Is the increase in tobacco price effective to lower the smoking rate of the poor?

ByBen Raynal

The proportion of smokers smoking cigarettes may increase as poverty and education level go downDiscoveredIn the United States, the smoking rate is 26.3% in the poor, whereas in other cases it is 15.2%, the smoking rate in the poor is much higher than the other. One of the policies for smoking is raising the tobacco tax increase, but Priceonomics specializing in data analysis and marketing analyzes past data, and the tax increase does not contribute to lowering the smoking rate of the poor As a result, we are raising a question mark on the effect of the tax increase.

How Cigarettes Tax the Poor

http://priceonomics.com/how-cigarettes-tax-the-poor/

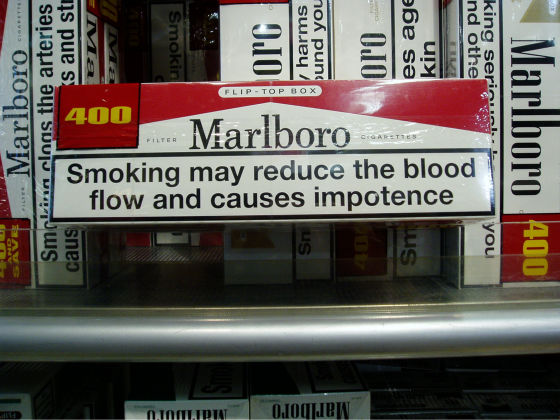

In the United States, as a policy for smoking, we are implementing a public program that sticks a label to the cigarette package to appeal to danger and to recognize the dangers of smoking. Also, I've been trying to raise the tobacco tax a number of times and try to reduce the smoking rate. According to the economist, the tax increase was aimed at increasing the tax revenue in addition to the decrease in the smoking rate, but the tax increase is based on the consumption of tobaccoIt has little influenceAnd that. Some scholars insist that "People who quit smoking because the price of tobacco has gone up are supposed to be quit due to the initial increase in taxes," but the government's tax cut campaign has been repeatedly carried out It was.

The history of tobacco excise tax is never new, and it exists before the harm caused by smoking is widely perceived. Immediately after Christopher Columbus brought tobacco from indigenous people back to Europe, tobacco seems to have been subject to high tax as a luxury item. It was in 1862 that the tobacco tax was born in the United States, and the government had a purpose to make tax revenues collected from tobacco the funding source of the Civil War. In 1883, the tax revenue from tobacco accounted for about a third of all tax revenues in the United States.

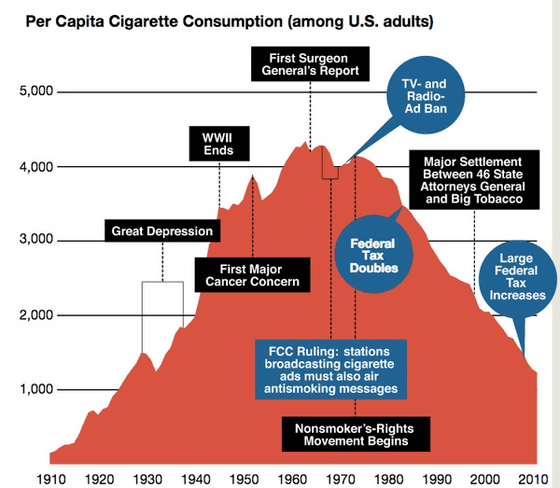

We did not know that the popularity of tobacco will decline even if tobacco tax is introduced, and from 1900 to 1964 annual tobacco consumption per capita increased from 54 to over 4000. However, from 1970 onwards, advertising on television and radio was prohibited, and the annual consumption was sharply declining due to two large tax increases.

By implementing public policy on tobacco, the smoking rate was 196442.4%From 2015Decrease to 16.8%. With thisSimilar phenomena confirmed in developed countriesAlthough it is being done, the smoking rate in the developing countries where the poverty level is high does not seem to decrease as much as developed countries.

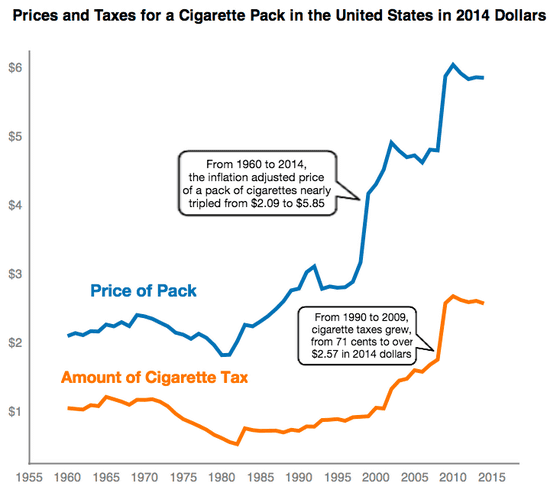

Developed countries have repeatedly increased taxes to reduce smoking rates, and the tobacco tax in the United States is more than three times that in 1989. Below is a graph showing the price of one box of cigarettes in the US (blue) from 1960 to 2014 and tobacco tax (orange color) per box. Tax increases began around the year 2000 and tobacco tax increased by more than $ 1 in 2009. The price of tobacco is also showing a sharp rise along with the tax increase.

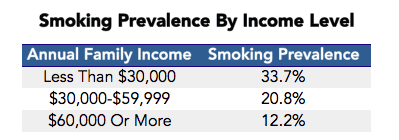

In terms of the whole of the United States, the price rises in proportion to the increase in tobacco tax, which means that the number of people who quit smoking came from that,Smoking rate by incomeWhen looking at, from 1965 to 1999, the households with high incomes showed a decrease of 62%, whereas in the case of low-income families, a slight decrease of 9%, a big difference due to income was born It is clear that it is. Also implemented by Matthew Farrelly of RTISurvey in 2012, The smoking rate of households with an annual income of $ 60,000 (about 4.8 million yen) or more is 12.2 (about 4.8 million yen), while the household smoking rate of less than 30,000 dollars per year (about 2.4 million yen at that time) is 33.7% It turned out that there was only%.

The following table shows the ratio of consumption to tobacco by income, but households with an annual income of 30 thousand dollars or less consume 14.2% of the income for tobacco, smoking greatly pressures households It is clear that there is.

It is also found that the higher the poverty level, the lower the rate of success in quitting smoking. It was carried out in 2012InvestigationHe tried smoking cessation with cognitive behavioral therapy and nicotine patch and found that the smoking cessation rate at six months after smoking cessation treatment was born more than twice the difference between high income and low income . The organizations who conducted the survey speculate that the existence of stress and the fact that many smokers among the same low-income people as themselves are the reasons why it is hard to stop smoking.

In response to such survey results, Priceonomics said, "Is it not only that tax increases in tobacco tax help to smoke cessation among poor people, they are not only pressing on their lives?" I have a question mark.

In Japan, price hikes for tobacco were raised in line with the consumption tax increase in April 2014. Also, since April 2016, the Japanese Tobacco Industry (JT) is the main brand "Mebius" and "Wakaba" "Echo" "Golden Bat" where tobacco tax reduction measures are abolishedImplement price increaseTo do. Regarding tax increases and smoking rates,Survey results conducted by the Institute of Social Science, University of Tokyo, It is said that the effect of smoking cessation due to the increase in tobacco excise tax is temporary and there is little possibility that long-term effects on smoking cessation and smoke reduction are not significant. If tax increases do not lower the smoking rate of the poor, it seems necessary to explore some other effective measures.

Related Posts:

in Note, Posted by darkhorse_log