Semiconductor industry enters unprecedented 'gigacycle' as massive advances in AI drive simultaneous economic improvements in computing, memory, networking, and storage

The Semiconductor Gigacycle - Creative Strategies

https://creativestrategies.com/research/the-semiconductor-giga-cycle/

Semiconductor industry enters unprecedented 'giga cycle', says report — scale of artificial intelligence is rewriting compute, memory, networking, and storage economics all at once | Tom's Hardware

https://www.tomshardware.com/tech-industry/semiconductors/semiconductor-industry-enters-giga-cycle-as-ai-infrastructure-spending-reshapes-demand

According to market research, global semiconductor sales are expected to grow from approximately $650 billion (approximately 101 trillion yen) in 2024 to approximately $717 billion (approximately 111 trillion yen) in 2025. It is predicted to exceed $1 trillion (approximately 156 trillion yen) in 10 years, with some even predicting that the $1 trillion milestone will be reached sooner than expected, between 2028 and 2029.

According to Creative Strategies, the semiconductor market expansion is not driven by a single product category or geographic market, but rather a 'fundamental restructuring of the industry' that is being driven by infrastructure requirements that simultaneously affect every category of semiconductor technology. 'The semiconductor industry will never be the same,' Creative Strategies said. 'The sector has been forever reshaped.'

The semiconductor industry has changed in response to trends in the technology industry. For example, during the PC era, the benefits were primarily focused on microprocessors and general-purpose memory, but with the emergence of smartphones, profits were concentrated on mobile application processors and NAND storage. However, building AI infrastructure is different. The architectural requirements for training and inference workloads create problems across compute, memory, networking, and storage simultaneously. This sudden shift in demand and revenue in the semiconductor industry, driven by the need for simultaneous expansion in all areas rather than just one, is what Creative Strategies calls a 'gigacycle.'

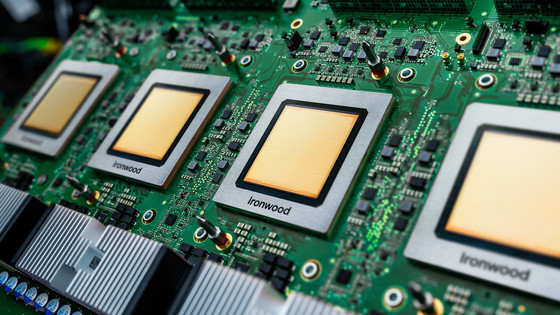

GPUs represent the largest market for building AI infrastructure. NVIDIA's GPU shipments are expected to grow approximately 85% in 2025 and another 50-60% in 2026. AI servers are becoming a trillion-dollar category in their own right, projected to grow from approximately $140 billion in 2024 to approximately $850 billion in 2030.

AMD CEO Lisa Su described demand as 'insatiable,' predicting that AMD's AI data center chip sales will grow 80% annually and total sales will grow 35% annually through 2030. Also, NVIDIA CEO Jensen Huang said during the company's second-quarter 2026 earnings call, 'Over the next five years, the AI infrastructure business opportunity will grow from $3 trillion to $4 trillion. We're still in the very early stages of building this.'

Additionally, the market for custom semiconductors (ASICs) designed for specific applications is expanding rapidly, driven by changes in the investment strategies of major IT companies. By designing and controlling their own chips optimized for key workloads such as AI and cloud computing, IT giants like Google and Amazon are seeking to improve cost and power efficiency rather than relying on third-party GPUs. This trend is approaching a level that challenges the dominance of general-purpose GPUs. For example, OpenAI, in collaboration with semiconductor company Broadcom, announced plans in October 2025 to develop and deploy 10 gigawatt-class custom AI chips.

OpenAI enters into strategic partnership with Broadcom to develop AI processing chips, plans to produce 10 gigawatt-class chips, contract amounting to hundreds of billions of yen - GIGAZINE

In addition, the rapid increase in demand for high-bandwidth memory (HBM), which is essential because high bandwidth is a bottleneck for large-scale memory, and the reliance on advanced semiconductor processes to achieve high performance with low power consumption are causing large-scale capital investment over several years and tightening supply and demand for a wide range of products.

The semiconductor gigacycle is characterized by simultaneous demand and investment across memory, networking, storage, and packaging, creating significant business opportunities. 'Everyone is benefiting from the largest semiconductor market expansion in history,' Creative Strategies said.

On the other hand, misestimating demand carries the risk of oversupply and a decline in value. Furthermore, excessive demand may be outpaced by shortages of production capacity and specialized materials, creating a major bottleneck. Creative Strategies points out that the gigacycle is not a bubble-like boom, but rather a fundamental, long-term structural change brought about by AI, and attention is focused on how technological bottlenecks will be resolved in the future.

Related Posts: