at No. 1 is a company with an evaluation of 46 billion dollars (about 5 trillion yen), but this is of course due to sales of highly popular smartphones, especially in China. 2nd Taxi · Hire distribution serviceUber, 3rd place big data analysis companyPalantirFollowing, etc., the fifth place is a private rocket development companySpaceXAre ranked in, you can see that the hardware related companies are included in the upper rank.

Among the above graphs, the companies based in Asia are those based in Asia, but many of them are companies in countries such as China, Korea, and Singapore, and I do not mind that Japan's name does not come out It is a fact.

About this situation, it is one of the representatives of VCY CombinatorMr. Sam Altman, who is representative of the company, said the secret of finding a company with remarkable growth is "Best BuyI'm talking about looking for a company that makes something that you can get at a general store like 'It's like something like that.'

Furthermore, Mr. Altman says, "What we are trying to do is to have a definition of 'hardware' that is not part of the frame." This is clear also from the company's latest investment destination being a rocket development enterprise and being a company related to nuclear power plants, and it is clear that "a very wide understanding of what" is what hardware " We need it, "and shows the importance of having a concept different from conventional one.

In interview with the Wall Street Journal (WSJ), Mr. Altman explains the idea of Y combinator's hardware company as follows.

WSJ:

What is the difference between the investment in the hardware company that the Y combinator is doing and the investment in the hardware company by other VCs?

Altman:

We are helping startup companies and matching experts they need. Y like combinatorAcceleratorIf the Accelerator, for example, tells software startup companies how to write a program, it is the beginning of the problem and such things are actually done. The important thing for accelerators is to give you knowledge about business and business, not to teach skills.

WSJ:

What kind of change is occurring in Y combinator? Is there a move to strengthen the hardware field newly?

Altman:

Y combinator does not guarantee investment in a specific field in advance. Simply find the best company. I always tell my partner that "our work is to invest in all companies growing to more than 10 billion dollars (about 1 trillion yen) in the future". Conversely, there are no more stringent rules.

We need to look to the world and infer from where we are going to see truly valuable companies. If something is going on, it is said that the world is ready to accept a very valuable hardware firm. So we are investing in rockets, nuclear power generation, and hardware-oriented bio-related companies.

BySpaceX Photos

WSJ:

I understood that the investment strategy of Y combinator has not changed. However, in the world, there are more investments in hardware. In fact what is going on?

Altman:

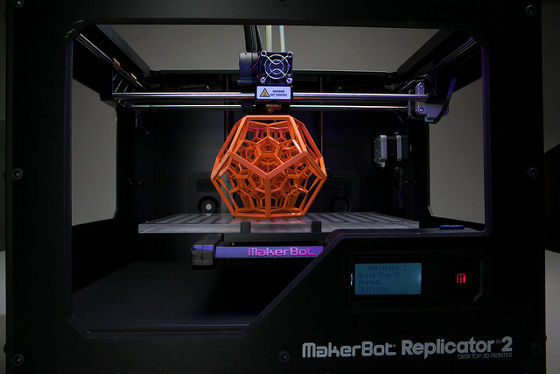

It will be saying "Hardware is becoming software-like". All the reasons why software has been successful are also in the field of hardware. All the speeds, such as the production of prototypes, got to go faster and the cost was lower.

What I am looking at for startup companies is the shortness of the "cycle time" to make prototype and its cost. When the two are satisfied, the aircraft becomes ripe state and a big change will occur. This is exactly what is happening in the field of hardware.

ByCreative Tools

Related Posts:

in Note, Posted by darkhorse_log