Matt Katz, Google's antispam team leader, talks about the desirable attitude toward money and investment?

ByLiz west

Matt Katz's remarks, which leads Google's anti-spam team and is addressing the search engine optimization (SEO) problem, is gaining attention as a keyword to web administrators who take measures against SEO. Mr. Katz, who is deeply conscious of optimizing its search engine, has released its way of thinking about money and investment in his own blog.

Nine hard-won lessons about money and investing

https://www.mattcutts.com/blog/make-money-investing-tips/

◆ It is not easy to make money with stocks easily

In around 2000, Mr. Katz says that he has opened an account with an invitation to a sweet word "opening a bank account for 400 dollars (about 42,000 yen at that rate)" from the online bank. IntoCiscoHe said he invested in shares. At that time the Cisco stock was a safe stock recommended by every business magazine,Dot com bubbleWhen it began, the stock price which was 60 dollars per share has collapsed to 12 dollars. After all, Mr. Katz said that he was to sell the shares at 18 dollar that returned a little bit, and he lost a lot.

ByPetr Dosek

Mr. Katts who paid a high tuition fee after receiving 400 dollars (about 42,000 yen), but while many people lose belief in the "good issue" as a result of the certification, "some People "realized that they were profitable without using their own money. To make it easier to make money with shares is that "Amateur football players are like trying to win the NFL professional athletes and winning," should not abandon the frank idea of easily making money with stocks, Mr. Katz I am thinking.

◆ Nobody cares about my money

Mr. Katz says that "I was very lucky about being able to join Google, which was established soon," said Mr. Katz for those who succeed in getting large money, suddenly hitting the lottery, succeeding by starting a business As an advice, "I should know that" others do not care about their money carefully. "

Katts used to be a financial brokerCommercial paper (CP)It is recommended as an "easy and safe" financial product, and he said that he has purchased from 4 to 5% interest. However, when the financial crisis comes, the CP is not redeemed. At this time, the dialogue that the financial broker's "this product is safe" is often "The Blue SkyMr. Katz said that he knew that it would be changed to a pretty speech saying "It was". Mr. Katz says that even securities managers, bankers, financial advisors and those who actually trust the operation of assets should "do not expect to care about their own assets". It is only you who protect your own assets.

There is no friend in Wall Street

A masterpiece published in 1940 "Where is the investor's yacht?"Point out that irony is pointing out that" there is a certain fee that customers pay for securities companies and banks, but it is uncertain whether it will be able to obtain returns, "and investors are made foods in the financial system Mr. Katz thought that Wall Street's entity was uncovered, but 70 years later it still has no change in the essence of Wall Street.

Wall Street is good at making simple things complicated and if you try to increase assets on Wall Street without fully understanding the nature of complex systems and financial products, Kutz says that the risk of receiving losses along with complexity is increasing.

ByAnant Nath Sharma (www.thelensor.tumblr.com)

◆ Benefits of startup

Many people have a huge admiration for living with huge assets that can live only with asset management such as interest and dividends, but most people who are employed by someone to work to earn salaries are is. Mr. Katz is attractive as an intermediate position between wealthy and salaried workers for two reasons: starting a business as "becoming a business owner and getting stock" at the same time as "getting salary" I believe. However, it can not be recommended for everyone because the success is not guaranteed, and if you become a manager, it is awaiting the heavy pressure and risk that are not comparable to the one hired. However, Mr. Katz says that it may be Ali to start a business even if taking risks if young.

◆ What to do after success

I won the big money I got about what to do after a successful startup or hitting the lottery, why the reason is why I succeeded in getting a lot of moneyEarlon maskInstead of putting it in a new business like Mr. Katz says, "We should separately pay the money we can eat with dividends or interest."

Mr. Katz recommends that investment in assets be balanced in stocks and bonds, and if young, we focus on stocks, if we already have a large sum of money, we will form a portfolio with emphasis on fixed income He says that is good.

ByEpSos .de

◆ Continued study

As a specific asset management method, Mr. Katz utilizes credit union, a financial institution managed by the invested member, financial fundVanguardWe are also considering purchasing municipal bonds, but we are still studying about what type of asset management is good for themselves. In the content written in the blog, if there is a mistake due to unexamined study, I'd like you to point out more and leave comments quickly.

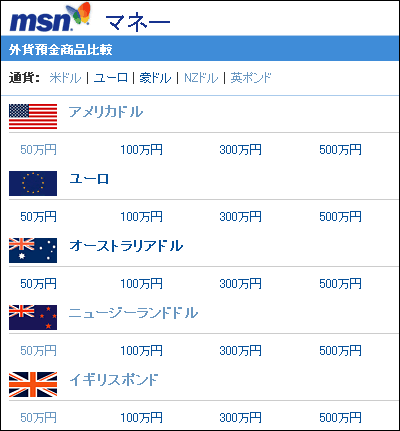

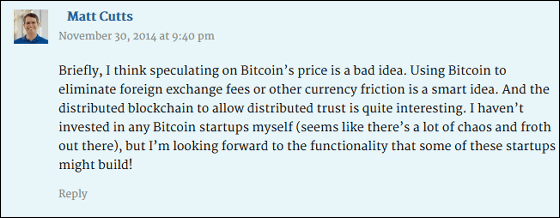

Please note that the "Bit coinDo you operate? In response to the question: "I do not think it is a good idea to be just caught in the market for bit coins, take advantage of the bit coin's advantage of eliminating costs such as fees incurred by overseas remittances I think that it is a good idea.Because the bit coin market is still confusing, I have not invested in bit coin related startup, but I am looking forward to the startup to take advantage of the advantages of bit coin I will reply ".

Related Posts:

in Note, Posted by darkhorse_log