Summarize the rank of Japanese consumption tax and the "doubt on reduced tax rate" seen worldwide

The consumption tax will be raised for the first time in 17 years from 5% to 8% on April 1, 2014 (Tuesday), causing fluctuations in prices and prices of all kinds of products and services. Increasing the tax increases the burden on consumers, so we will reduce the tax rate on daily goods and food itemsReduced tax rateAlthough the introduction of introduction is discussed, is Japan's consumption tax and reduced tax rate high when viewed worldwide? Is it low? What is the reduced tax rate? Infographic that understands that it is open to the public.

What is the difference? World consumption tax (VAT) and reduced tax rate | Harmoney.jp

http://www.harmoney.jp/archives/1121

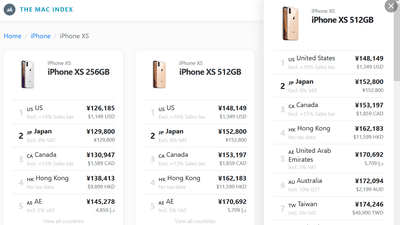

The following is yellow for each country and consumption tax (Standard tax rate), Which shows the reduced tax rate of food and other items in brown. The highest consumption tax is 27% of Hungary, and Norway / Sweden 2nd in the same rate is 25%, which means that nearly three times the consumption tax is set compared to Japan after the tax increase. Meanwhile, the country with the lowest consumption tax is 5% of Japan, Taiwan, Canada. However, in Japan and Taiwan, the reduced tax rate is also 5% compared to Canada, so the reduced tax rate in Canada is zero%, so in some cases it is possible to buy groceries etc. without adding tax.

Japan isWorld GDP ranking in 2013, But the consumption tax 5% is the lowest level in the world, and when it is 8% from April 2014, it will exceed 7% in Singapore and Thailand and will be in line with 8% in Switzerland. Consumption tax will be raised to 10% the same as Indonesia, Korea and Australia in 2015, it is high if I think that it will be doubled from 5%, but to the EU countries where nearly 20% consumption tax is set Still it is about half. However, the UK has a high consumption tax of 20%, but the reduced tax rate is balanced with zero%. The reduced tax rate in Japan is expected to be reviewed in 2015.

The US consumption tax is written as 8.875%, which is modeled on New York City. Strictly not a consumption tax, but a state ·county· For each city / school district, "Retail sales tax" set by time, goods, and amount of money, the total of all is 8.875%.

In countries where the consumption tax rate is high, the tax reduction rate is often set much lower than for daily necessities including food items, and the applicable items vary from country to country. In Italy, you can purchase "livestock, meat, ham, flour, rice, medicine, fertilizer, ornamental plants, fruits, fresh fish, movies, eggs, vinegar, sugar" at a reduced rate of 10%, "tea · medical auxiliary equipment · fresh A reduced tax rate for vegetables, milk, margarine, cheese, butter, books, newspapers, olive oil, bread, pasta "is 4% how much.

Although the applicable items are different for each country, it is difficult to understand the reduced tax rate, but there are cases where it is determined that it is "luxury item" or "food item" from the culture of the country. In France, the standard tax rate is set as a rule for the chocolate confection that it was a luxury item of the upper class in medieval European era, but the reduced tax rate is set only for general board chocolate in principle.

Also, as in German, the reduced tax rate may be applied by "takeaway" although it will be the standard tax rate "fast in the store" at fast food restaurants etc. In Canada, if you buy donuts in 5 or less, It is regarded as a standard tax rate when it is deemed to be "ready to eat", but if you purchase with more than 6 items, the reduced tax rate will be applied as it is considered "grocery" for stockpiling.

It is not only a simple saying that "Japan should be aligned because overseas is like this", but in the future, the consumption tax will be gradually increased from April 2014 until October 2015 As a consumer, you must know at what timing the reduced tax rate will be required to introduce, what kind of items you are interested in.

Related Posts:

in Note, Posted by darkhorse_log