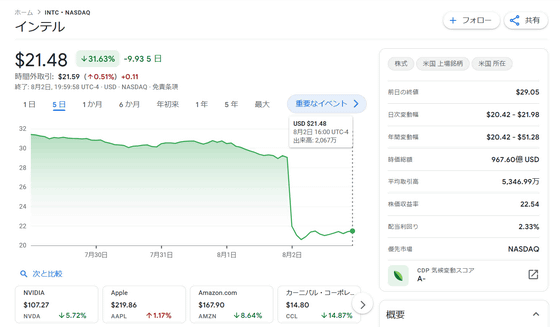

Intel shares plummet 26% to their lowest in 10 years, the biggest drop in 50 years, after reporting a major downturn in earnings.

by

Intel shares plunged 26%, the worst drop since 1974, to their lowest since 2013. The drop was driven by Intel's weaker-than-expected second-quarter 2024 results and the company's announcement of a major restructuring plan to cut more than 15% of its workforce.

Intel share plunge drags down global chip stocks from TSMC to Samsung

https://www.cnbc.com/2024/08/02/intel-share-plunge-drags-down-global-chip-stocks-from-tsmc-to-samsung.html

Intel shares slump 26% as turnaround struggle deepens | Reuters

https://www.reuters.com/technology/intel-shares-set-fall-most-24-years-it-struggles-with-turnaround-2024-08-02/

On August 2, 2024, Intel's stock price closed at $21.48 (approximately 3,100 yen) on the New York Stock Exchange, down 26.05% from the previous day. The stock price reached its lowest level in 11 years since April 15, 2013 on a closing price basis, and showed the largest decline since the 31% crash in 1974. At the time of writing, Intel's market capitalization is below $100 billion (approximately 14.5 trillion yen).

The decline in Intel caused the NASDAQ to fall 2.4%, and global semiconductor stocks also fell. Shares of semiconductor manufacturer TSMC (Taiwan Semiconductor Manufacturing Co.) fell 4.6% as of the close of trading on August 2.

On August 2, 2024, Intel announced its financial results for the second quarter of 2024 (April to June). In the report, the company reported a net loss of $1.61 billion (approximately 230 billion yen) and revealed that it would not pay dividends in the fourth quarter of 2024. In addition, it also announced that it would cut about 15,000 employees, equivalent to more than 15% of its total workforce.

Intel announces second quarter 2024 financial results, announces deficit of over 240 billion yen and cuts about 15,000 jobs - GIGAZINE

'This is Intel's biggest restructuring since we moved from memory to microprocessors 40 years ago,' Intel CEO Pat Gelsinger said in an interview with CNBC. 'We have a bold plan to rebuild Intel, and we're going to get it done.'

Intel said it was accelerating production of its Core Ultra chips to catch up in the AI chip market, which contributed to the loss. CNBC also noted that reports of a Department of Justice antitrust investigation into NVIDIA are putting added pressure on the entire semiconductor sector.

US Department of Justice and Federal Trade Commission to investigate Microsoft, OpenAI, and NVIDIA for alleged antitrust violations - GIGAZINE

Despite CEO Gelsinger's confidence in the company's turnaround, market analysts have pointed out that Intel's problems are 'survival-threatening.' Investment strategy analyst Ross Mayfield said, 'A string of investments in AI companies that didn't impress Wall Street raises doubts about future investment in AI. There are broader questions about whether AI-related capital spending will continue to grow essentially vertically or exponentially, especially in a softening macroeconomic environment.'

Related Posts:

in Note, Posted by log1i_yk